Last Update 17 Dec 25

Fair value Decreased 3.12%CSL: Shares Will Recover As Seqirus Drag Fades After AGM Downgrade

Analysts have nudged down their price target on CSL by A$5 to reflect slightly softer long term revenue growth assumptions and a modestly higher discount rate, even as they highlight resilient margins and view the recent selloff as an opportunity to re engage with the shares.

Analyst Commentary

Recent commentary around CSL reflects a more constructive stance on the stock despite near term earnings noise, with valuation support emerging after the sharp pullback. Analysts broadly acknowledge slower contributions from Seqirus, but see this as largely reflected in revised forecasts and the lower price target.

Bullish analysts argue that the market reaction to the AGM downgrade has been exaggerated, particularly given CSL's still solid core plasma and specialty performance, as well as management's decision to defer the vaccine demerger rather than push ahead in a challenging backdrop. They see the current share price as more than discounting the softer U.S. vaccination trends and providing an attractive entry point for long term growth in the underlying franchise.

Bullish Takeaways

- View the recent correction as overdone relative to the magnitude of the Seqirus downgrade, creating a more compelling risk reward profile at current levels.

- Highlight resilient margins and core plasma growth as evidence that execution in CSL's main franchises remains intact, supporting a premium multiple.

- See management's decision to defer the vaccine demerger as reducing execution risk in the near term, allowing focus on capital allocation and integration priorities.

- Argue that modestly lower long term growth assumptions are already embedded in consensus, leaving scope for upside if Seqirus or new products recover faster than expected.

Bearish Takeaways

- Flag persistent weakness in U.S. vaccination rates as a structural risk to Seqirus growth, which could cap group revenue momentum and justify a higher discount rate.

- Warn that repeated guidance resets around the vaccine business may undermine confidence in management forecasts, pressuring the valuation multiple.

- Caution that, while the core business is solid, near term earnings revisions are still biased lower, limiting catalysts for a rapid re rating.

- Note that investor sentiment could remain fragile until there is clearer evidence of stabilization in vaccination demand and a more visible earnings trajectory.

What's in the News

- Five year Phase 3 HOPE B data for HEMGENIX show durable factor IX activity above 36%, around 90% reduction in annualized bleeding rates, and 94% of patients remaining off routine prophylaxis, with no treatment related serious adverse events reported (New England Journal of Medicine / ASH presentation)

- CSL lowers financial year 2026 revenue growth guidance to 2% to 3%, down from a prior 4% to 5% outlook, citing weaker performance drivers in the first half (company guidance update)

- Chief Strategy Officer Ken Lim is appointed Chief Financial Officer effective 7 October 2025, succeeding Joy Linton, who will remain for a transition period before retiring (company executive announcement)

Valuation Changes

- Fair Value: trimmed modestly from A$244.20 to A$236.57, reflecting more conservative long term assumptions.

- Discount Rate: nudged higher from 6.99% to 7.03%, slightly increasing the hurdle rate applied to future cash flows.

- Revenue Growth: revised down marginally from 4.22% to 4.11% per annum, capturing softer long term top line expectations.

- Net Profit Margin: adjusted fractionally higher from 21.62% to 21.63%, indicating stable to slightly improved profitability in the model.

- Future P/E: lowered slightly from 25.0x to 24.5x, implying a modestly reduced valuation multiple on forward earnings.

Key Takeaways

- Operational transformation and investment in innovation are expected to drive margin expansion, earnings growth, and faster introduction of high-value therapies.

- Market expansion, a focused business structure, and strong demand for plasma and specialty products support sustainable top-line growth and premium positioning.

- Revenue and margin growth are threatened by market competition, regulatory risks, high costs, slow new product uptake, and execution challenges from restructuring efforts.

Catalysts

About CSL- Engages in the research, development, manufacture, marketing and distribution of biopharmaceutical products and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

- CSL is undertaking significant operational transformation initiatives, targeting over $0.5 billion in cost savings by FY28, focusing on increased efficiency in plasma collection, manufacturing, and R&D, which should expand margins and support stronger net earnings growth as these benefits are realized.

- The company is leveraging advances in biotechnology-with a refreshed late-stage pipeline (including gene therapies and high-margin products like ANDEMBRY and HEMGENIX)-and plans to reinvest around half of cost savings into innovation and clinical development, potentially accelerating top-line revenue growth from new product launches benefiting from increased acceptance and effectiveness of biologic and precision therapies.

- CSL expects robust long-term demand in its core plasma and specialty franchises, supported by the rising prevalence of chronic diseases and global population aging, positioning the business for sustainable revenue growth as these demographic health trends continue to expand the addressable market.

- The demerger of Seqirus is expected to unlock simplification and focus for both resulting companies, enhancing capital allocation, speed of decision-making, and driving revenue and earnings growth through greater business agility and independent strategic execution.

- Ongoing geographic expansion and market development (e.g., growth in China and new market entry for products like FLUAD and Ferinject) are capitalizing on rising global healthcare spending and broadening access, which should underpin future revenue growth and further support the company's premium pricing power and margin trajectory.

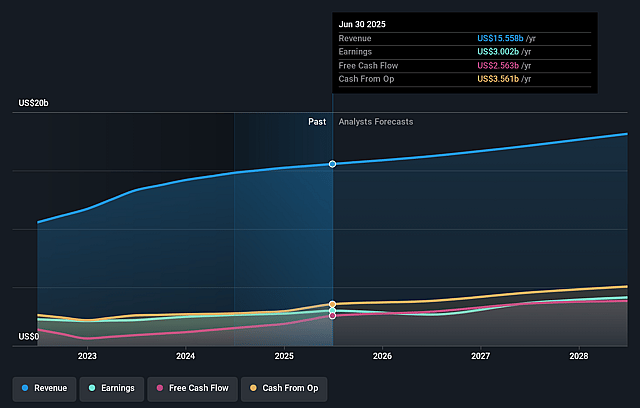

CSL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CSL's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.3% today to 22.9% in 3 years time.

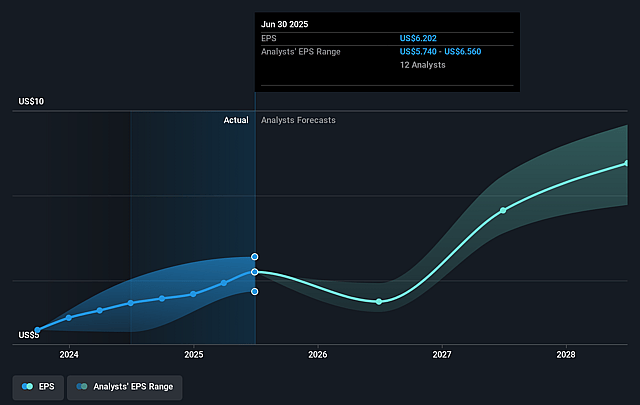

- Analysts expect earnings to reach $4.2 billion (and earnings per share of $8.67) by about September 2028, up from $3.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $4.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from 21.8x today. This future PE is greater than the current PE for the AU Biotechs industry at 21.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

CSL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition and non-regrettable tender losses in key plasma and iron markets, alongside increased international generic activity, pose sustained risks to both top-line revenue growth and gross margins, particularly as the company deliberately chooses not to chase lower-margin contracts.

- Slower-than-expected uptake of new product launches (e.g., ANDEMBRY, HEMGENIX) and R&D pipeline setbacks, combined with discontinued or delayed clinical programs, could undermine both revenue acceleration and long-term earnings growth.

- Persistent cost pressures-particularly related to plasma collection (donor compensation, labor costs, fixed cost absorption from underperforming centers), combined with slower realization of planned cost reductions, threaten to compress net margins if not adequately offset by price or efficiency gains.

- Heightened regulatory and policy risks, such as the implementation of Medicare Part D reform, Most Favored Nation (MFN) pricing, or potential sector-specific tariffs, may restrict CSL's pricing power or directly reduce U.S. revenues and earnings.

- Demerger of Seqirus and ongoing organizational restructuring introduce significant execution risk, including one-off restructuring costs and long transition timelines for cost savings, which may constrain near-to-medium-term net profit and create uncertainty around future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$284.792 for CSL based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$316.67, and the most bearish reporting a price target of just A$225.54.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.1 billion, earnings will come to $4.2 billion, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$206.62, the analyst price target of A$284.79 is 27.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CSL?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.