Key Takeaways

- Accelerated rail expansion, automation, and logistics upgrades are enabling Rumo to capture export market share and drive outsized revenue growth and margin expansion.

- Strong financial discipline and a focus on sustainability position Rumo for premium partnerships, stable earnings, and substantial long-term value creation opportunities.

- High capital needs, regulatory and competitive pressures, and reliance on key corridors threaten profitability and financial flexibility amid evolving market and environmental risks.

Catalysts

About Rumo- Through its subsidiaries, provides rail transportation services.

- While analyst consensus sees ongoing rail expansion in Mato Grosso as simply increasing volume and revenues, current execution suggests that Rumo is not only on schedule but poised for an accelerated ramp-up, enabling first-mover capture of record crop exports and persistent share gains, which could drive materially higher-than-expected revenue growth and operating leverage starting as early as the next crop cycle.

- Analysts broadly expect margin stability as Rumo balances pricing and cost efficiency, but with new larger trains and automation rolling out ahead of plan, management is likely to achieve step-changes in unit costs and throughput, pushing net margins and EBITDA higher even in the face of near-term volatility and market headwinds.

- The continued global shift toward decarbonized, low-emission supply chains-amplified by ESG mandates and Rumo's inclusion in global sustainability indices-positions the company to gain preferred-partner status for international grain traders and commodity exporters, allowing for premium pricing and long-term contracts that enhance earnings stability and upside.

- Robust multi-year investments in port and terminal upgrades, combined with expanding storage and intermodal integration in Brazil, will unlock disproportionate volume growth as farm-gate to port logistics bottlenecks diminish, capturing latent demand and translating into compound revenue acceleration across export corridors.

- Rumo's demonstrated ability to maintain financial discipline-evidenced by reduced cost of debt below Brazil's sovereign rate, long maturity profiles, and healthy leverage-suggests capacity for value-creating growth investments, special dividends, or opportunistic M&A, each with substantial potential to drive re-rating of earnings and free cash flow multiples.

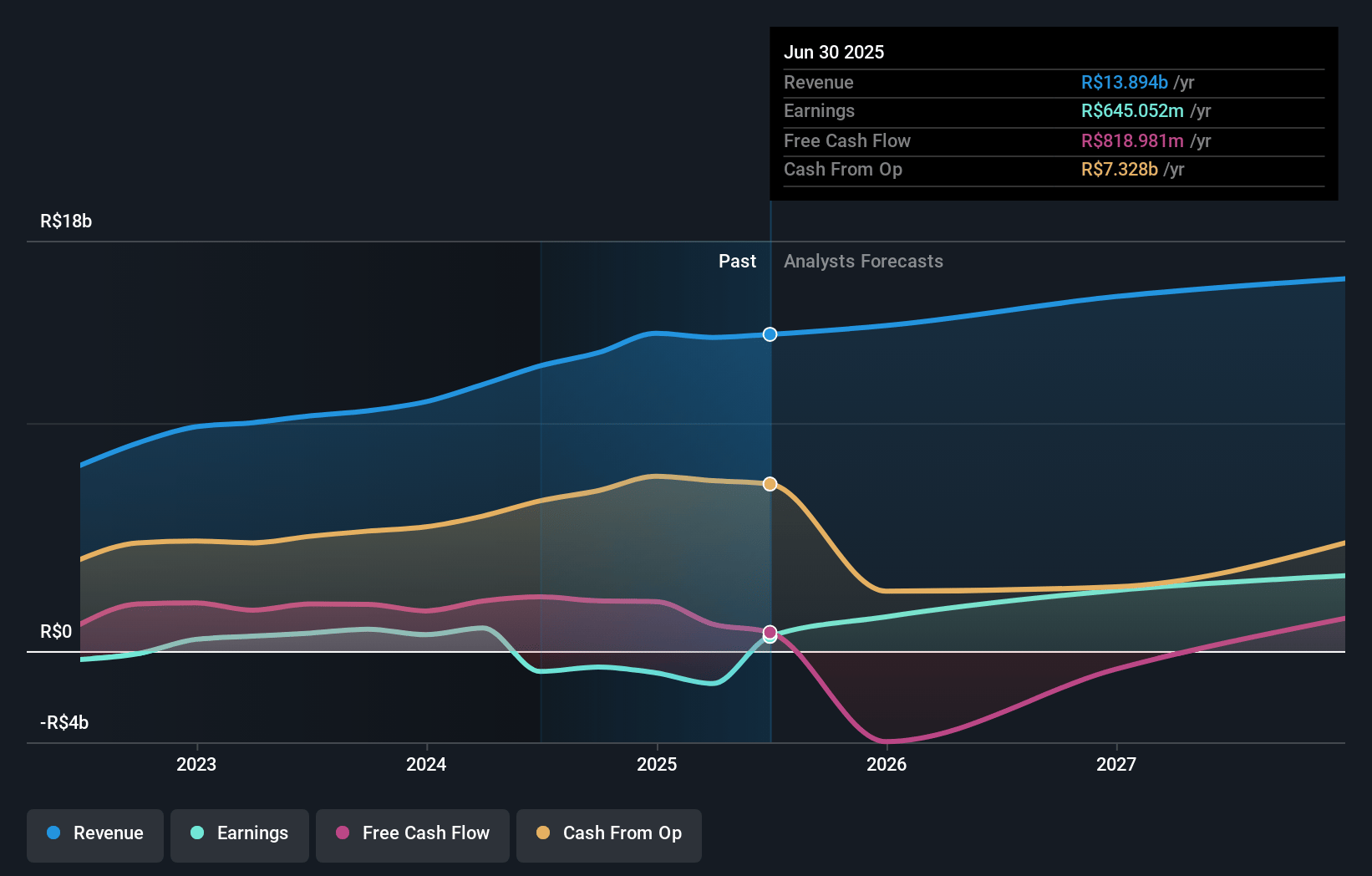

Rumo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Rumo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Rumo's revenue will grow by 10.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -10.4% today to 26.6% in 3 years time.

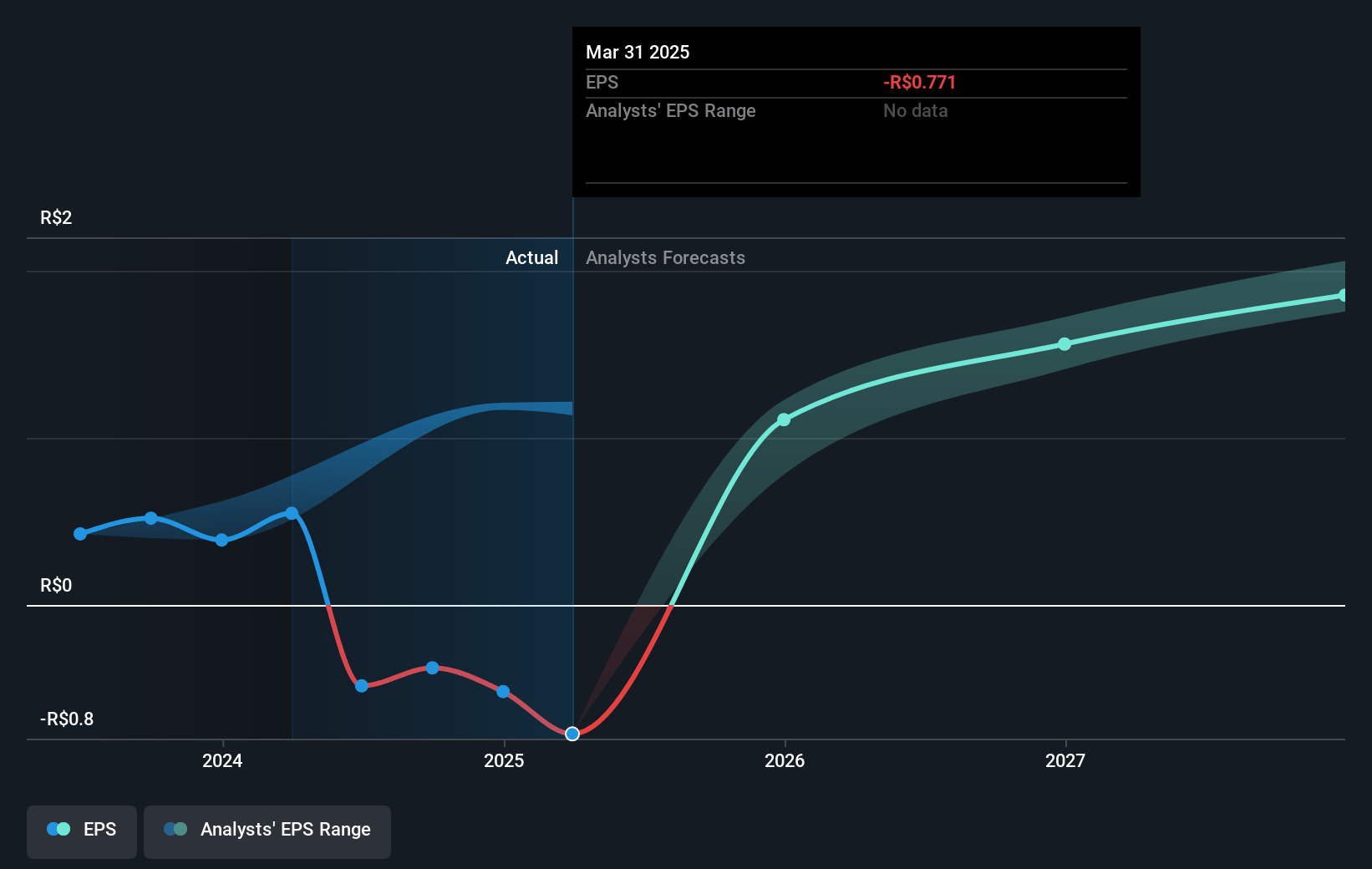

- The bullish analysts expect earnings to reach R$5.0 billion (and earnings per share of R$2.7) by about July 2028, up from R$-1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from -21.8x today. This future PE is greater than the current PE for the BR Transportation industry at 7.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 22.06%, as per the Simply Wall St company report.

Rumo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Climate change regulation and the global push for decarbonization may significantly disadvantage Rumo if it continues to rely on diesel locomotives, potentially forcing high capital expenditures for greener technology upgrades and increasing operating costs, which would negatively impact net margins and long-term free cash flow.

- The company's heavy investment requirements-evidenced by recurring high CapEx and ongoing large expansion projects such as the Mato Grosso railway-combined with elevated net debt and substantial financial expenses, could constrain Rumo's ability to return capital to shareholders, reduce flexibility for innovation, and ultimately compress earnings and net income.

- Shifts in global commodity markets, particularly if long-term demand for Brazilian soy or corn declines or export volumes remain volatile, would reduce rail freight utilization and pricing power for Rumo, resulting in lower revenue and increased difficulty in maintaining profitability.

- Competitive pressures from advancements in road logistics and increased investment in highways threaten Rumo's traditional cost advantage in rail transport, which could erode market share, suppress transported volumes, and place downward pressure on revenues.

- Rumo's reliance on a few key rail corridors, particularly in the North and South operations, makes it vulnerable to infrastructure disruptions, adverse regulatory changes, or increased competition, exposing the company to revenue concentration risks and potentially undermining earnings stability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Rumo is R$31.65, which represents two standard deviations above the consensus price target of R$25.51. This valuation is based on what can be assumed as the expectations of Rumo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$31.7, and the most bearish reporting a price target of just R$19.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$18.8 billion, earnings will come to R$5.0 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 22.1%.

- Given the current share price of R$16.79, the bullish analyst price target of R$31.65 is 47.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.