Key Takeaways

- High-quality production, premium pricing, and advanced automation will expand margins and cement CSN Mineração's status as a top global premium ore supplier.

- Strong ESG performance and rising demand for green steel position the company for lasting revenue growth and market share gains.

- Heavy reliance on China and exposure to shifting global demand, regulation, and ESG trends heighten risks of declining margins and limited investment capacity amid industry headwinds.

Catalysts

About CSN Mineração- Engages in the iron ore mining business in Brazil.

- While analysts broadly agree that the P15 project will drive incremental capacity and revenue, the high-grade quality (67% Fe) and anticipated $22 per ton premium suggest CSN Mineração could unlock a magnitude of margin expansion and pricing power far beyond consensus, transforming its earnings profile and positioning it as the top premium ore supplier globally.

- Analyst consensus highlights operational efficiency and shipping enhancements, but this fails to capture the compounding impact of automation, logistics digitization, and the shift to proprietary production, which together could structurally lower C1 costs well below peers and permanently boost EBITDA margins over the next several years.

- Iron ore is poised for a supercycle driven by relentless urbanization and unprecedented infrastructure investment in both emerging and developed markets, providing robust long-term volume growth and supporting high price floors, which could enable sustained double-digit revenue expansion for CSN Mineração even in adverse cycles.

- CSN Mineração's leadership in ESG-demonstrated by significant emissions reduction and diversity milestones-positions it to capture rising global green premiums, attract low-cost capital, and secure contracts with emission-sensitive buyers, all of which can meaningfully enhance net margins and support multi-year enterprise value growth.

- As governments and industries worldwide accelerate the energy transition, demand for premium, low-impurity iron ore required in green steel and renewable infrastructure will rise sharply, allowing CSN Mineração to consolidate its market share, maintain pricing premiums, and deliver outsized earnings growth for the foreseeable future.

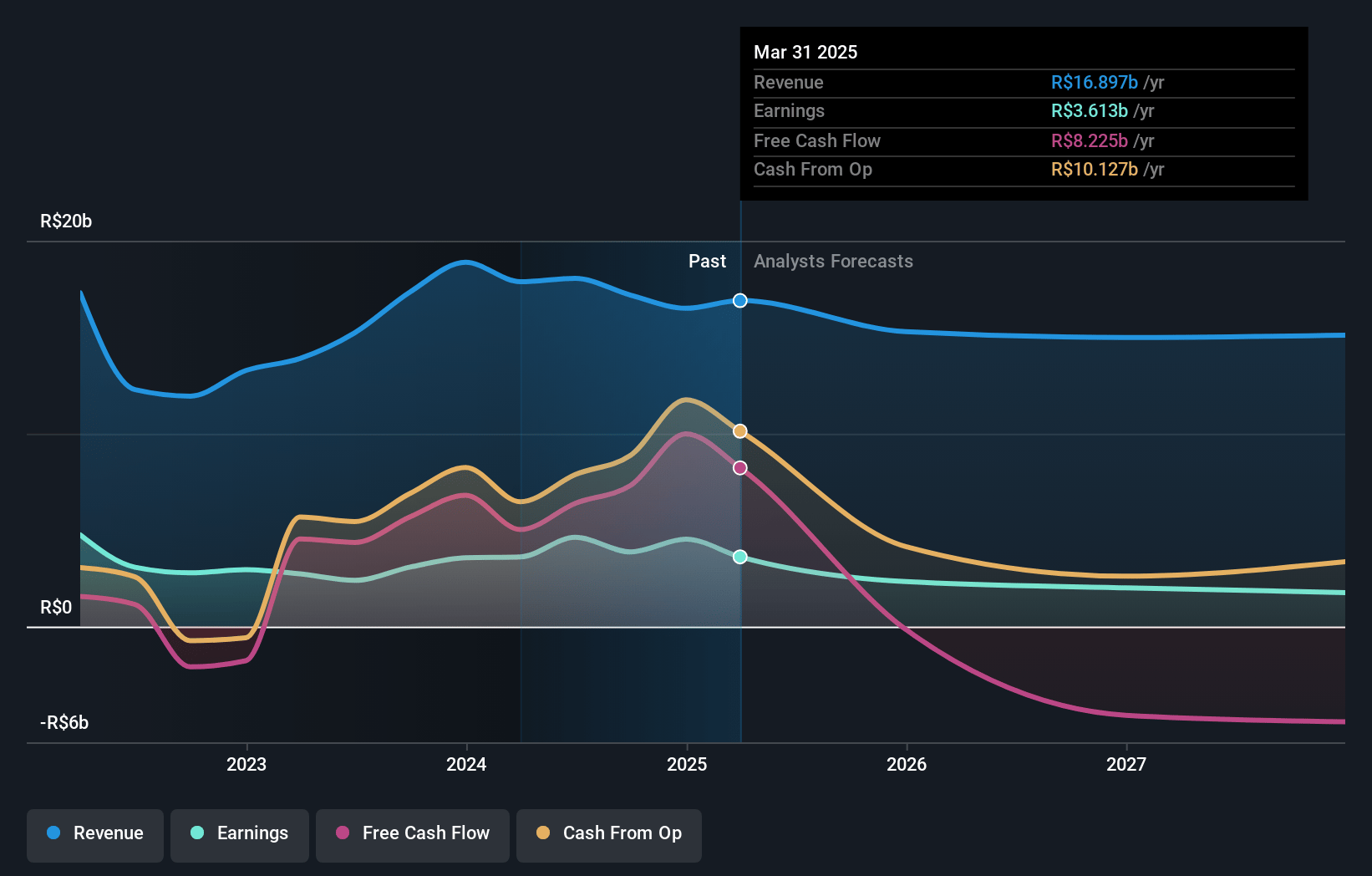

CSN Mineração Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on CSN Mineração compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming CSN Mineração's revenue will decrease by 0.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 21.4% today to 10.3% in 3 years time.

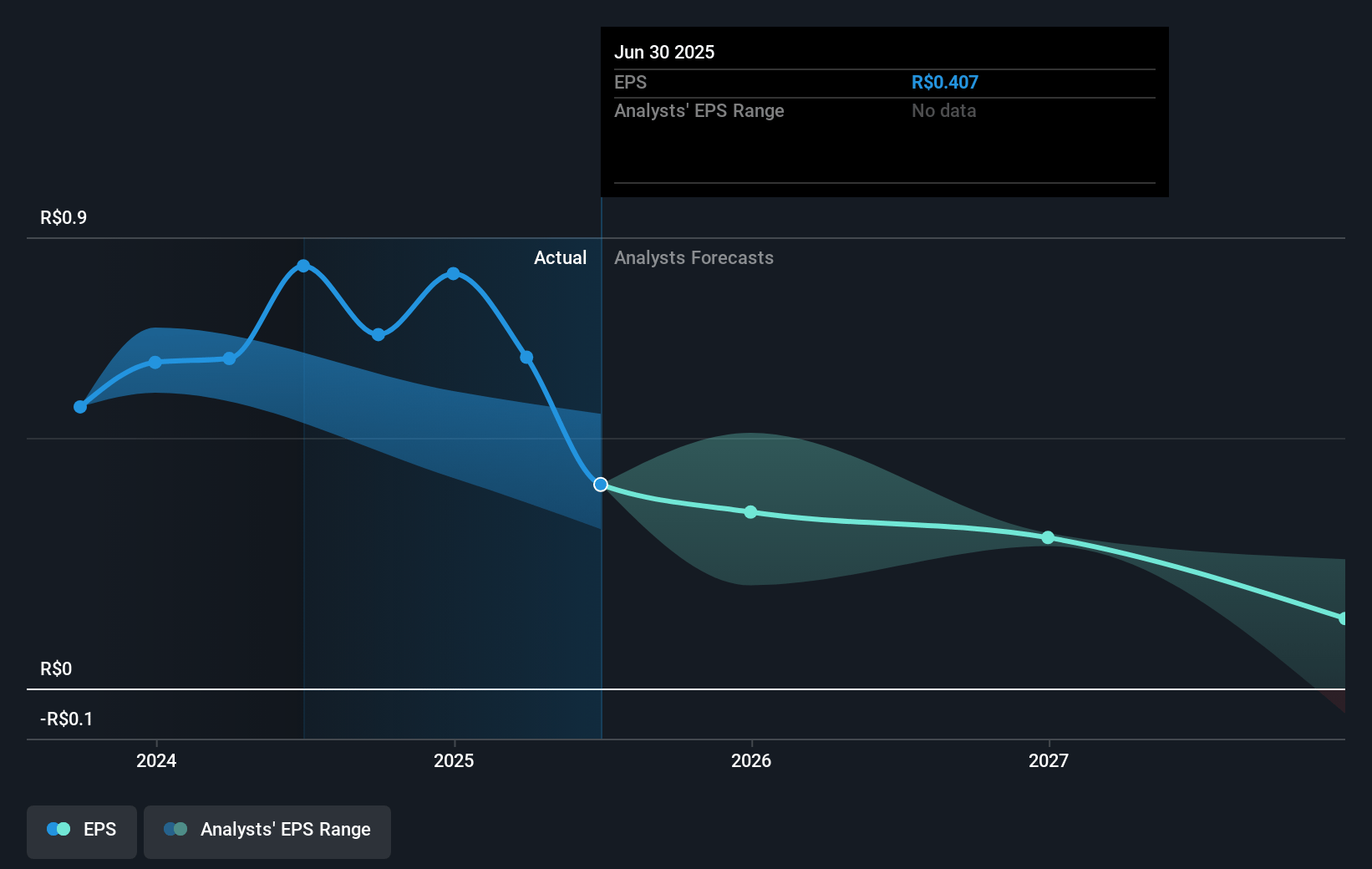

- The bullish analysts expect earnings to reach R$1.8 billion (and earnings per share of R$0.18) by about July 2028, down from R$3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 35.5x on those 2028 earnings, up from 8.0x today. This future PE is greater than the current PE for the BR Metals and Mining industry at 8.0x.

- Analysts expect the number of shares outstanding to decline by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.44%, as per the Simply Wall St company report.

CSN Mineração Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CSN Mineração's revenue and earnings are heavily exposed to long-term declines in global steel and iron ore demand driven by decarbonization policies, as increasing climate regulation and scrap steel substitution depress demand for virgin iron ore-this raises the risk of stagnant or declining revenues and thinner net margins over time.

- The company remains dependent on China for roughly 65% of its sales, making future cash flows and top-line growth vulnerable to Chinese economic cycles, property market deceleration, and any policy-driven contraction in steel imports or production, which could impair revenue stability for years.

- Intensifying geopolitical tension-including escalating tariffs, resource nationalism, and global trade war threats involving China, the US, and key Asian nations-pose structural risks to export market access, potentially causing sustained volatility or losses in revenues and operating earnings.

- While CSN Mineração saw recent operational cost improvement, industry-wide iron ore grade depletion and tightening global environmental standards will require persistently high capital expenditures for beneficiation and compliance, placing long-term upward pressure on unit costs and reducing operating margins if not managed efficiently.

- Despite recent ESG enhancements, broader investment trends favoring decarbonized and ESG-compliant companies could increase the company's cost of capital and hinder access to financing, threatening future investment capacity and potentially affecting earnings and debt servicing in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for CSN Mineração is R$7.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CSN Mineração's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$7.0, and the most bearish reporting a price target of just R$3.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$17.1 billion, earnings will come to R$1.8 billion, and it would be trading on a PE ratio of 35.5x, assuming you use a discount rate of 19.4%.

- Given the current share price of R$5.33, the bullish analyst price target of R$7.0 is 23.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.