--- [Narrative update per Investor announcement 24-Mar-2025] ---

The analysis below was written ahead of Opthea’s Phase 3 results. As stated, the thesis was highly dependent on trial success. The results released today were unfortunately negative, which fundamentally changes the outlook. The scenario planning I outlined accounted for upside, but this clearly falls below even the downside case. This is a reminder of the binary risk nature of biotech investments:

Announcement key takeaways:

- Clinical failure is material - this was not a marginal miss. There is no efficacy benefit over existing treatment.

- DFA terms have potential to be devestating.

- Massive strategic uncertainty - management are in crisis mode and will be assessing whether to end the ShORe trial early.

- Going Concern Qualification - strong possibility of a wind-down, fire sale.

END.

---- [Narrative update per Investor announcement 29-Jan-2025] ---

Note: Issues with website 'Valuator' model tool, see price assessment below. Price target is AU$4.11 pre-phase 3 read out, and >AU$5.14 post-read out (mid-2025). Pls comment below w/ questions or corrections. Enjoy.

Opthea (ASX:OPT) – A Pathway to Commercialisation

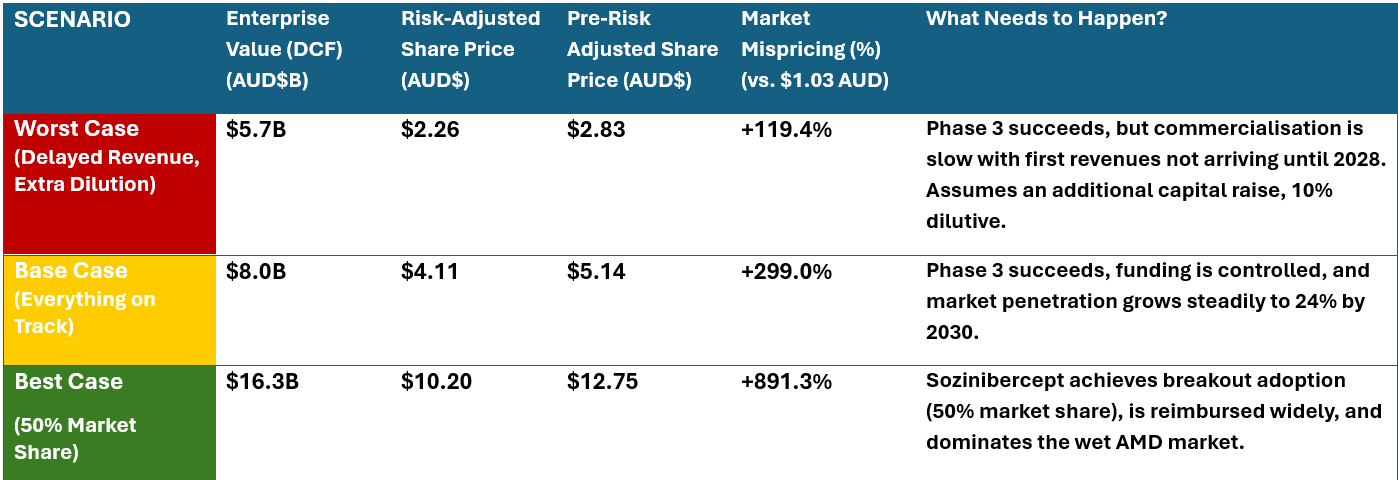

We've undertaken a rigorous and comprehensive analysis of Opthea, spanning valuation modelling, market opportunity, funding risks, and demand-driven price adjustments. While the fundamental question remains, "What is Opthea worth?", flashing a wide range of share prices ($2.26 to $10.20 AUD) would be meaningless without context.

Instead, we’ll connect the dots—to show investors exactly why these scenarios exist and what has to happen for each valuation to materialise.

1. Understanding the Opportunity – Why Opthea Could be a Game-Changer

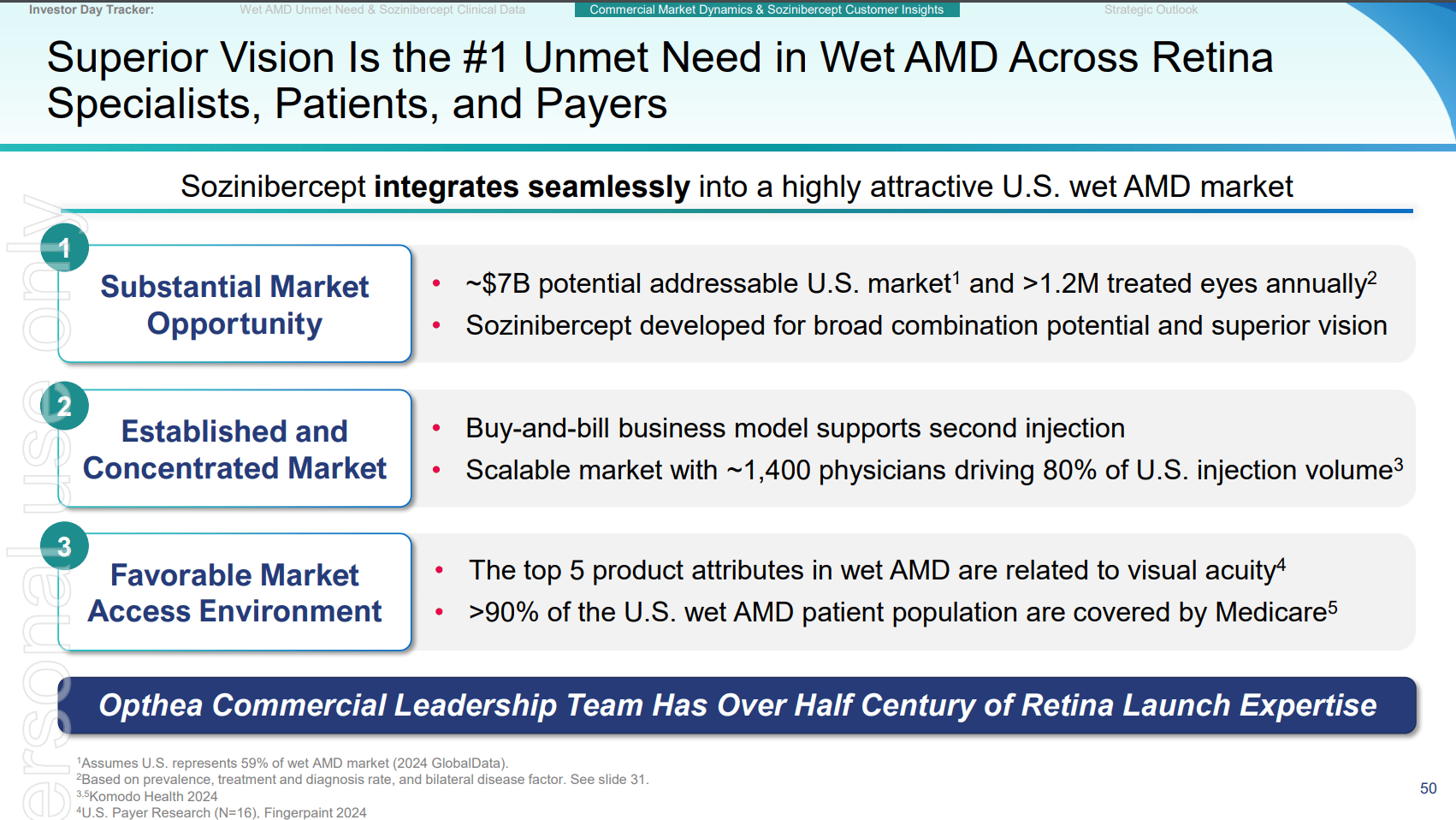

Opthea’s lead drug, Sozinibercept, is in Phase 3 trials for wet AMD, a market currently dominated by Regeneron’s Eylea and Roche’s Lucentis. Unlike competitors, Sozinibercept doesn’t compete—it enhances.

- A global $15B+ Market: The wet AMD treatment market is enormous.

- The US market alone is estimated to be ~50% of the global market $7B+, or 1.2M eligible Americans annually.

- A Complementary Treatment: Sozinibercept works alongside existing therapies, potentially improving vision outcomes significantly.

- A Unique Position: There is no other competing drug targeting the VEGF-C/D pathway.

The Thesis: If Sozinibercept delivers superior results, it won’t steal market share—it will expand it.

2. Breaking Down the Valuation – How We Built the Price Scenarios

Valuation isn’t just about building a model and landing on a number. It’s about matching the output to reality—ensuring that for every valuation, there is a real-world pathway that gets us there.

Assumptions Underpinning Pre- and Post-Risk Adjustments:

- Risk-Adjusted Valuation:

- Incorporates a 20% probability of Phase 3 failure, applying a risk discount. I.e. What the fair value should be before the phase 3 read-outs assuming a 20% probability of failure.

- Accounts for potential delays in commercialisation, leading to further capital raising needs.

- Factors in trading liquidity constraints and institutional demand, adjusting for market mispricing dynamics.

- Pre-Risk Adjusted Valuation:

- Assumes Phase 3 success and no regulatory delays. i.e. What the fair value should be, after positive phase 3 read-out.

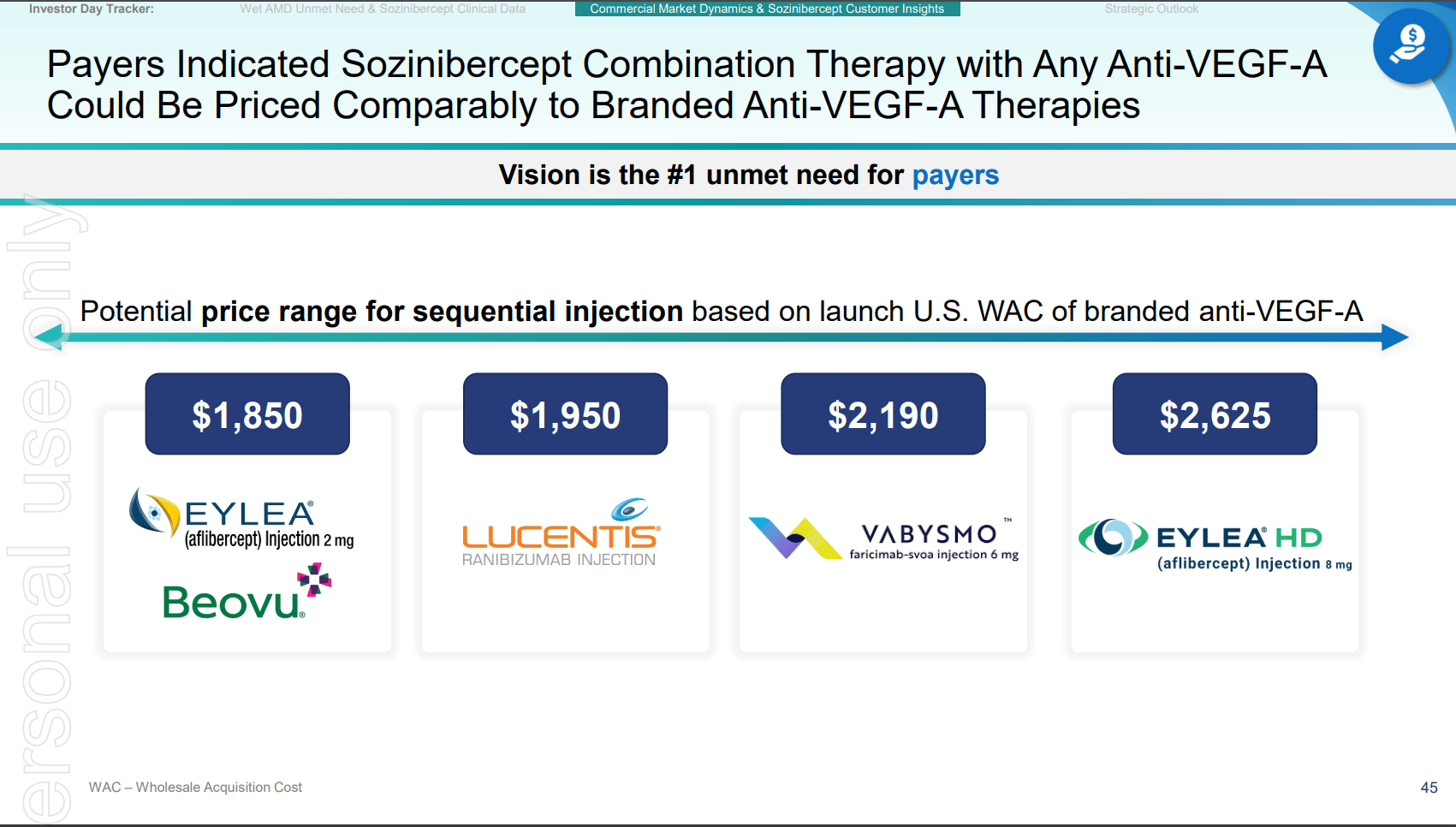

- Revenue projections begins in 2027, scaling up to 24% market capture by 2030.

- Pricing per dose set at $2,100, with 80% gross margins.

- Standard discount rate of 10% and terminal growth of 4.5%.

- Under both scenarios’ currency adjusted at $0.65 USD per AUD.

- Capital raise dilutions factored in per the below.

This table provides the real investor takeaway:

- The market today ($1.03 AUD) is pricing in failure.

- Even if things don’t go perfectly, the stock is undervalued.

- If Phase 3 is a success, we have a clear path to $5+ AUD per share.

- If adoption explodes, a double-digit share price is realistic.

3. Funding & Dilution – What Investors Need to Know

- Opthea likely requires a $300M equity raise, leading to ~20% dilution at the current price. <10% if the price trades >$2.00. i.e. higher the price = lower the dilution.

- A worst-case scenario could involve an additional 10% dilution, stretching the impact further.

- Despite dilution, the upside remains compelling—even in the worst-case scenario, shares should be trading higher than today.

- A 2021 (Long-term Employee Incentive Plan) LTEI announcement, allows for management to issue up to 10% of outstanding shares in new options. They aren't taking much of a wage yet, but their dilutive effect needs some careful oversight. Shareholders need to be active in seeking the enforcement of option price floors well above the current price, minimum 3 year vesting periods, and objective milestones (e.g. positive phase 3 read out; or ‘upon achieving a net profit as declared in the annual audited accounts’) before options can vest.

Key Concern: Can They Avoid More Dilution?

- Non-dilutive funding (partnerships, licensing) remains a possibility.

- A deal with Regeneron or Roche could transform the financial outlook overnight.

4. Final Takeaways – What The Market is Getting Wrong

This analysis isn’t about picking a single price target. It’s about identifying mispricing and showing how the market is failing to price in multiple upside scenarios.

Three Key Investor Insights:

- Phase 3 success is the defining moment. If results are strong, Opthea won’t be worth $1.03 AUD anymore—even in a cautious case, it should be in the $2.26-$5.14 range.

- The market is overly discounting risk. Today’s price assumes failure—yet, even if commercialisation is slow, the valuation still suggests ~119% upside.

- Dilution is a concern, but doesn’t break the thesis. Even if Opthea raises $300M in equity, investors can still expect significant upside.

What’s Next?

The next six months will determine everything:

- Phase 3 trial data (mid-2025) will be the biggest catalyst.

- An acquisition or licensing deal could significantly de-risk the investment.

- Investors should monitor funding updates and strategic partnerships closely.

Final Thought:

This is a high-risk, high-reward play. The upside far outweighs the downside if Phase 3 succeeds, and the market is currently mispricing the probability of success.

For investors willing to accept biotech risk, Opthea could be one of the most undervalued plays in the sector today.

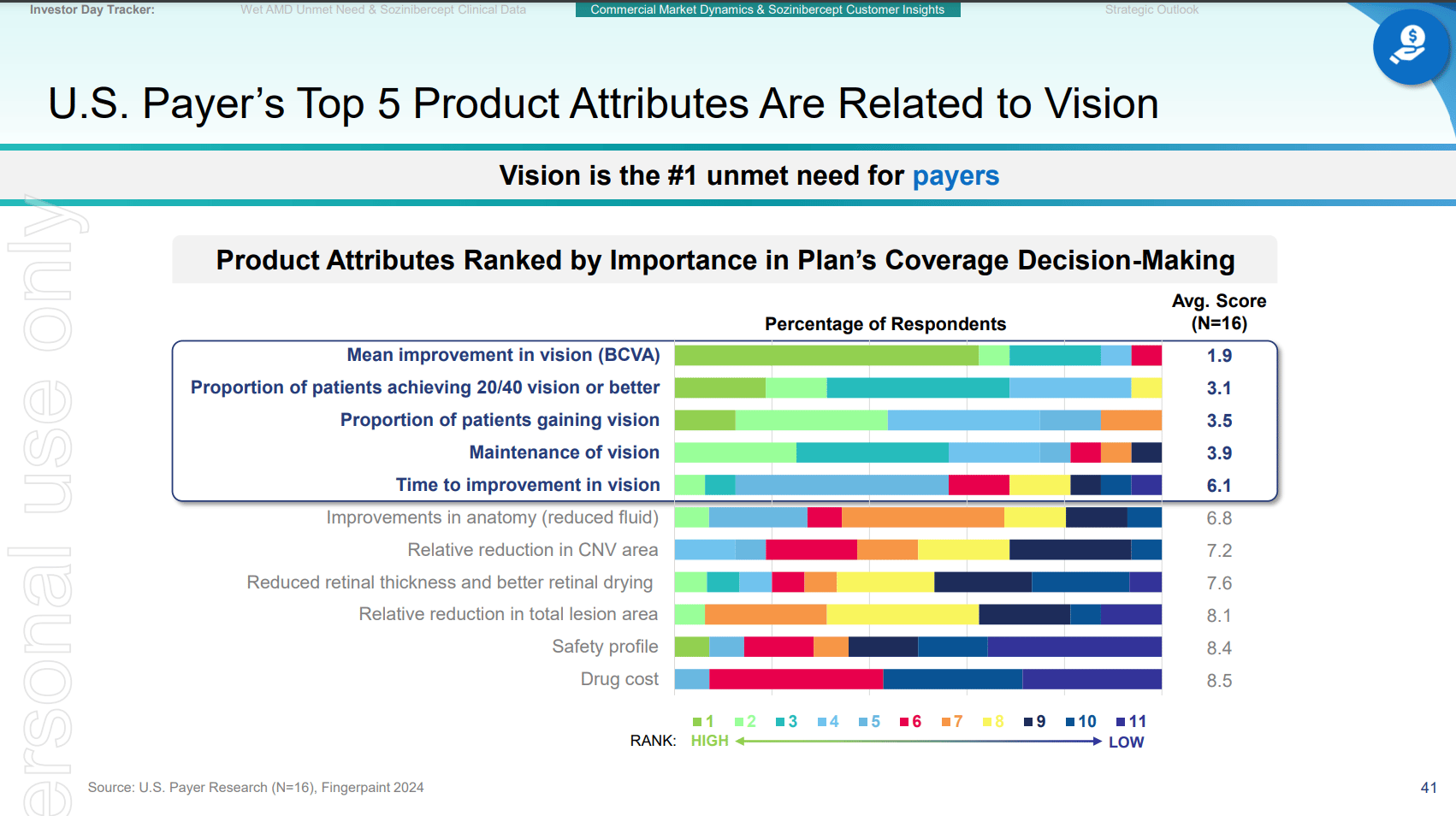

Key slides from the latest Investor presentation are attached below, which formed the basis of assumptions in the the above analyis.

END.

--- Analysis - November 2024 ---

'OPTHEA - Breakthrough in Vision Care'

Key takeaways:

- Opthea's sozinibercept (in phase 3 trials) offers a breakthrough in eye care as a complementary treatment that could significantly improve outcomes for wet AMD patients alongside existing therapies.

- Wet AMD treatment is a $15 Billion global market,.With no other product in the pipeline addressing the same mechanism of action, Opthea is strategically positioned as a unique player in the market.

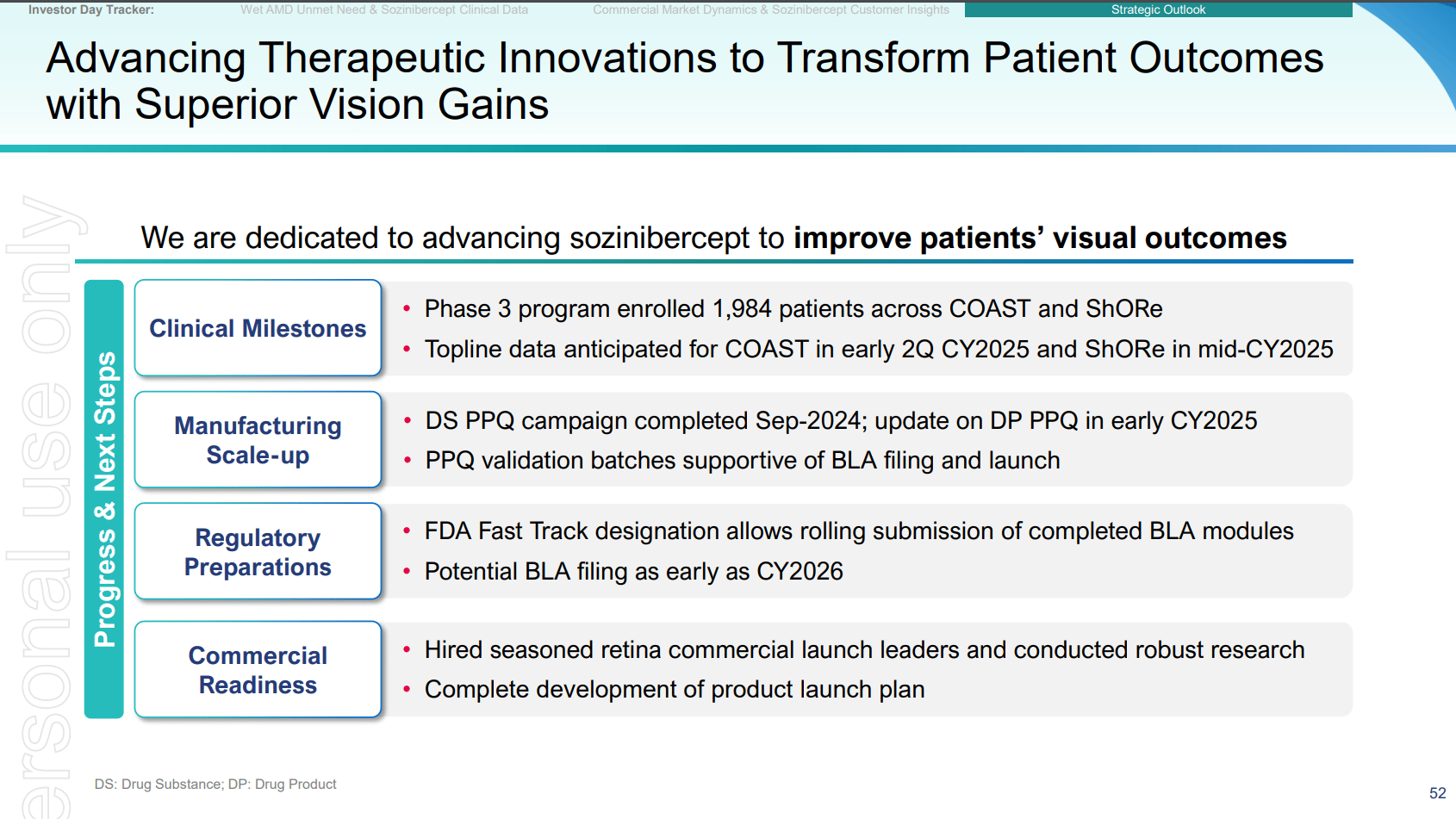

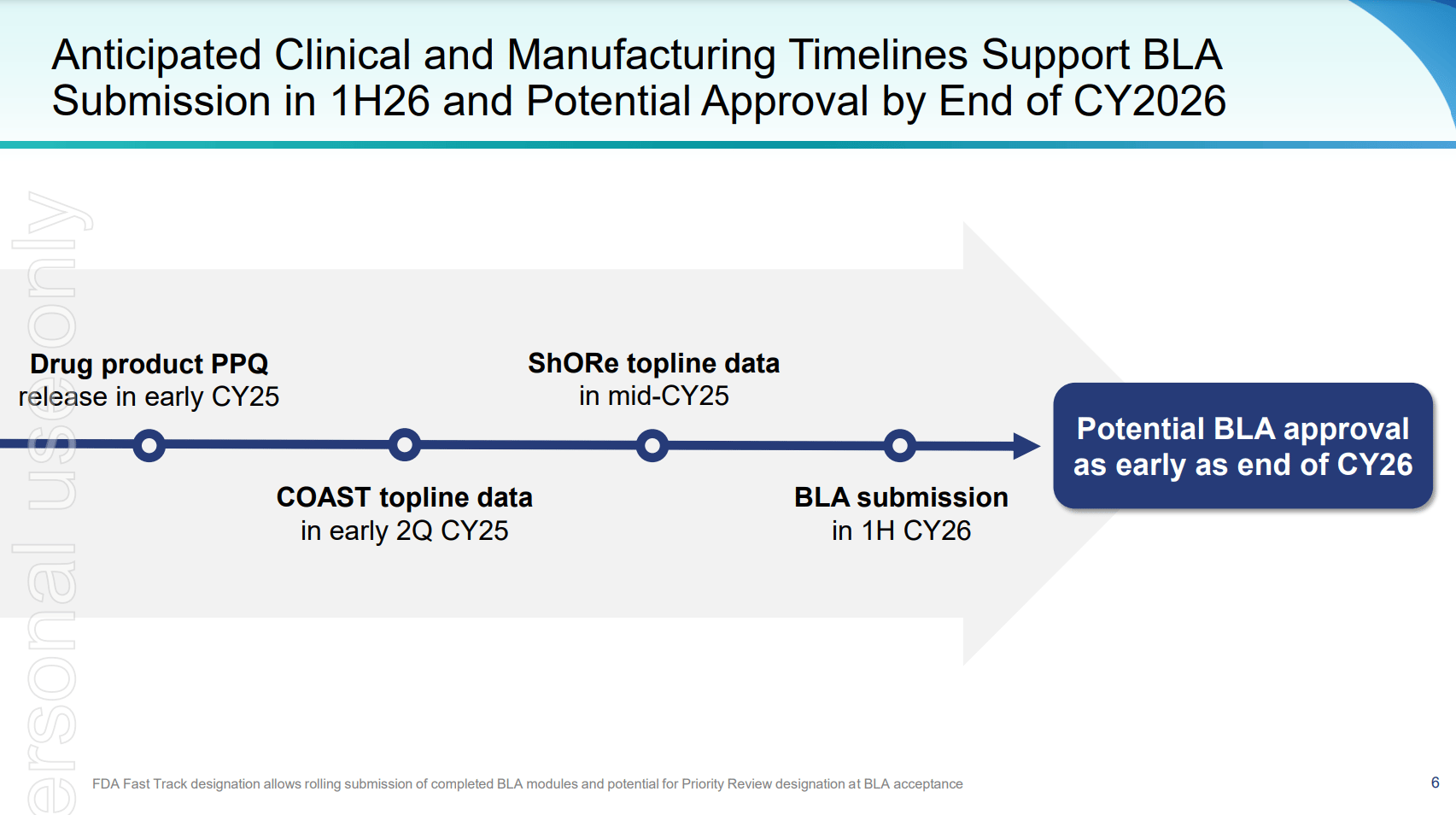

- Phase 3 trials are fully enrolled, with top-line results expected in mid-2025, positioning Opthea for a potential FDA submission and accelerated commercialization.

- High gross profit margins typical of biologics (60%-80%) could make sozinibercept a major financial success, potentially generating $600 million in annual gross profit at 5% market share.

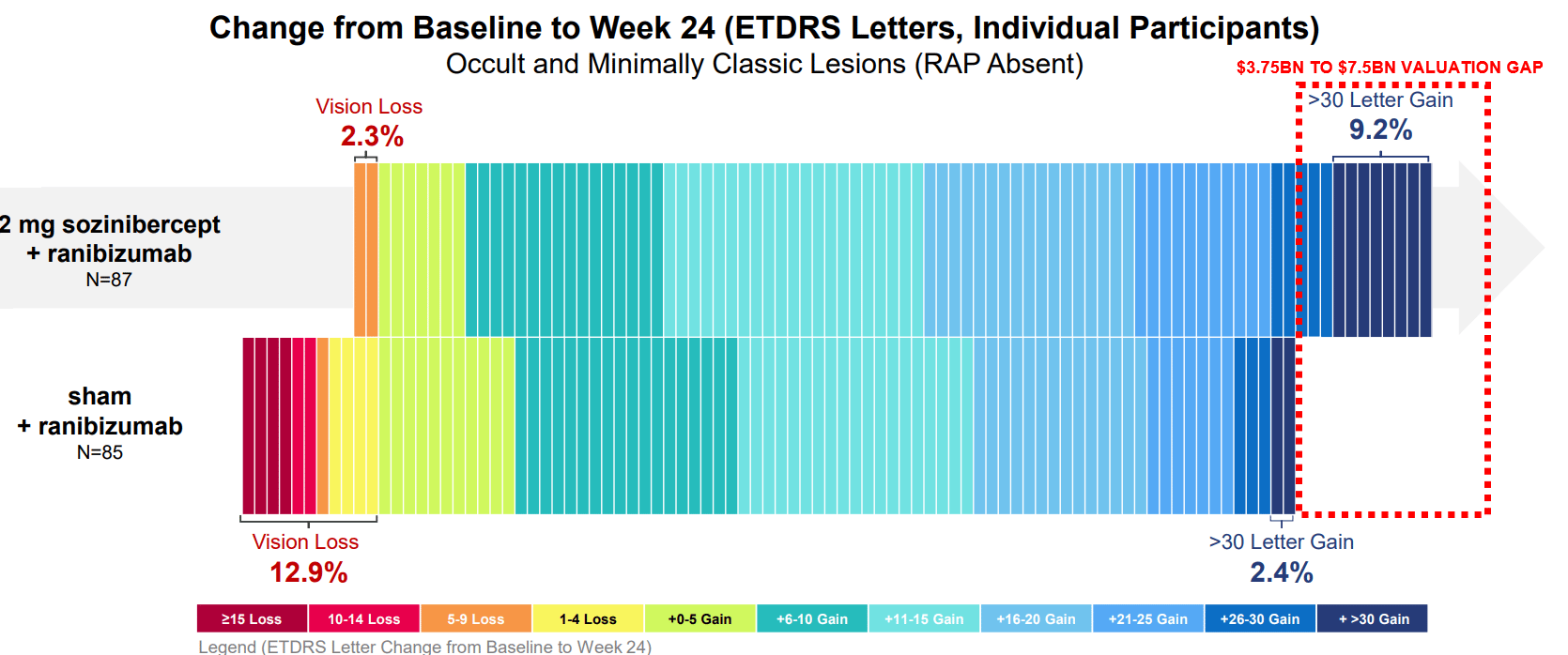

- Revenue targets of $750 million, Opthea could theoretically achieve a market valuation of $3.75 billion to $7.5 billion if sozinibercept is successful and receives regulatory approval (5x to 10x sales; Regeneron 6.6x sales).

1. A Potential Breakthrough in Vision Care

Opthea’s lead product, sozinibercept, is designed to address a major unmet need in eye care. Wet age-related macular degeneration (wet AMD) affects millions of people, and while current treatments like Eylea (aka Aflibercept, by Regeneron) and LUCENTIS (aka Ranibizumba by the Roche Group) are effective, they can only manage part of the disease’s progression.

Sozinibercept has shown promising results in Phase 2 trials as a unique complementary treatment that enhances the effects of existing therapies. It does this by targeting additional pathways involved in disease progression, potentially enabling patients to maintain or even improve their vision longer than existing treatments alone allow.

Think of the eye as a car that’s been running for years. Over time, it's developed some issues with visibility—imagine the windshield getting foggy and cracks forming. Current treatments for wet AMD, like Eylea and Lucentis, are like high-performance windshield wipers. They work hard to keep the windshield clear, allowing you to see ahead, but over time, they can only do so much. No matter how fast or often they swipe, some fog and cracks persist, and over the long haul, visibility gets worse.

Here’s where Sozinibercept comes in. Think of it as a powerful new defogger and anti-crack resin that works alongside those wipers. Instead of replacing the current treatments (windshield wipers), Sozinibercept works with them, tackling the parts they miss. It blocks specific signals in the eye (like preventing fog and stopping new cracks from forming), which existing treatments don’t fully cover. The goal is for patients to see clearer for longer, giving them improved visual acuity and slowing down vision loss much more effectively than the wipers (current treatments) alone.

And while current treatments have been on the market for a while, there aren’t any “new upgrades” being developed in the immediate pipeline. Sozinibercept could become the enhancement that keeps the eye functioning more effectively over time, potentially expanding the market and improving outcomes for those already on existing treatments.

2. Large Market Opportunity with Established Demand

The wet AMD treatment market is massive—valued at over $15 billion globally—with leading products like Eylea generating over $9 billion annually. Sozinibercept is designed to work alongside these blockbuster therapies rather than compete against them. This cooperative potential opens doors for significant market share without directly threatening existing market leaders, making it a compelling enhancement rather than a replacement.

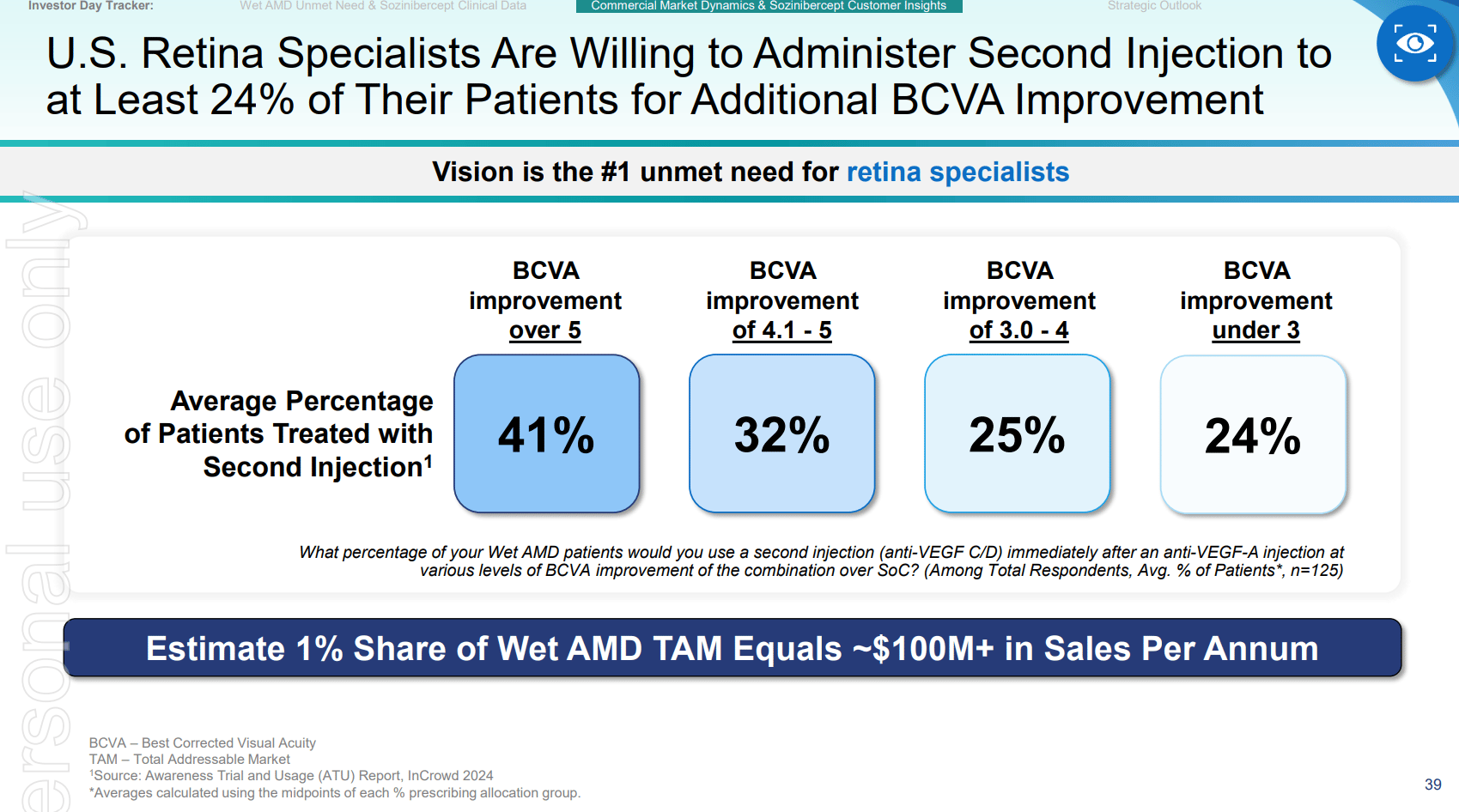

Furthermore, even a modest market share could lead to substantial revenue. 1% of the market represents a $100 million opportunity annually. Positive Phase 3 results could pave the way for rapid adoption among physicians and potentially increase reimbursement and support from health insurers globally.

3. Strong Clinical and Strategic Positioning

Opthea’s Phase 3 trials (COAST and ShORe) are fully enrolled, positioning the company for top-line data readouts by mid-2025. The design of these trials builds on strong Phase 2 data, where sozinibercept demonstrated superior vision improvements when added to existing therapies. Should the Phase 3 results reflect similar success, sozinibercept would likely become a powerful tool in the treatment regimen for wet AMD.

Moreover, Opthea has secured FDA Fast Track designation, which can facilitate an accelerated regulatory pathway, allowing the company to expedite sozinibercept’s commercialization if the results are favorable.

4. Upside Potential in Financial Terms

Considering the market size and expected gross profit margins for biologics, sozinibercept has the potential to deliver substantial financial upside. If Opthea captures just 5% of the global wet AMD market, this could translate into $750 million in annual revenue. With gross profit margins for similar biologics typically exceeding 80%, Opthea could potentially realize around $600 million in annual gross profit.

Moreover, this revenue would significantly improve Opthea’s valuation. In the biotech industry, companies with approved drugs often trade at 5–10 times revenue (Regeneron ~6.6x Sales). With a revenue target of $750 million, Opthea could theoretically achieve a market valuation of $3.75 billion to $7.5 billion if sozinibercept is successful and receives regulatory approval. This represents a substantial upside relative to Opthea's current valuation and would place it among the top players in the eye care market.

5. Strategic Partnership Potential with Industry Leaders

As an add-on therapy, sozinibercept could become an attractive acquisition or partnership opportunity for larger pharmaceutical companies like Regeneron (Eylea) or Roche (Lucentis). Such a partnership could accelerate sozinibercept’s global distribution and strengthen Opthea’s balance sheet. With no other product in the pipeline addressing the same mechanism of action, Opthea is strategically positioned as a unique player in the market.

6. Financial Considerations and Risks

Opthea’s cash burn and reliance on funding, including a Development Funding Agreement (DFA), highlight a key risk. The DFA provides significant non-dilutive funding but comes with obligations that may require additional capital raises if trial results or regulatory processes are delayed. This poses a potential dilution risk for shareholders but is balanced by the potential for high returns if sozinibercept reaches the market.

The company has enough cash to support operations into Q3 2025, around the time top-line Phase 3 results are anticipated. Positive results could transform Opthea’s financial profile by attracting new investment, partnerships, or acquisition interest. However, investors should be prepared for possible dilution if further funds are needed ahead of these milestones.

7. High-Growth Potential with Favorable Market Dynamics

The global aging population and rising prevalence of wet AMD contribute to strong growth projections for the AMD treatment market. The lack of new breakthroughs in treatment over the last two decades further highlights the significance of Opthea’s work, especially as health agencies and insurers are increasingly focused on funding treatments that enhance patients' quality of life. Success in Phase 3 trials could secure Opthea’s position in a market primed for disruption, making sozinibercept a potential game-changer.

Conclusion: A High-Risk, High-Reward Opportunity

Opthea offers a rare investment opportunity within the vision care sector, with a lead product, sozinibercept, that could redefine the treatment landscape for wet AMD. The potential for sozinibercept to work synergistically with established therapies provides a clear commercial pathway, whether through direct sales or strategic partnerships with industry leaders like Regeneron and Roche.

For investors seeking high-growth potential within the biotech space, Opthea represents a high-risk, high-reward opportunity. With Phase 3 results anticipated in 2025, a successful outcome could transform Opthea’s market position and deliver significant returns.

End.

Disclaimer:

This narrative is for informational purposes only and does not constitute investment advice. Investors should perform their own research, assess their risk tolerance, and consult with financial professionals before making any investment decisions. All projections and financial scenarios are based on current information and are subject to change. Investing in biotechnology companies involves significant risks, including potential loss of capital.

How well do narratives help inform your perspective?

Disclaimer

The user StockMan has a position in ASX:OPT. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.