Key Takeaways

- Accelerated store expansion, premium refits, and franchise reacquisitions are unlocking new geographies, boosting revenue potential, and driving higher margins through operational leverage.

- Proprietary brands, robust loyalty programs, and structural demand for athleisure underpin sustained sales growth, reduced acquisition costs, and continued gross margin improvement.

- Dependence on exclusive brand deals, physical stores, and traditional products leaves Accent Group exposed to digital disruption, cost pressures, and shifting consumer preferences.

Catalysts

About Accent Group- Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

- Analysts broadly agree that store rollout and footprint expansion are a key catalyst, but management has suggested a substantial acceleration is possible, as current targets are viewed as conservative and the Board is actively redeploying capital towards faster expansion and premium refits that have shown immediate uplifts in store performance, creating significant upside for revenue and operating leverage.

- Analyst consensus highlights TAF reacquisitions, but the full earnings benefit is likely being understated, as reacquisition unlocks new geographies for corporate rollout and enables a step change in format innovation, driving higher net margins and accelerating earnings from FY26 onwards as the majority of franchise buybacks are completed.

- Accent Group's extensive customer database of 10 million, combined with advanced data analytics and high-performing loyalty programs, is poised to significantly reduce customer acquisition costs and increase repeat purchases, underpinning strong comp sales growth and sustainable improvements in gross margin.

- Growth in high-margin owned vertical brands (such as Alpha, Nude Lucy, Stylerunner, and NiLS) is still in the early innings, with strong consumer trends towards branded and trend-led footwear and athleisure suggesting vertical brands could double their mix of sales within the next few years, materially boosting group gross profit and net margin.

- The ongoing surge in health, fitness, and athleisure demand across ANZ and rapid urbanization in metro regions are structural trends that will drive sustained category growth and higher store productivity, supporting multi-year comp sales outperformance and providing a rising tide for revenue and earnings growth.

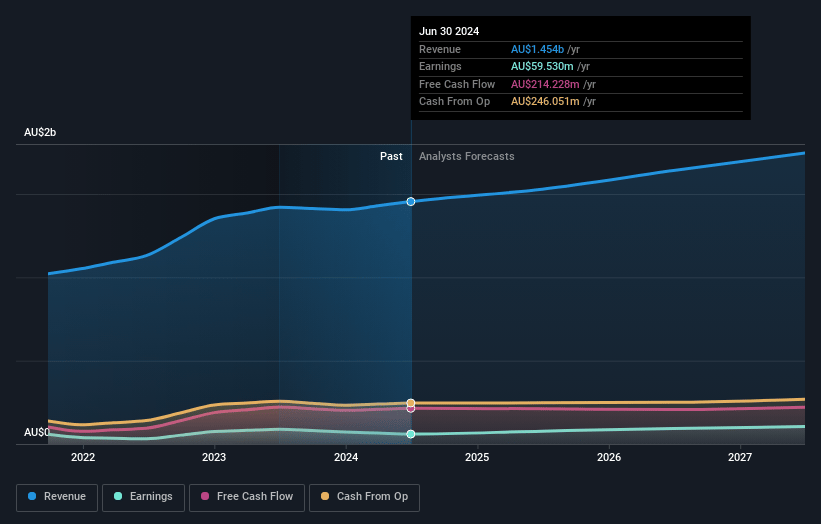

Accent Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Accent Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Accent Group's revenue will grow by 9.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.3% today to 6.4% in 3 years time.

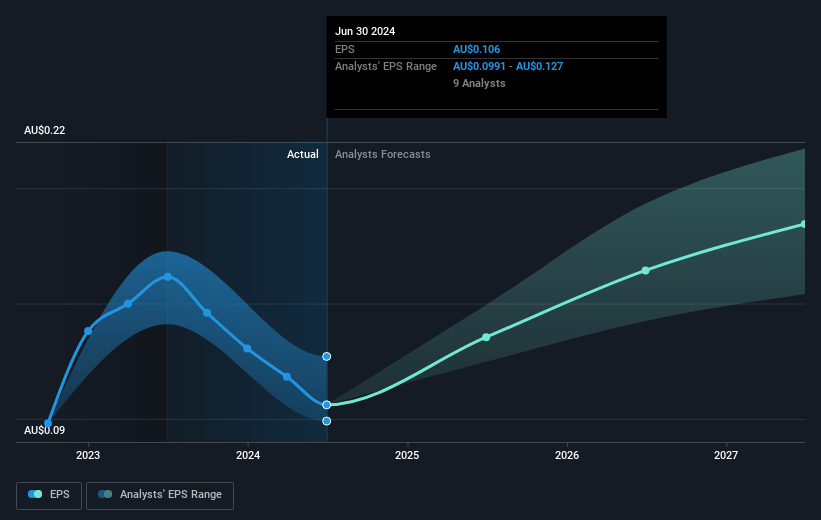

- The bullish analysts expect earnings to reach A$124.4 million (and earnings per share of A$0.21) by about July 2028, up from A$64.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 13.9x today. This future PE is lower than the current PE for the AU Specialty Retail industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.06%, as per the Simply Wall St company report.

Accent Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing dominance of global footwear brands shifting to direct-to-consumer and digital channels could eventually bypass Accent Group, threatening its role as a specialty retailer and exposing it to exclusivity losses, which may adversely affect future revenues.

- Accent Group's significant investment in expanding and refurbishing physical stores, despite a broader industry shift toward e-commerce and digital retail, risks creating excessive fixed costs and possible store write-downs, which could erode net margins and earnings over time.

- The heavy reliance on exclusive distribution agreements with major international brands-including recent focus on brands such as Hoka, Merrell, and Skechers-creates vulnerability; renegotiations or terminations of any major agreements could drive significant declines in both revenue and profits.

- Persistent cost inflation, rising wages, and continued rent escalations in Australia and New Zealand are likely to compress operating margins, especially if Accent Group is unable to achieve consistent like-for-like sales growth above three percent or pass higher costs to price-sensitive consumers.

- Growing consumer demand for ethically sourced and sustainable products poses a risk to Accent Group's portfolio of conventional branded footwear, potentially requiring expensive adaptation or resulting in the loss of market share, which would negatively impact revenues and long-term financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Accent Group is A$2.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Accent Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.5, and the most bearish reporting a price target of just A$1.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$2.0 billion, earnings will come to A$124.4 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 9.1%.

- Given the current share price of A$1.49, the bullish analyst price target of A$2.5 is 40.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.