Key Takeaways

- Expansion into higher-margin and sustainable solutions is underway, but new business lines remain too small to offset declines in the core segment.

- Margin growth is challenged by high costs, slow market adoption of new technologies, and vulnerability to revenue volatility from customer concentration.

- Weak demand, currency pressures, and delayed technology adoption threaten Tupy's profitability and competitiveness amid structural market shifts and ongoing margin compression.

Catalysts

About Tupy- Engages in the development, manufacture, and sale of cast and compacted graphite iron structural components in North America, South and Central Americas, Europe, Asia, Africa, Oceania, and internationally.

- While Tupy is poised to benefit from rising global infrastructure investment and a recovery in off-road and commercial vehicle demand-especially as tariffs ease and fleet renewals resume-the timing of this rebound remains uncertain, with persistent macroeconomic headwinds, muted prebuy effects, and cautious OEM customers likely to prolong weak sales and delay meaningful revenue recovery.

- Despite ongoing expansion into higher-margin aftermarket parts, energy, and decarbonization solutions-capitalizing on the shift toward sustainable transport and broadening Tupy's addressable market-these newer business units, while growing rapidly, are still a small fraction of total revenue and may be unable to fully offset structural declines in the core cast iron components segment over the medium term, limiting improvement in overall earnings and margins.

- Although Tupy's enhanced operational flexibility and cost-cutting measures support margin resilience and set the stage for future profit growth as volumes recover, the company continues to face intense pressure from rising labor, energy, and compliance costs, as well as currency volatility, which could erode any gains in net profit margin during prolonged periods of subdued demand.

- While Tupy's investments in advanced materials technology (such as lightweight alloys and compacted graphite iron) and global manufacturing locations attract new contracts with leading OEMs and support long-term diversification, high customer concentration and idle capacity in core plants leave the company vulnerable to revenue volatility and underutilization, impairing near-term operating leverage.

- Even though electrification and hybridization of vehicles are opening new markets (e.g., battery housings, decarbonization solutions), the slow pace of commercial adoption and long lead times for product development mean that these opportunities may not contribute meaningfully to revenue or margin expansion for several years, exposing Tupy to ongoing pressure from both disruptive industry shifts and competition from lower-cost Asian foundries.

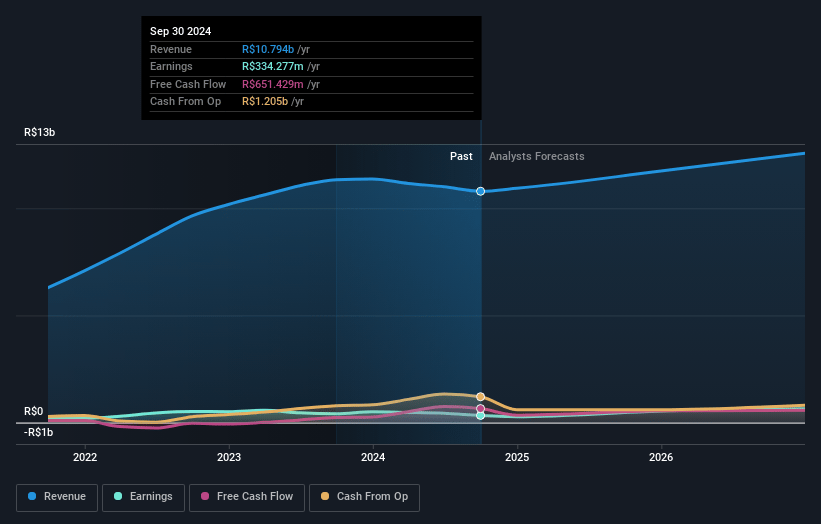

Tupy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tupy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tupy's revenue will grow by 3.1% annually over the next 3 years.

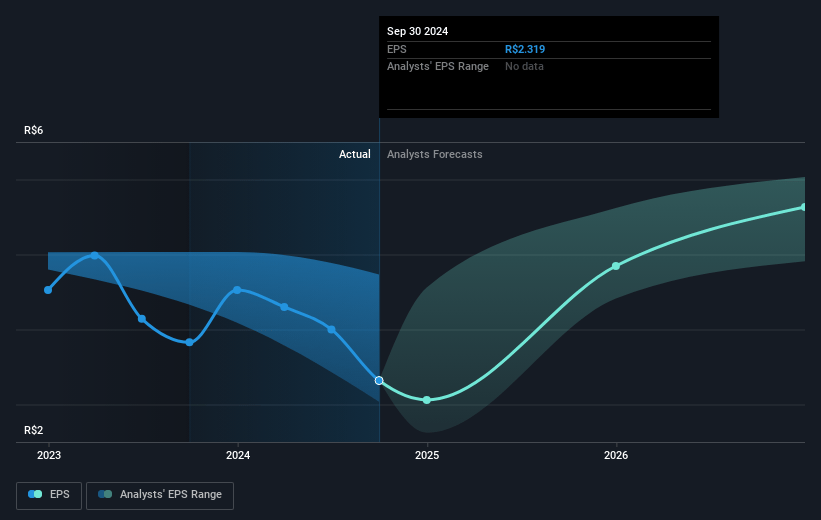

- The bearish analysts assume that profit margins will increase from -0.4% today to 4.7% in 3 years time.

- The bearish analysts expect earnings to reach R$547.2 million (and earnings per share of R$4.79) by about July 2028, up from R$-42.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -48.3x today. This future PE is lower than the current PE for the BR Machinery industry at 7.3x.

- Analysts expect the number of shares outstanding to decline by 5.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 26.52%, as per the Simply Wall St company report.

Tupy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and potentially escalating global trade tariffs-particularly those imposed by the United States-are already resulting in reduced demand, continued postponement of fleet renewals, and a decline in commercial vehicle sales, which directly limit Tupy's core revenue from heavy and commercial vehicle components.

- Growing caution and delayed investment by Tupy's OEM customers, as noted in the US and Europe, suggest extended weakness in new truck and heavy equipment sales; this demand softness may be structural if global economic uncertainty and credit conditions persist, risking prolonged contraction of Tupy's addressable market and sustained downward pressure on revenues.

- Currency volatility, especially the depreciation of the Brazilian real and fluctuations in the Mexican peso, is increasing financial expenses and causing significant exchange rate losses, which are already eroding net profits and could further destabilize earnings given Tupy's large proportion of foreign currency-denominated debt.

- Ongoing high levels of operational idle capacity, particularly in Mexico and Brazil, indicate persistent underutilization of assets, pointing to continued margin compression as fixed costs are spread over fewer units and profitability remains tied to uncertain volume recovery.

- The company's delayed commercial progress on new material technologies, such as ultralight alloys still in technical development phase but not yet generating revenue, underscores the risk that accelerated industry adoption of alternative lightweight materials and electrification could undermine Tupy's competitiveness and long-term revenue base if diversification efforts do not scale rapidly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tupy is R$18.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tupy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$35.0, and the most bearish reporting a price target of just R$18.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$11.6 billion, earnings will come to R$547.2 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 26.5%.

- Given the current share price of R$16.75, the bearish analyst price target of R$18.5 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.