Key Takeaways

- Rapid adoption of premium products and AI-driven personalisation is fueling accelerated revenue growth and deeper user engagement beyond conservative analyst expectations.

- Expansion in financial services and international markets, especially India, is creating new high-margin profit streams and underappreciated long-term growth opportunities.

- Structural and market risks, regulatory pressures, competition, and costly diversification threaten REA Group's margins, long-term growth, and profitability.

Catalysts

About REA Group- Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

- Analyst consensus assumes sustained, incremental uplift from new product launches and premium product penetration, but this could be far too conservative-record adoption of Premiere+, Elite Plus, Luxe, and rapidly growing bundling (AMAX) signal a structural shift towards platform-wide premiumisation, enabling REA to accelerate ARPU and revenue expansion at a pace above historical averages for several years.

- While analyst consensus sees financial services as a new margin lever, it likely understates the upside; Mortgage Choice Freedom and adjacent financial product uptake are building at a scale that, with continued digital adoption and leads from the core platform up 45% year-on-year, may transition financial services from a supplementary to a core high-margin profit engine, driving significant step-change in group net margins.

- REA's leadership in data-driven personalisation and rapid deployment of AI-powered property experiences-already generating record user engagement and a 6% increase in active membership-positions the company for outsized revenue uplift as property seekers become locked into its ecosystem and as higher-value data monetisation opportunities emerge.

- The company's continued record-setting organic audience dominance, combined with a robust mobile-first app strategy and the largest exclusive user base in the market, creates reinforcing network effects that are likely to outpace any competitive threats and enable lower customer acquisition costs, translating to long-term margin expansion.

- Rising momentum in REA India and early evidence of developer market green shoots present underappreciated international and segment upside; as digital adoption and verified listings increase across India and developer activity lifts in Australia, REA is positioned to realise diversified revenue growth well beyond consensus assumptions.

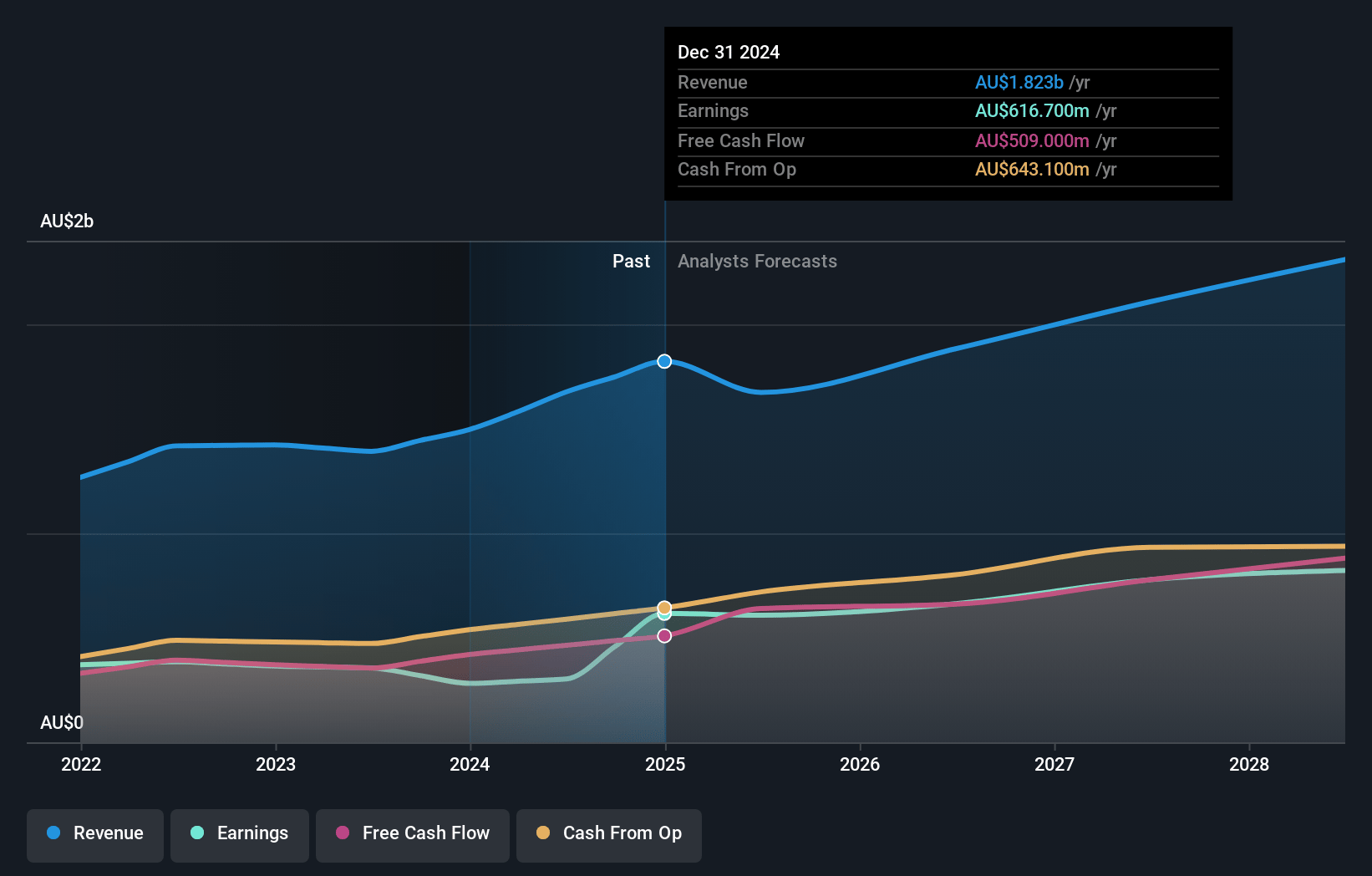

REA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on REA Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming REA Group's revenue will grow by 11.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 33.8% today to 36.4% in 3 years time.

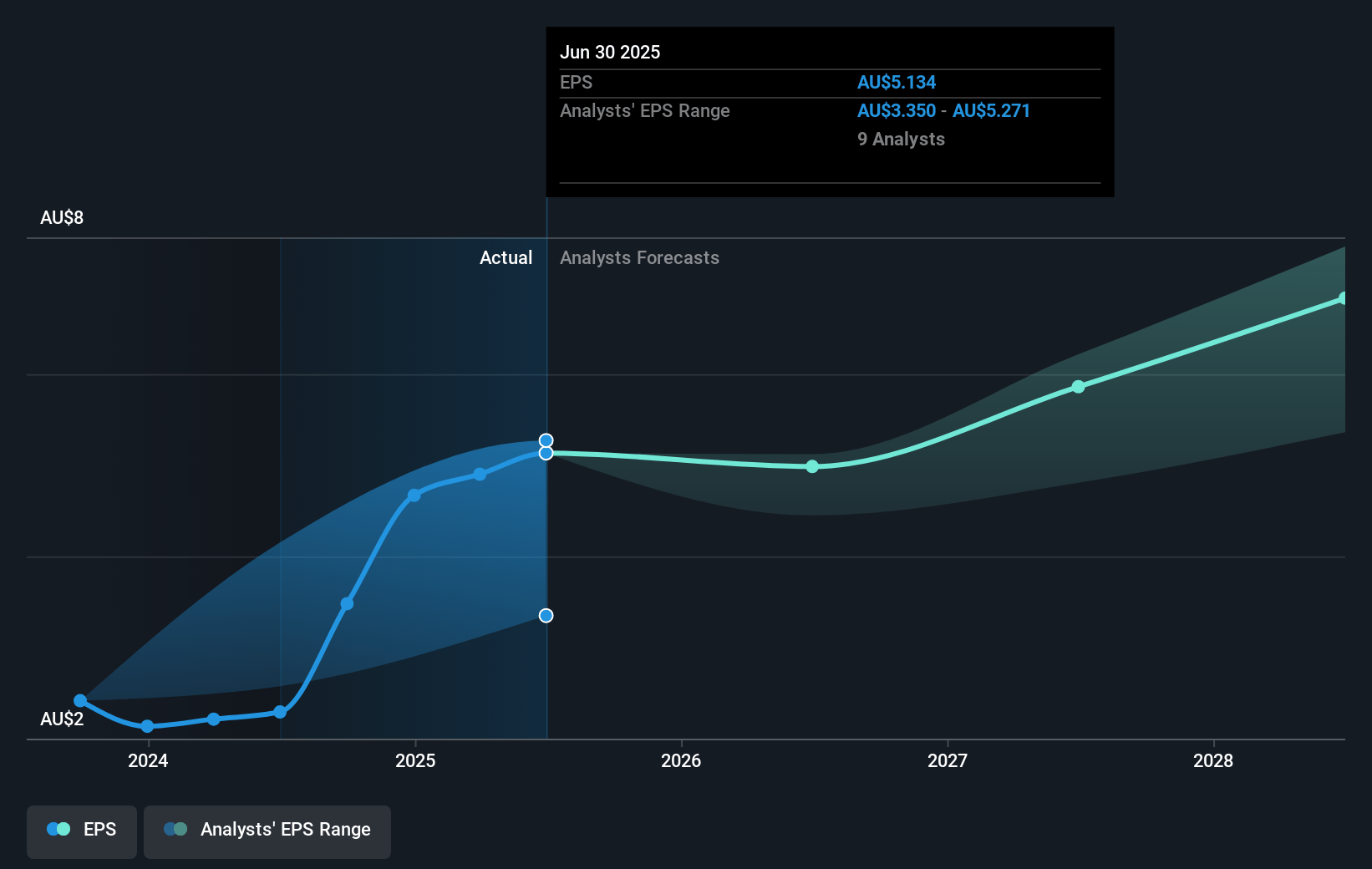

- The bullish analysts expect earnings to reach A$908.2 million (and earnings per share of A$6.87) by about July 2028, up from A$616.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.5x on those 2028 earnings, up from 49.7x today. This future PE is greater than the current PE for the AU Interactive Media and Services industry at 51.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

REA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural stagnation or decline in Australian home ownership rates, combined with ongoing affordability pressures and demographic shifts, may lead to sustained periods of low residential property transaction volumes and listings, which could shrink REA Group's total addressable market and negatively impact its long-term revenue and earnings.

- Persistent or higher-for-longer interest rates and tighter credit conditions could suppress the residential property market more than expected, leading to ongoing flat or negative listing growth and reduced advertising spend on REA platforms, resulting in revenue headwinds and margin pressure over multiple years.

- Increased regulatory intervention, such as new rental reforms, digital advertising regulations, or stricter data privacy laws, may increase compliance costs and operational complexity for REA Group, placing downward pressure on operating margins and overall profitability.

- Over-reliance on premium listing products and high-margin advertising offerings faces risk of pricing pressure or saturation, particularly if emerging competitors such as CoStar (potentially through Domain) or disruptive PropTech platforms adopt aggressive pricing strategies, which could erode REA's pricing power, compress margins, and slow long-term earnings growth.

- Expansion into non-core verticals like financial services and India remains highly competitive and capital intensive, with uncertain returns on investment, as highlighted by continued losses in Indian associates and pressure on yields in the Indian market, potentially leading to wasted capital and muted revenue diversification, weighing on group earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for REA Group is A$290.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of REA Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$290.0, and the most bearish reporting a price target of just A$130.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$2.5 billion, earnings will come to A$908.2 million, and it would be trading on a PE ratio of 52.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$232.2, the bullish analyst price target of A$290.0 is 19.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.