Key Takeaways

- Strategic emphasis on healthcare real estate and geographic diversification enhances revenue stability, reduces regional risk, and captures demographic-driven growth opportunities.

- High-quality assets, long-term leases, and a potential merger position the company for predictable cash flow, operational efficiencies, and future earnings growth.

- Conservative investment approach, market illiquidity, rising debt costs, development delays, and regulatory changes all pose risks to revenue growth, asset values, and profitability.

Catalysts

About Cofinimmo- Cofinimmo has been acquiring, developing and managing rental properties for more than 40 years.

- Cofinimmo's growing focus on healthcare real estate (now 77% of the portfolio) positions it to benefit from demographic shifts such as Europe's aging population and increased public/private healthcare spending, supporting stable occupancy, resilient rent growth, and long-term revenue expansion.

- The company's ongoing geographical diversification-with 53% of assets now outside Belgium-reduces exposure to any single country's economic or regulatory risks and expands its opportunity set for future top-line growth and earnings stability.

- High portfolio occupancy rates (98.6%) and long average lease terms (13 years overall, 15 years in healthcare), supported by triple-net leases with strong tenants, underpin predictable cash flows and support steady EPS growth.

- Sustained investment in energy-efficient and sustainable properties, highlighted by multiple green certifications and recognition in climate leadership rankings, is likely to lower operating costs and may enable premium rents in the future, positively impacting net margins.

- The anticipated combination with Aedifica to create Europe's leading healthcare REIT could unlock operational efficiencies, enhance acquisition and development potential, drive revenue synergies, and potentially lead to multiple expansion, all of which could meaningfully boost future earnings.

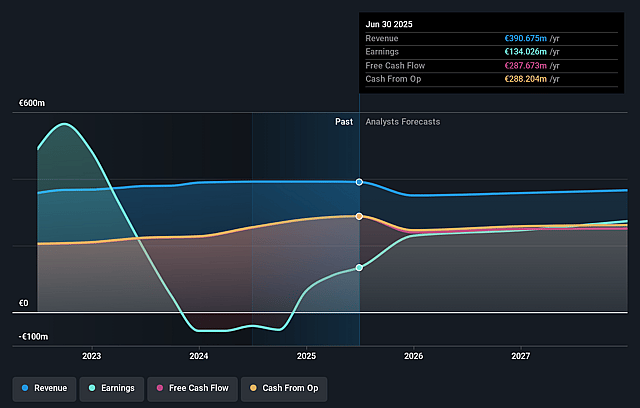

Cofinimmo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cofinimmo's revenue will decrease by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.3% today to 89.6% in 3 years time.

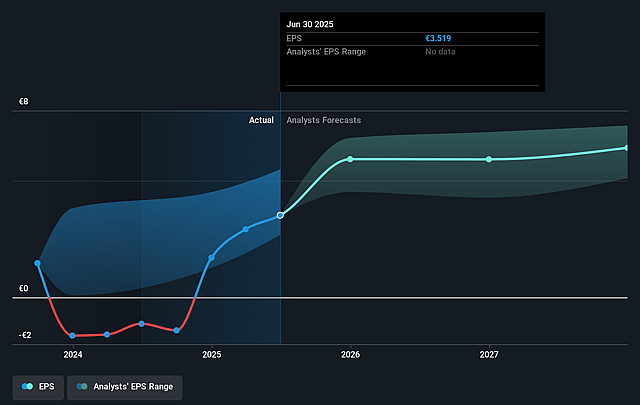

- Analysts expect earnings to reach €315.2 million (and earnings per share of €6.41) by about August 2028, up from €134.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €357 million in earnings, and the most bearish expecting €194.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 21.9x today. This future PE is lower than the current PE for the GB Health Care REITs industry at 19.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Cofinimmo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing portfolio growth and selective divestments since 2022, along with a recent net divestment trend and guidance for a nearly neutral net investment in 2025, may limit future revenue and earnings growth if this cautious investment posture persists.

- Persistent weakness and illiquidity in the Brussels office investment market, combined with skeptical external valuations (suggesting possible over-valuation by Cofinimmo) could lead to downward revaluations, asset write-downs, or slower-than-expected disposals, directly pressuring NAV and net income.

- Anticipated gradual rise in average debt costs (projected to reach 2.2% by 2028 from 1.4%-1.5% currently), alongside a debt-to-asset ratio already above 43%, could increase interest expenses and reduce net margins, particularly if rental indexation plateaus or declines as suggested for 2026.

- Delays and slow pace in the European healthcare real estate development pipeline (notably in Spain due to market-wide construction bottlenecks) could postpone rental income realization and constrict revenue growth from new properties, potentially affecting future earnings trajectories.

- Regulatory changes (such as higher registration fees in France and increasing ESG/sustainability requirements) are already impacting asset values and could necessitate further capital expenditures, increasing operating costs and reducing profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €79.416 for Cofinimmo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €85.91, and the most bearish reporting a price target of just €70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €351.8 million, earnings will come to €315.2 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 7.7%.

- Given the current share price of €76.9, the analyst price target of €79.42 is 3.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.