Key Takeaways

- Strong operational improvements and premium medical course offerings are likely to drive sustained cash flow growth and superior returns beyond analyst expectations.

- Strategic focus on hybrid education, expanding addressable market, and diversified program investments position Ser Educacional for resilient, long-term top-line and margin outperformance.

- Intensifying competition, demographic decline, and policy changes threaten Ser Educacional's enrollment growth, revenue, and margins amid rising costs and limited efficiency improvements.

Catalysts

About Ser Educacional- Develops and manages activities for on-campus and distance-learning undergraduate, graduate, and professional training courses and other education-related areas in Brazil.

- While analyst consensus highlights strong operating cash flow, they may be underestimating the magnitude and sustainability of future cash generation, as Ser's operational turnaround, improved student payment punctuality, and margin gains from a much higher average ticket in new medical courses creates a positive feedback loop that can drive outsized multi-year growth in free cash flow and return on equity.

- Analysts broadly agree on the revenue and margin benefits from new medical places, but are likely not factoring in the full upside: robust demand for premium-priced medical courses and ongoing expansion approvals mean revenue per student could accelerate well above sector averages, rapidly compounding both top-line growth and net income as these cohorts mature.

- The company's leadership and execution in hybrid education, with double-digit annual student base and intake growth, is aligning perfectly with the surge in demand for scalable, tech-enabled learning across Brazil-this positions Ser to capture a disproportionate share of a growing addressable market, thus supporting long-term revenue outperformance.

- Large structural tailwinds-including the expansion of the middle class, rising urbanization, and persistent government incentives for higher education-are set to significantly expand Ser Educacional's addressable market, enabling years of organic enrollment growth with minimal reliance on cyclical macro drivers, translating into higher revenue visibility and reduced volatility.

- An ongoing strategy of selective regional acquisitions and continuous investment in vocational/professional programs allows Ser to not only diversify revenue streams and geographic risk, but also to tap into rising demand for lifelong learning and reskilling, which could unlock recurring revenue streams and further boost both margin expansion and earnings durability over the next decade.

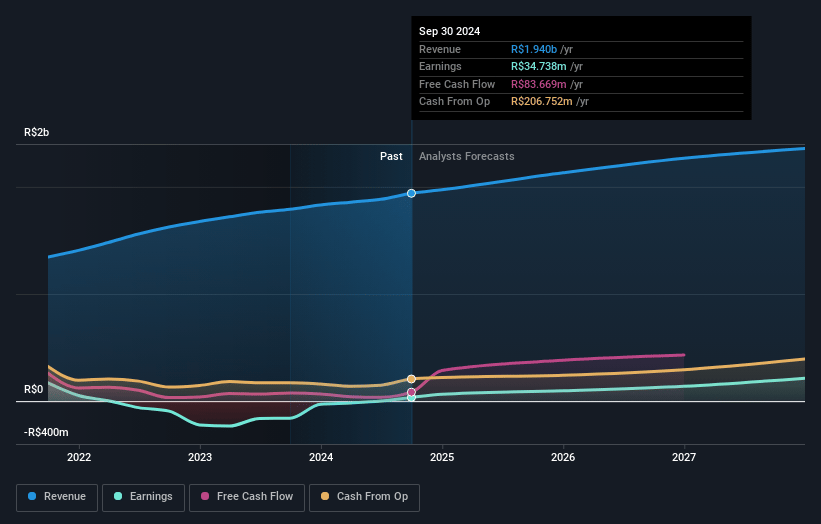

Ser Educacional Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ser Educacional compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ser Educacional's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.9% today to 9.4% in 3 years time.

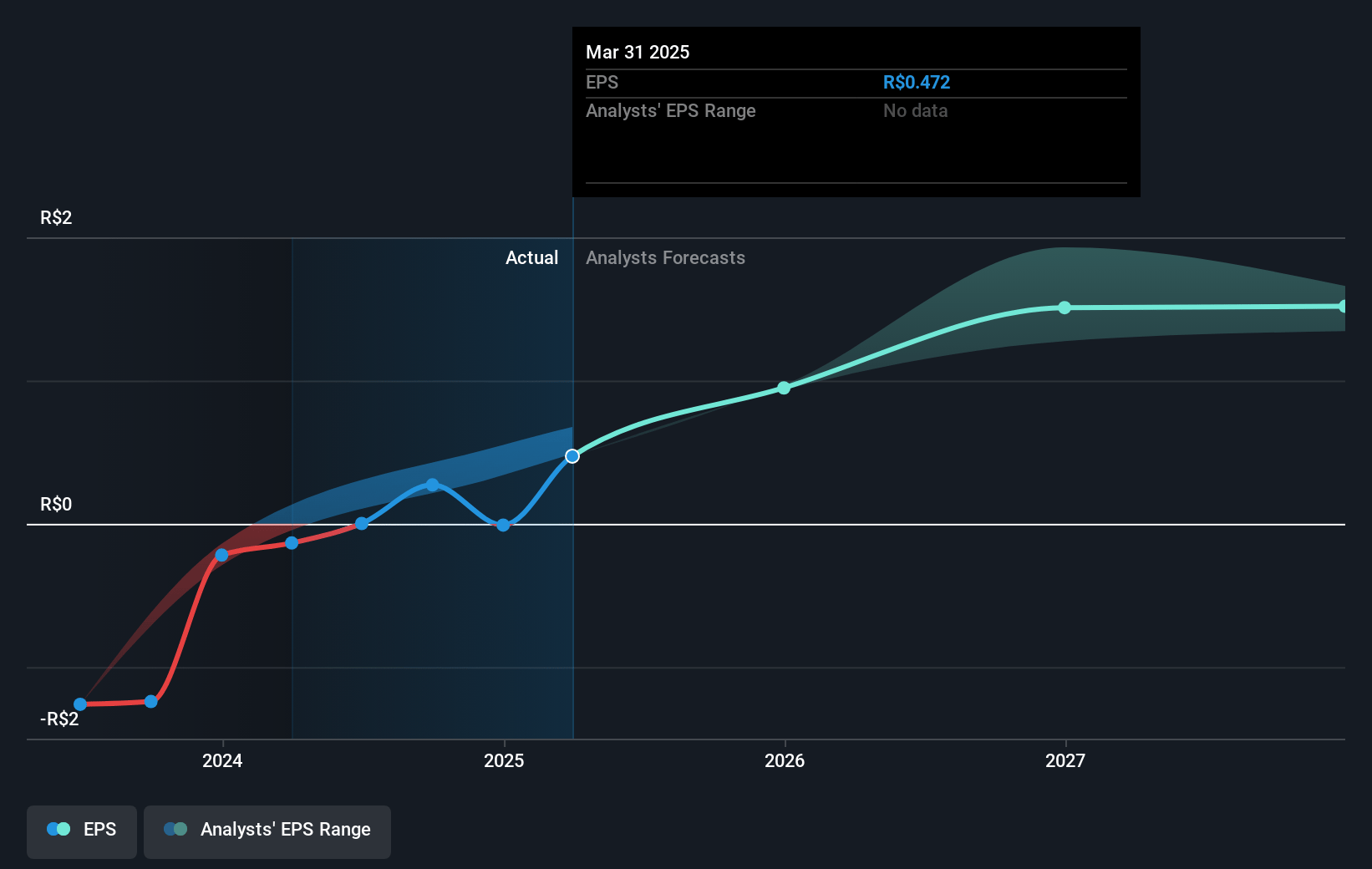

- The bullish analysts expect earnings to reach R$251.6 million (and earnings per share of R$1.94) by about July 2028, up from R$60.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 18.3x today. This future PE is greater than the current PE for the BR Consumer Services industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 1.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.7%, as per the Simply Wall St company report.

Ser Educacional Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining demographic trends in Brazil leading to a smaller pool of prospective higher education students over time may result in weaker enrollment growth for Ser Educacional, ultimately slowing revenue growth and pressuring margins.

- The company noted strong recent results in hybrid and on-campus programs, yet flagged that digital education saw a reduction in student intake due to intense price competition, underscoring Ser Educacional's vulnerability to further shifts toward global online education platforms, which could undermine both enrollment and tuition revenue in the long term.

- Ser Educacional remains exposed to adverse changes in Brazilian government student financing programs such as FIES and PROUNI-for example, FIES now represents less than 4% of the undergraduate base after tighter eligibility and reduced participation-which could further strain enrollment and increase defaults, ultimately affecting cash flow and net profit.

- Management has acknowledged that cost reductions from real estate optimization and operational turnaround may have diminishing returns moving forward, increasing the risk that future efficiency gains will be less significant, thereby hampering net margin improvement as wage and other inflationary pressures persist.

- Sector-wide competition is intensifying, particularly from larger and more technologically advanced private education providers; sustained price wars for distance and hybrid learning could raise student acquisition costs and require discounting, eroding Ser Educacional's ability to maintain revenue growth and compressing earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ser Educacional is R$14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ser Educacional's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$14.0, and the most bearish reporting a price target of just R$5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$2.7 billion, earnings will come to R$251.6 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 21.7%.

- Given the current share price of R$8.69, the bullish analyst price target of R$14.0 is 37.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.