Key Takeaways

- Expansion of digital platforms and premium product lines is boosting direct consumer engagement, higher margins, and revenue diversification.

- Cost optimization and supply chain improvements are enhancing margins and cash flow stability amid challenging market conditions.

- Overdependence on Brazil, shifting consumer preferences, and regulatory, operational, and competitive pressures challenge Ambev's ability to sustain revenue growth and market share.

Catalysts

About Ambev- Through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada.

- Acceleration of digital platforms such as Bees Marketplace and Zé Delivery is expanding direct-to-consumer channels, deepening customer engagement and data-driven customization, which is likely to boost top-line growth and net revenue per hectoliter, while also improving distribution efficiency and margins.

- Increasing demand from emerging market middle classes and urbanizing, younger demographics underpin long-term volume growth in core Latin American markets, supporting sustained revenue expansion and potential pricing power, despite recent short-term volume headwinds related to adverse weather.

- Strong expansion in Premium, Super Premium, Balanced Choice, and non-alcoholic portfolios aligns with consumer premiumization and health trends, increasing the company's share in higher-margin segments and supporting improved net margins and earnings stability.

- Ongoing cost optimization initiatives, including rationalization of SKUs, supply chain improvements, and targeted SG&A reduction, have already driven margin expansion and should further protect EBITDA margins and cash flow against cost pressure and raw material volatility.

- Strategic partnerships and rapid growth in third-party (3P) marketplace sales are diversifying revenue streams beyond traditional beer, reducing earnings volatility and making the business model more resilient-positively impacting long-term revenue and operating leverage.

Ambev Future Earnings and Revenue Growth

Assumptions

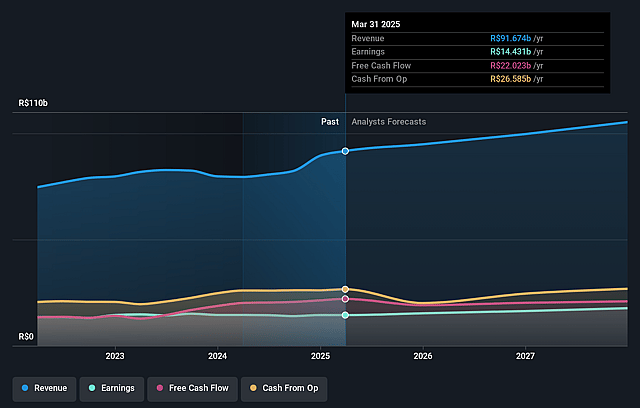

How have these above catalysts been quantified?- Analysts are assuming Ambev's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.1% today to 17.2% in 3 years time.

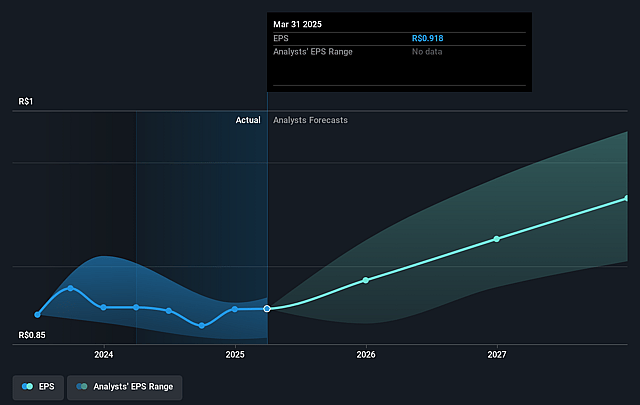

- Analysts expect earnings to reach R$18.4 billion (and earnings per share of R$1.21) by about August 2028, up from R$14.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$15.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from 13.2x today. This future PE is greater than the current PE for the US Beverage industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 0.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.8%, as per the Simply Wall St company report.

Ambev Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ambev's heavy reliance on the Brazilian market exposes it to significant risks from macroeconomic volatility, inflation, and FX fluctuations, as evident from volume declines tied to consumer disposable income pressure and adverse currency impacts, which could threaten future revenue and cash flow stability.

- Despite growth in premium and non-alcoholic portfolios, core beer segments showed substantial volume declines (down 9% in Brazil Beer, double-digit contraction in key markets) and high sensitivity to price increases and adverse weather, indicating ongoing risk from shifting consumer preferences away from traditional beer and mainstream brands, potentially impacting long-term revenue growth.

- Operational efficiencies and cost controls (e.g., SKU rationalization, focus on distribution efficiency) are highlighted as key contributors to recent margin improvements; however, sustained cost inflation in raw materials, FX-driven COGS, and structural headwinds in logistics could erode net margins if Ambev cannot maintain pricing power without sacrificing volume.

- The competitive environment remains intense, with market share loss in the Core segment and only partial offset from premiumization strategies, suggesting risk of further erosion by local brands, new entrants, or changing distribution models (such as D2C bypassing traditional structures), potentially impacting both revenue and market share.

- Regulatory and economic headwinds-including inflation above CPI for essential goods, persistent FX volatility in markets like Argentina and Bolivia, and greater sensitivity to adverse weather or business days-leave Ambev vulnerable to macro shocks and policy shifts (including potential alcohol and sugar regulation), which may compress earnings and create revenue uncertainty.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$14.244 for Ambev based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$17.7, and the most bearish reporting a price target of just R$11.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$107.1 billion, earnings will come to R$18.4 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 17.8%.

- Given the current share price of R$12.48, the analyst price target of R$14.24 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.