Key Takeaways

- Rising internal production, premium product focus, and sustainability initiatives will drive superior margins, outpaced growth, and strong brand value amid robust infrastructure investment.

- Strategic capital allocation toward buybacks and away from expansion projects boosts per-share returns and further elevates long-term profitability.

- Weak trade defenses, intense competition, and slow green investments threaten Gerdau's margins, market share, and long-term growth amid evolving industry and economic challenges.

Catalysts

About Gerdau- Operates as a steel producer company.

- Analyst consensus expects incremental EBITDA from the expansion of hot-rolled coil production and mining, but current demand is so strong that Gerdau is still sourcing product from competitors-implying the ramp-up could trigger both volume and margin upside well above consensus as the company replaces third-party purchases with its own, higher-margin supply, sharply boosting EBITDA and net margins.

- While analysts broadly agree that North American strength will support revenue and earnings, this view likely understates the multi-year, compounding impact of U.S. infrastructure spending and reshoring-Gerdau's focus on premium segments and a healthy backlog over 70 days position it for outpaced growth, especially as its product mix shields performance from macro softness, supporting both sustained revenue expansion and structurally higher margins.

- Gerdau's industry-leading sustainability credentials, demonstrated by IRMA certification at its Miguel Burnier mine and growing investments in scrap-based steel and renewable energy, will increasingly unlock pricing premiums, preferred supplier status for ESG-sensitive megaprojects, and cheaper financing, all supporting long-run margin expansion and brand value accretion.

- The company's strong self-funding and disciplined capital allocation-highlighted by planned CapEx reductions and a significant capital re-allocation toward share buybacks instead of new greenfield projects-suggest EPS could inflect even faster, as the reduced share count and lower capital outlays magnify per-share results and return on equity.

- Global trends of massive infrastructure investment and rapid urbanization in the Americas mean Gerdau's geographic diversification and product evolution (structural steels, specialty, and flat products) will deliver sustained volume growth, less cyclicality, and entrenched pricing power, translating into accelerating long-term revenue and earnings growth.

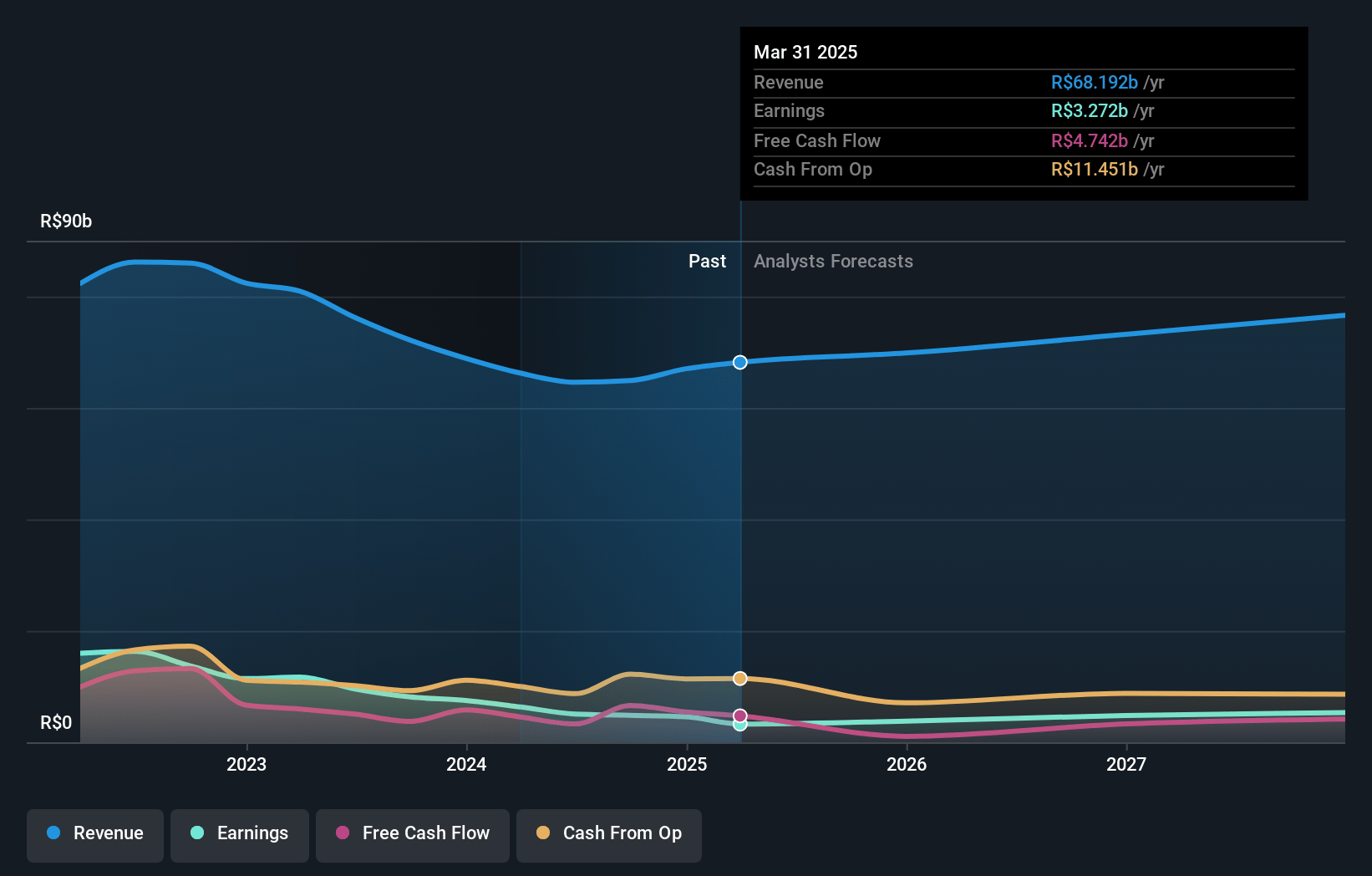

Gerdau Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gerdau compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gerdau's revenue will grow by 8.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 7.9% in 3 years time.

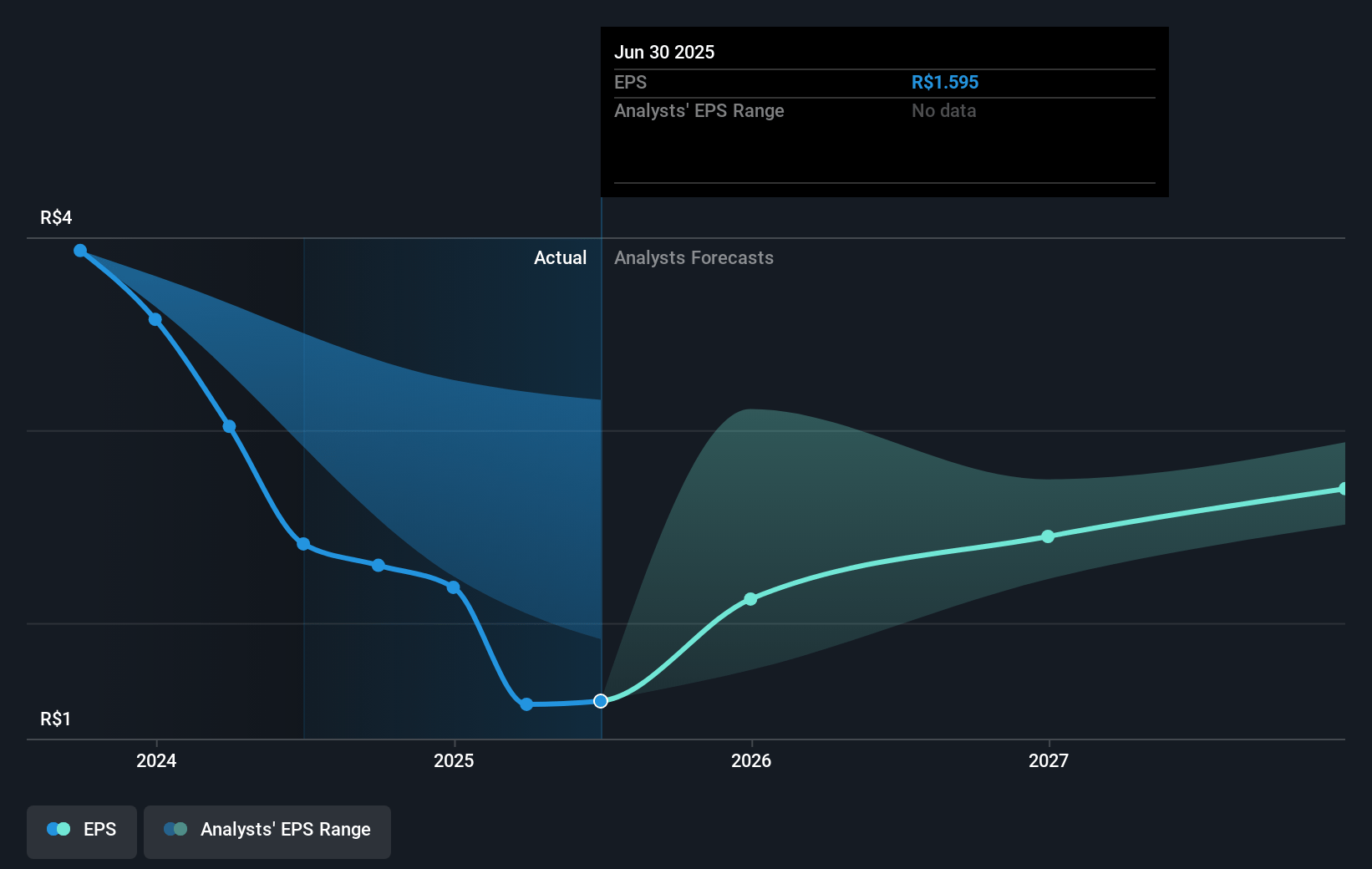

- The bullish analysts expect earnings to reach R$6.9 billion (and earnings per share of R$3.46) by about July 2028, up from R$3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the US Metals and Mining industry at 7.7x.

- Analysts expect the number of shares outstanding to decline by 3.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.88%, as per the Simply Wall St company report.

Gerdau Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The influx of imported steel into Brazil has reached record levels, while existing quota and tariff systems have proven ineffective, creating sustained price pressure and eroding Gerdau's domestic market share and revenue.

- Persistent overcapacity and intense price competition in both long and flat steel, especially in the rebar segment, have compressed margins, with Gerdau openly willing to sacrifice profitability to maintain market share, which may lead to structurally lower net margins.

- The company's high exposure to Brazil leaves it vulnerable to economic volatility, currency risk, and political inertia, particularly as the government remains slow to implement effective trade defenses; this uncertainty can disrupt revenue and increase costs.

- Industrial decarbonization, the global energy transition, and the potential shift toward alternative construction materials threaten to undermine long-term steel demand, putting Gerdau's core business model, earnings resilience, and future growth at risk.

- Aging facilities and a stated lag in investment decisions regarding green steel and energy self-sufficiency relative to industry trends risk increasing long-term capital expenditure needs while competitors advance, further squeezing future earnings and return on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gerdau is R$30.17, which represents two standard deviations above the consensus price target of R$23.09. This valuation is based on what can be assumed as the expectations of Gerdau's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$31.0, and the most bearish reporting a price target of just R$17.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$86.6 billion, earnings will come to R$6.9 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 19.9%.

- Given the current share price of R$16.69, the bullish analyst price target of R$30.17 is 44.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.