Last Update26 Aug 25Fair value Increased 6.33%

Praemium's improved net profit margin and a notably lower future P/E ratio signal enhanced profitability and valuation appeal, justifying the increase in the consensus analyst price target from A$0.95 to A$1.01.

Valuation Changes

Summary of Valuation Changes for Praemium

- The Consensus Analyst Price Target has risen from A$0.95 to A$1.01.

- The Future P/E for Praemium has significantly fallen from 28.25x to 24.35x.

- The Net Profit Margin for Praemium has risen from 16.29% to 17.72%.

Key Takeaways

- Enhanced platform functionality and automation are boosting client retention, operating efficiency, and recurring revenue growth through increased adoption of digital and AI-driven solutions.

- Regulatory and industry trends are expanding Praemium's market, with strong client wins, successful integrations, and cost synergies supporting sustainable profit and cash flow gains.

- Loss of major clients, rising competition, integration risks, and operational changes may pressure margins, hinder growth, and increase exposure to regulatory and technology-related challenges.

Catalysts

About Praemium- Provides advisors and wealth management solutions in Australia and internationally.

- The company is positioned to benefit from increasing global wealth and demographic trends driving greater demand for advanced wealth management and retirement solutions-the successful launch and ongoing enhancement of Spectrum, their next-generation platform, is supporting strong client interest and delivering new sales momentum, which is set to underpin double-digit revenue growth.

- Growing preferences for digitalization and automation in financial services, including increased adoption of AI and machine learning capabilities, are allowing Praemium to enhance its platform functionality and efficiency, leading to stronger client retention and expanding EBITDA margins as recurring SaaS revenues grow faster than operating costs.

- Heightened regulatory requirements for transparency and compliance are pushing advisors towards specialist platforms with robust reporting and administration solutions, creating an ongoing tailwind for Praemium's addressable market and supporting higher revenue and stable, recurring cash flows.

- Large new client wins and a competitive sales pipeline-plus ongoing migration of assets from legacy providers-are driving strong forward-looking platform inflows; as onboarding completes, these will translate to revenue and profit uplift with significant operating leverage.

- Completion of the OneVue integration and increased use of scalable, modular technology and selective third-party suppliers are expected to deliver cost synergies and automation benefits, improving operating margins and driving stronger free cash flow generation over the coming years.

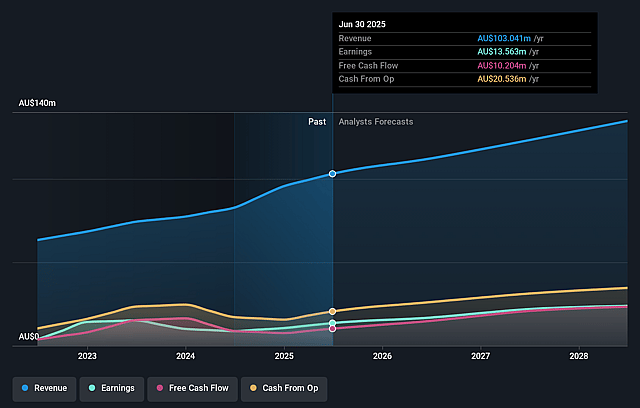

Praemium Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Praemium's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.2% today to 17.7% in 3 years time.

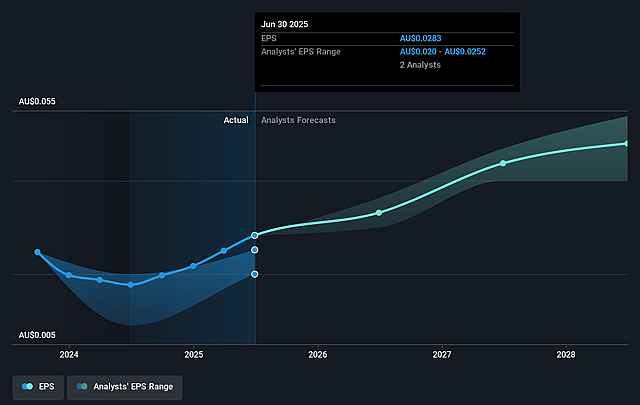

- Analysts expect earnings to reach A$23.9 million (and earnings per share of A$0.05) by about August 2028, up from A$13.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as A$20.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.4x on those 2028 earnings, down from 25.9x today. This future PE is lower than the current PE for the AU Software industry at 32.3x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Praemium Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming departure of large clients such as Asgard and IPS, with Asgard contributing a minimum of approximately $3 million per year, creates a headwind that may not be fully offset by expected wins or price increases, posing a long-term risk to Praemium's revenue trajectory.

- Ongoing industry consolidation and intensified competition-both from larger incumbents and new digital/AI-driven entrants-may drive down fee rates and require higher R&D spend to maintain competitive edge, threatening margins and long-term earnings growth.

- The company's increasing reliance on technology investment and automation, while driving efficiency, introduces potential risks from rapid technological changes, escalating cybersecurity threats, and project execution missteps, which could result in unexpected cost overruns and impact net margins.

- Integration of OneVue and other acquisitions remains a source of operational and financial risk: currently, there are no synergies in the numbers, and if integration efforts face delays or fail to deliver planned cost savings, Praemium's margin expansion and earnings could be adversely affected.

- The move to bring superannuation administration capabilities in-house and replace third-party suppliers could create significant operational and regulatory complexity; if not properly managed, this transition could lead to higher compliance costs, hurt product quality, and potentially reduce customer retention, impacting revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.01 for Praemium based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.21, and the most bearish reporting a price target of just A$0.78.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$134.7 million, earnings will come to A$23.9 million, and it would be trading on a PE ratio of 24.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$0.74, the analyst price target of A$1.01 is 27.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.