Key Takeaways

- Debt restructuring and land sale strategies enhance net margins and stabilize balance sheet, preparing for revenue recovery.

- Cost-saving measures and strategic realignment aim to boost cash flow and long-term operational resilience as market conditions stabilize.

- High inventory levels, regulatory risks, and financial strain from dividend pauses and debt restructuring threaten Lifestyle Communities' margins, revenue, and investor confidence.

Catalysts

About Lifestyle Communities- Provides housing for its homeowners in community in Australia.

- The refinancing and restructuring of the company's debt provides additional covenant headroom, allowing time for market conditions to improve and the sales rate to recover, which is likely to impact both revenue stabilization and future earnings.

- The strategic review and planned exit from up to 3 land sites to reduce excess land bank will release $80 million to $100 million in capital, which can be used to reduce debt and stabilize the balance sheet, positively affecting the company's net margins.

- The slowdown in development spend and a focus on reducing excess inventory are strategic moves to realign costs with revenue, likely to improve net margins and cash flow over the next fiscal periods.

- Implementation of cost-saving initiatives and a pause in dividend payments are measures to maintain balance sheet strength and liquidity, supporting long-term earnings growth and future operational resilience.

- Early signs of sales improvement from better face-to-face appointment conversion rates and targeted price adjustments are expected to drive future revenue growth and enhance profitability as market conditions stabilize.

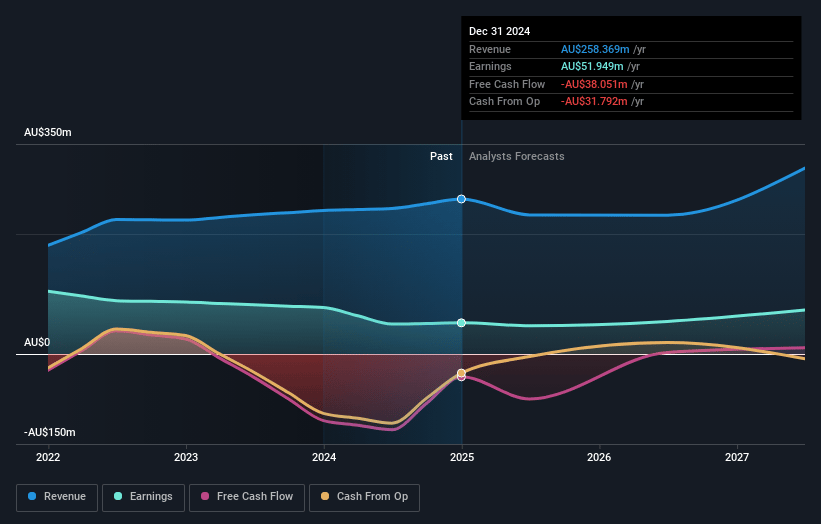

Lifestyle Communities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifestyle Communities's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 22.6% in 3 years time.

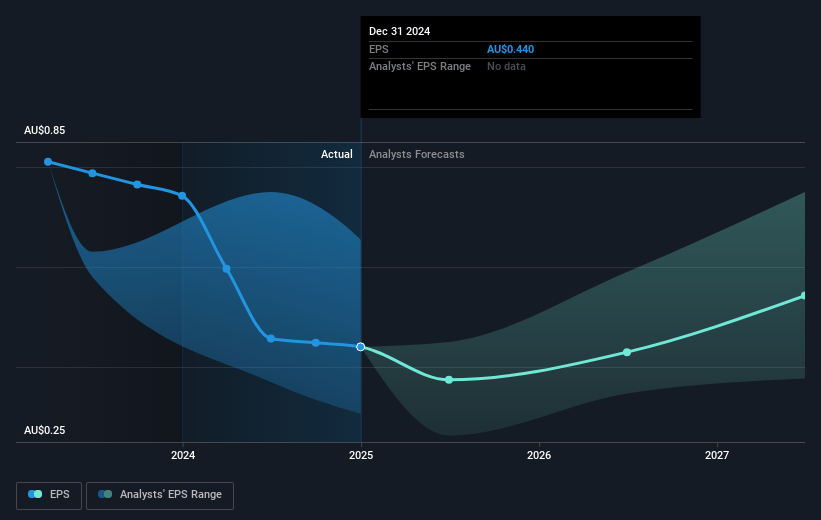

- Analysts expect earnings to reach A$74.5 million (and earnings per share of A$0.69) by about July 2028, up from A$51.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as A$15.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 10.7x today. This future PE is greater than the current PE for the AU Real Estate industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

Lifestyle Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifestyle Communities is dealing with declining sales and settlements, which may negatively impact future revenue and earnings. The expected subdued settlement in FY '26 due to previous low sales highlights this issue.

- The company has high inventory levels and an outsized land bank, indicating a potential overextension of capital and resources, which might pressure net margins and financial flexibility.

- The decision to pause dividends to preserve capital and the need for refinancing and debt restructuring suggest financial strain that could affect investor confidence and the company's earnings potential.

- Uncertain outcomes of legal proceedings like the VCAT case and the Victorian government's review of the Residential Tenancies Act pose regulatory risks that could impact the company's revenue and profitability if unfavorable decisions are made.

- The ongoing need for inventory reduction and land bank rightsizing indicates potential challenges in asset management that, if not successfully addressed, could strain margins and reduce net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$6.248 for Lifestyle Communities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$8.83, and the most bearish reporting a price target of just A$4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$329.3 million, earnings will come to A$74.5 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of A$4.6, the analyst price target of A$6.25 is 26.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.