Catalysts

About Electrovaya

Electrovaya develops and manufactures advanced lithium ion battery systems for mission critical industrial, robotics, transportation and energy storage applications.

What are the underlying business or industry changes driving this perspective?

- Although the transition to warehouse automation and 24/7 logistics operations should support continued demand for durable material handling batteries, customer ordering remains lumpy and late stage, which could cap near term revenue visibility and create volatility in quarterly growth rates.

- Despite rising demand for electrified robotics and autonomous systems that align with Electrovaya's fast charging and long life technology, design cycles with large OEMs in the U.S. and Japan are lengthy and technically demanding, which may slow the pace at which these programs translate into meaningful incremental revenue.

- While growth in data centers and backup power infrastructure offers a substantial opportunity for high power, safety differentiated ESS solutions, certification requirements and initial pilot deployments through 2026 could delay broad adoption, limiting the near term uplift in ESS revenue and associated margin expansion.

- Although domestic battery content rules and U.S. manufacturing incentives should structurally benefit Jamestown's cell and module production economics, ramping a new cell facility is capital intensive and operationally complex, which increases the risk of startup inefficiencies that compress gross margins and earnings during the scale up period.

- Despite a stronger balance sheet and ample liquidity to support expansion, diversifying into multiple new verticals and recurring revenue models at once raises execution complexity, which could drive higher operating expenses and constrain net margin progression if commercialization timelines slip.

Assumptions

This narrative explores a more pessimistic perspective on Electrovaya compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

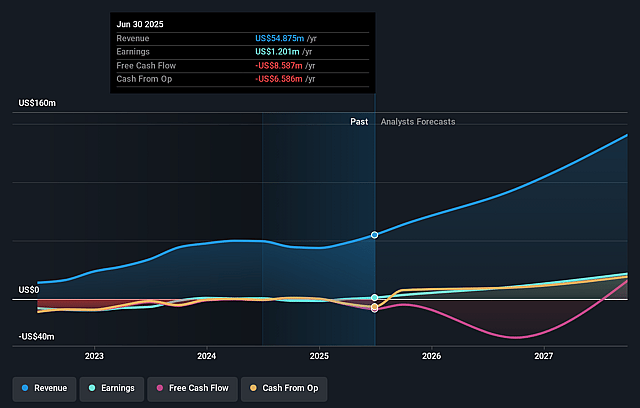

- The bearish analysts are assuming Electrovaya's revenue will grow by 35.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.3% today to 10.0% in 3 years time.

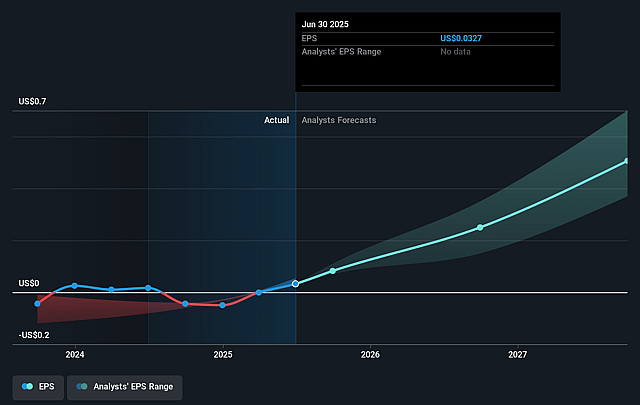

- The bearish analysts expect earnings to reach $15.7 million (and earnings per share of $0.33) by about December 2028, up from $3.4 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $34.1 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, down from 96.6x today. This future PE is greater than the current PE for the CA Electrical industry at 24.2x.

- The bearish analysts expect the number of shares outstanding to grow by 5.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- If Electrovaya sustains revenue growth above 30% in 2026 and then successfully ramps high margin energy storage and new verticals like robotics, airport ground equipment and defense from 2027 onward, the company could deliver compounding top line growth that materially lifts the share price through higher revenue and expanding earnings.

- Successful execution of the Jamestown cell and module facility, supported by EXIM financing, domestic content incentives and better supplier pricing, could structurally enhance gross margins and operating leverage, which would support a higher valuation multiple driven by stronger gross margins and net margins.

- If robotics, defense and airport ground equipment customers move from trials and initial orders to large scale deployments, especially with fast charging and super fast charging solutions, Electrovaya could build durable new revenue streams that diversify away from material handling and accelerate earnings growth.

- Rapid adoption of the Infinity ESS platform for high power, short duration backup applications such as data centers and critical infrastructure, combined with Electrovaya's strong safety record, could position the company as a leader in a high growth niche of the energy storage market and drive significant upside to revenue and long term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Electrovaya is CA$9.5, which represents up to two standard deviations below the consensus price target of CA$11.75. This valuation is based on what can be assumed as the expectations of Electrovaya's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$14.0, and the most bearish reporting a price target of just CA$9.5.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $156.9 million, earnings will come to $15.7 million, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 8.1%.

- Given the current share price of CA$9.35, the analyst price target of CA$9.5 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Electrovaya?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.