Last Update27 Aug 25Fair value Decreased 21%

Despite a notable increase in consensus revenue growth forecasts, a sharp decline in the future P/E multiple has driven the consensus analyst price target for Integrated Research down from A$0.70 to A$0.55.

What's in the News

- Integrated Research previewed enhanced Cisco cloud migration solutions at Cisco Live, offering deeper visibility, real-time and intelligent insights.

- The enhancements aim to reduce risk, lower total cost of ownership, and support seamless cloud transitions for organizations.

- Live demonstrations emphasized Prognosis’ ability to simplify complex migrations, ensure user adoption, and maintain service quality.

Valuation Changes

Summary of Valuation Changes for Integrated Research

- The Consensus Analyst Price Target has significantly fallen from A$0.70 to A$0.55.

- The Consensus Revenue Growth forecasts for Integrated Research has significantly risen from 6.8% per annum to 10.5% per annum.

- The Future P/E for Integrated Research has significantly fallen from 20.26x to 11.89x.

Key Takeaways

- Growing demand for real-time observability and unified communication monitoring is boosting recurring revenue opportunities and strengthening client retention.

- Strategic product innovation and a shift to subscription models are expected to improve revenue stability and support long-term growth.

- Revenue instability, declining core segment performance, and execution risks from product transitions threaten growth and margins amid intense industry competition and shifting customer preferences.

Catalysts

About Integrated Research- Designs, develops, implements, and sells software for business-critical computing, unified communication, and payment networks.

- Acceleration of digital transformation and cloud adoption continues to increase the complexity and criticality of IT ecosystems, which is expanding demand for real-time observability and performance analytics platforms like those of Integrated Research-supporting future revenue growth as organizations require robust monitoring across both hybrid and cloud environments.

- Widespread proliferation of hybrid and remote work is driving growing reliance on unified communications and collaboration platforms, directly underpinning the need for IR's real-time monitoring and diagnostic solutions, especially as enterprise customers focus on IT resilience and user experience-providing a tailwind for both client retention and upsell opportunities that will benefit recurring revenues.

- The company's strategic pivot to product-led growth and accelerated R&D investment-highlighted by the release of new cloud-hosted solutions (Prognosis Elevate), AI-powered analytics (Iris), and domain-specific products (High Value Payments)-is positioning IR to open new revenue streams and improve cross-sell/upsell, supporting a structural improvement in long-term growth.

- Transition towards subscription-based and consumption pricing models (akin to SaaS), as well as increasing adoption of cloud-native delivery, is expected to increase both revenue visibility and margin stability, smoothing earnings and reducing cyclicality traditionally associated with one-time license deals.

- Strong balance sheet (net cash position and no debt) ensures IR can continue to invest heavily in product innovation and commercial expansion, increasing the probability of capturing market share as clients migrate to modern performance management and compliance-driven solutions-potentially leading to margin expansion and sustained earnings growth once the investment phase moderates.

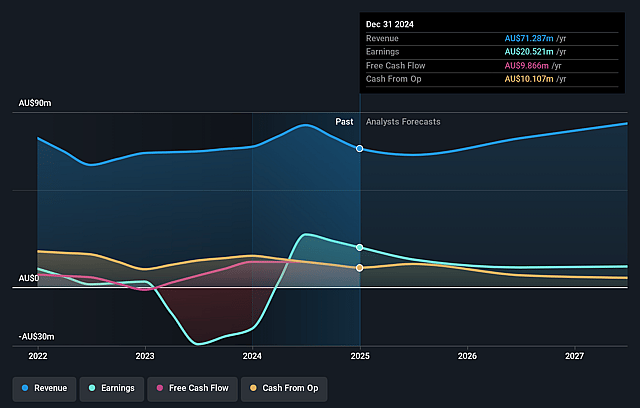

Integrated Research Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Integrated Research's revenue will grow by 10.5% annually over the next 3 years.

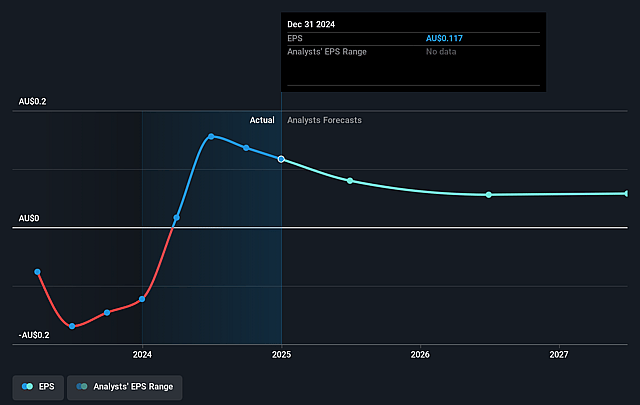

- Analysts assume that profit margins will shrink from 19.6% today to 11.4% in 3 years time.

- Analysts expect earnings to reach A$10.5 million (and earnings per share of A$0.06) by about September 2028, down from A$13.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 5.6x today. This future PE is lower than the current PE for the AU Software industry at 33.4x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

Integrated Research Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's historical reliance on contract renewals-subject to annual fluctuation-remains unresolved, as new client and expansion revenues are still insufficient to offset persistent churn, risking revenue instability and potential ongoing declines in top-line growth.

- Despite the launch of new products and product-led growth initiatives, management expects profits and potentially EBITDA margins to decline for two to three years as investment in R&D and commercialization accelerates, directly impacting near

- and medium-term earnings and net margins.

- The core Collaborate segment is experiencing double-digit revenue decline (-10% YoY), while market commentary notes continued client trends toward shortening contract durations and cost-efficiency, suggesting ongoing vulnerability to customer loss and downward pressure on recurring revenues.

- Increased investment in new product launches (including cloud and AI products) carries significant execution risk; failure to successfully transition offerings to cloud/SaaS and scale new revenue streams could result in shrinking net margins and muted revenue growth while fixed costs remain high.

- Industry-wide shifts-including the growing dominance of integrated, all-in-one observability solutions from large tech providers and increased commoditization-may threaten Integrated Research's relevance as a niche provider, potentially leading to persistent margin erosion and earnings pressure.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.55 for Integrated Research based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$92.1 million, earnings will come to A$10.5 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$0.42, the analyst price target of A$0.55 is 23.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.