Key Takeaways

- Robust digital growth, premiumization, and category leadership position Ambev for accelerated margin expansion, top-line gains, and lasting brand strength in Latin America.

- Strong cash generation, cost optimization, and a resilient portfolio support significant shareholder returns and sustained market share growth through economic cycles.

- Economic instability, rising costs, shifting consumer preferences, and regulatory pressures threaten revenue, margin expansion, and market share, while dependence on legacy brands limits growth opportunities.

Catalysts

About Ambev- Through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada.

- While analyst consensus expects positive margin expansion and incremental gains from Ambev's digital platforms (BEES, and Ze Delivery), a far more bullish scenario is emerging-the rapid 60%+ GMV growth in the BEES marketplace and integration of premium SKUs indicates the company can drive structurally higher revenue per customer, accelerate ecosystem monetization, and meaningfully expand operating margins on a multi-year basis.

- Analysts broadly expect premiumization and non-alcoholic beer growth to provide gradual revenue upside, but with above-core brands and non-alcoholic beer registering volume increases in the 20-40% range-alongside premium SKUs now making up 30% of sales-it is highly plausible that both net margins and top-line growth could outperform expectations as the Latin American middle class continues trading up.

- Ambev's massive scale and aggressive cost optimization-combined with strong, multi-year cash flow generation-position it to leverage balance sheet strength for substantial shareholder returns through dividends and buybacks, which could drive both EPS growth and a rerating of its valuation.

- Category leadership across core and premium brands, plus proven ability to stimulate new consumption occasions during culturally significant events (e.g., Carnival), suggests Ambev is uniquely placed to capture disproportionate volume growth as urban populations in Brazil and Latin America expand and socialize more, boosting both revenues and enduring brand equity.

- The combination of a resilient, innovation-focused portfolio and capability to flexibly navigate affordability and price-mix across diverse markets sets the stage for Ambev to exit cyclical industry slowdowns with increased share, sustained margin expansion, and earnings outperformance as secular demographic trends play out in Latin America.

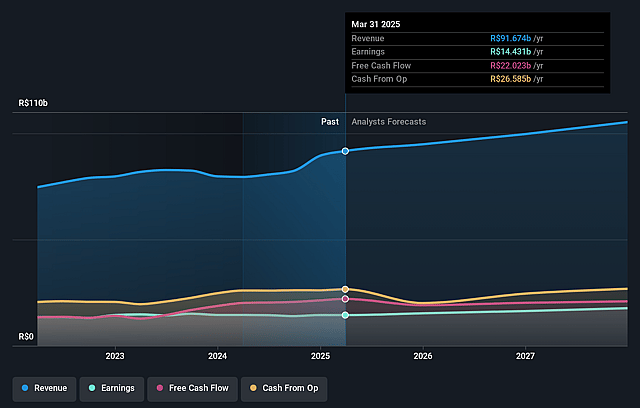

Ambev Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ambev compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ambev's revenue will grow by 6.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.7% today to 18.9% in 3 years time.

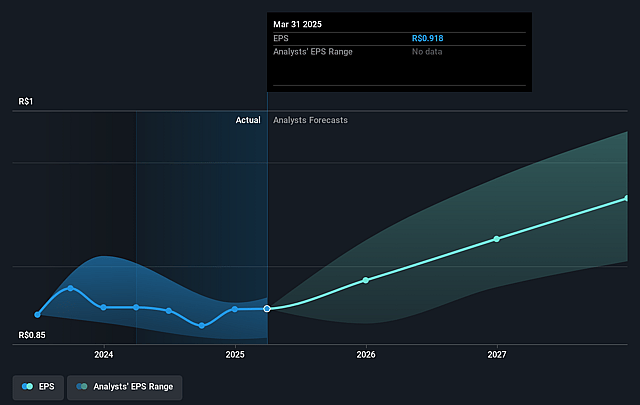

- The bullish analysts expect earnings to reach R$20.9 billion (and earnings per share of R$1.32) by about July 2028, up from R$14.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the US Beverage industry at 14.5x.

- Analysts expect the number of shares outstanding to decline by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.32%, as per the Simply Wall St company report.

Ambev Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a clear risk that persistent economic volatility and inflationary pressures in key markets like Argentina and Brazil will undermine consumer purchasing power, potentially leading to lower beer and soft drink volumes and adversely affecting overall revenue.

- Rising input costs for raw materials such as barley and packaging, combined with significant foreign exchange volatility (evident from the company's noted FX losses and cash upstreaming challenges in Argentina), threaten margin expansion and could erode net profit if cost increases cannot be fully passed through to consumers.

- Increasing health and wellness consciousness, especially among younger consumers, may drive long-term declines in beer consumption, directly suppressing volume growth and limiting top-line revenue potential in core categories.

- Over-reliance on legacy beer brands and a need to fix the declining trajectory of key brands like Skol, combined with only incremental progress in non-alcoholic and new product categories, could restrict Ambev's ability to capture growth opportunities as consumer tastes shift, negatively impacting future earnings growth.

- A more restrictive regulatory environment, coupled with intensifying competition from both craft and global players, may increase compliance costs, reduce pricing power, and contribute to further market share erosion, weighing on both revenue and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ambev is R$17.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ambev's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$17.0, and the most bearish reporting a price target of just R$3.12.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$110.7 billion, earnings will come to R$20.9 billion, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 17.3%.

- Given the current share price of R$13.4, the bullish analyst price target of R$17.0 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.