Last Update 26 Aug 25

Fair value Increased 28%The significant increase in consensus revenue growth and net profit margin forecasts has driven the upward revision of Aussie Broadband's analyst price target from A$4.54 to A$5.50.

Valuation Changes

Summary of Valuation Changes for Aussie Broadband

- The Consensus Analyst Price Target has significantly risen from A$4.54 to A$5.50.

- The Net Profit Margin for Aussie Broadband has significantly risen from 4.57% to 5.40%.

- The Consensus Revenue Growth forecasts for Aussie Broadband has significantly risen from 9.2% per annum to 10.8% per annum.

Key Takeaways

- Expanded high-speed broadband offerings and diversified business segments are fueling strong revenue and margin growth, supported by Australia's digital transformation trends.

- Investments in proprietary infrastructure and strategic wholesale partnerships are enhancing cost efficiency, customer base, and future earnings potential.

- Mounting price competition, regulatory risks, and emerging connectivity technologies threaten profitability and market share, while rising investment and compliance costs pressure future earnings and cash flow.

Catalysts

About Aussie Broadband- Provides telecommunications and technology services in Australia.

- The ongoing rollout of faster NBN plans, new full fibre (FTTP) and HFC upgrades, and the proliferation of connected devices in Australian households are expected to significantly increase demand for high-speed broadband, positioning Aussie Broadband to capture higher ARPU and market share, supporting both top-line revenue growth and margin expansion.

- The company is successfully broadening its revenue base through strong momentum and diversification in higher-margin business, enterprise, government, and wholesale segments-areas underpinned by Australia's accelerating digital transformation and adoption of cloud/ICT services, which is likely to drive sustainable double-digit earnings and margin growth over the medium term.

- Continued investment in self-owned fibre and infrastructure (Aussie Fibre) is already reducing dependence on third parties and generating step-change cost efficiencies (e.g., $20M+ in annual backhaul savings), with further margin improvement expected as network utilisation rises, supporting future net margin expansion.

- The recently announced exclusive wholesale agreement with More and Tangerine (CBA-backed brands) will push Aussie Broadband beyond 1 million total connections and is forecast to add $12 million EBITDA annually from FY27, offering substantial upside to revenue and earnings despite limited near-term impact.

- Industry-wide migration to premium, higher-speed tiers and Aussie's leadership in high-speed plan adoption (over 56% on 100Mbps+ connections) position the company to benefit from secular shifts in work-from-home and IoT device proliferation, raising both ARPU and customer retention rates, which together should drive net margin and EPS growth.

Aussie Broadband Future Earnings and Revenue Growth

Assumptions

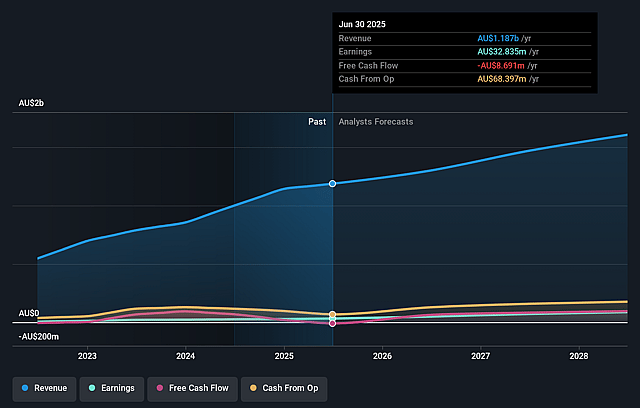

How have these above catalysts been quantified?- Analysts are assuming Aussie Broadband's revenue will grow by 10.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 5.4% in 3 years time.

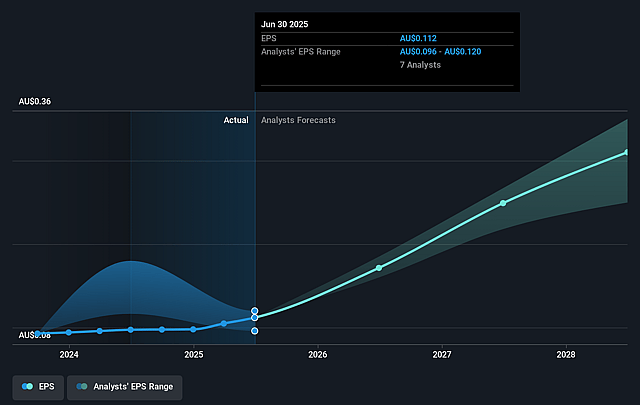

- Analysts expect earnings to reach A$87.8 million (and earnings per share of A$0.3) by about September 2028, up from A$32.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$102.0 million in earnings, and the most bearish expecting A$73.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 45.8x today. This future PE is lower than the current PE for the AU Telecom industry at 620.5x.

- Analysts expect the number of shares outstanding to decline by 3.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Aussie Broadband Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition and margin pressures in the Australian broadband and voice markets-repeatedly noted throughout the results-could erode average revenue per user (ARPU) and limit future EBITDA and net margin growth, especially if further discounting persists industry-wide.

- Ongoing dependence on NBN infrastructure and regulatory exposure, including the risk of changes in NBN's wholesale pricing/structure, may compress gross margins and earnings if NBN Co raises access costs or modifies pricing models unfavorably for resellers like Aussie Broadband.

- The rapid shift in market preference toward alternative connectivity solutions such as 5G home internet and satellite broadband poses a long-term risk of market share erosion in fixed-line broadband, potentially stalling organic connection growth and limiting revenue expansion.

- Industry consolidation and the growing scale of incumbents may strengthen competitors' bargaining power and ability to invest in bundled, value-added offerings, making it more difficult for Aussie Broadband to sustain high customer acquisition and retention, especially within both residential and business segments-affecting future revenue and EBIT growth.

- Sustained investment requirements in network infrastructure (e.g., fibre footprint, digital platforms, security) combined with emerging cybersecurity threats and data privacy regulations may require ongoing high CapEx and OpEx, placing pressure on free cash flow and net profits if revenue growth slows or operational efficiencies plateau.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$5.789 for Aussie Broadband based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.85, and the most bearish reporting a price target of just A$4.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.6 billion, earnings will come to A$87.8 million, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$5.14, the analyst price target of A$5.79 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.