Key Takeaways

- Strategic focus on urban logistics assets and divestment of non-core properties enhances portfolio quality, driving higher rental income and stable cash flow.

- Limited industrial supply and increased tenant demand support strong occupancy, rental growth, and long-term earnings resilience.

- High tenant concentration, legacy asset risks, and limited reinvestment flexibility threaten long-term earnings stability amid technological shifts and changing industrial property demand.

Catalysts

About Dexus Industria REIT- Dexus Industria REIT (ASX code: DXI) is a listed Australian real estate investment trust which is primarily invested in high-quality industrial warehouses.

- Rising e-commerce penetration and expanding same-day delivery requirements are driving ongoing demand for modern, well-located logistics and warehousing space; Dexus Industria's strategic weighting to infill, urban industrial assets with near-immediate access to major population centres positions it to benefit from above-market rental growth and high occupancy, positively impacting revenue and NOI.

- Limited new industrial supply due to elevated land and construction costs, alongside increased planning delays, is likely to continue supporting low vacancy rates and upward pressure on rents for existing portfolios such as Dexus Industria's, providing sustained tailwinds for income resilience and property valuation uplifts.

- The ongoing shift towards automation and sustainability in warehousing-exemplified by tenant investments in solar and advanced logistics facilities, as well as Dexus Industria's own delivery of high-spec, sustainable developments-should help capture premium tenants and support higher rental rates and retention, benefiting net margins and long-term earnings growth.

- The accelerated divestment of non-industrial and capital-intensive assets (such as the BTP office holding), with redeployment into high-quality Sydney urban logistics, enhances portfolio quality and cash flow reliability, while freeing capital for development and operational efficiency improvements-expected to drive future revenue and steady or improved net margins.

- Dexus Industria's conservative balance sheet and low gearing (moving to ~24%) following strategic transactions creates flexibility to pursue opportunistic acquisitions and developments, underpinning future asset base expansion and supporting earnings growth as market conditions remain favorable for industrial real estate.

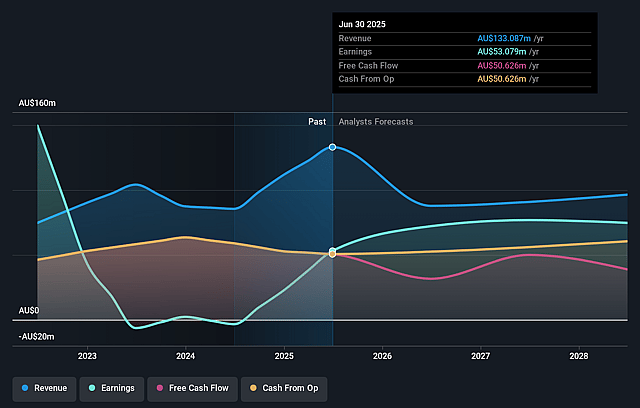

Dexus Industria REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dexus Industria REIT's revenue will decrease by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 39.9% today to 78.1% in 3 years time.

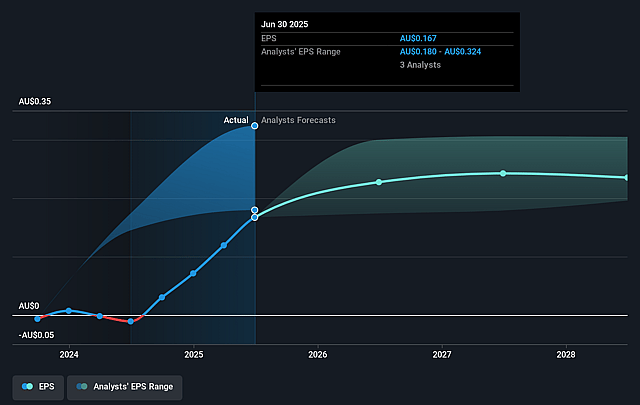

- Analysts expect earnings to reach A$74.7 million (and earnings per share of A$0.24) by about September 2028, up from A$53.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$96.8 million in earnings, and the most bearish expecting A$62.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, up from 16.7x today. This future PE is lower than the current PE for the AU Industrial REITs industry at 17.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Dexus Industria REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift towards high-quality, technologically advanced, and green-certified industrial assets is accelerating, potentially creating obsolescence risk for some of Dexus Industria REIT's older warehouse stock, which may require significant capital expenditure to remain competitive and could negatively impact net margins and long-term asset valuations.

- The portfolio's relatively high tenant concentration-most notably with WesTrac accounting for 18% of total income-exposes Dexus Industria REIT to cash flow and revenue risk if key tenants downsize, relocate, or face financial challenges, ultimately affecting income resilience and earnings stability.

- Although the Jandakot development pipeline presents growth potential, reliance on development-led upside increases exposure to execution risks, potential construction cost overruns, and leasing shortfalls-any of which could negatively affect future earnings growth and margin outcomes, especially if market conditions soften or demand moderates.

- A higher payout ratio into FY '26-approaching 96% (declining to low 90s if stabilized)-constrains retained capital and may limit financial flexibility to reinvest in portfolio upgrades, acquisitions, or weather asset devaluations, thereby putting pressure on long-term earnings and balance sheet strength.

- Ongoing automation and digitisation trends within logistics and supply chains may lead to reduced aggregate warehouse demand as tenants require less physical space, creating medium

- to long-term risks of lower occupancy or slower rental growth, which would adversely impact revenue and funds from operations (FFO).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.14 for Dexus Industria REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.5, and the most bearish reporting a price target of just A$2.89.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$95.6 million, earnings will come to A$74.7 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$2.8, the analyst price target of A$3.14 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.