Key Takeaways

- Developing multiple original IPs and launching on a new platform aims to capitalize on established fanbases and expand market reach.

- Investments in high-quality demos and marketing efforts focus on attracting partnerships and driving sales, enhancing earnings potential and net margins.

- Delays in securing contracts and high marketing costs have led to revenue uncertainty and strain on cash flow and margins despite positive game reviews.

Catalysts

About PlaySide Studios- Develops and sells mobile, PC, and console video games in Australia.

- PlaySide is developing multiple original IPs, including high-profile titles such as Game of Thrones, MOUSE, and Dumb Ways to Die. These projects are expected to drive future revenue growth as they reach commercialization and capitalize on established fanbases.

- The planned launch on the anticipated Nintendo Switch 2 platform, which is projected to have significant market impact, could expand PlaySide’s reach, boost sales, and thereby positively affect revenue.

- PlaySide's significant investment in a AAA quality demo using Unreal Engine 5 aims at attracting large publishers, which could lead to lucrative partnerships, potentially enhancing earnings and expanding their portfolio.

- Increased marketing efforts, particularly for the game MOUSE, are expected to create substantial sales momentum upon release, supported by rising wishlist numbers and social media virality, likely positively impacting revenue.

- Efficiency improvements and cost management strategies, including headcount adjustments and optimized contractor use, are expected to enhance net margins and improve cash flow management, stabilizing future earnings.

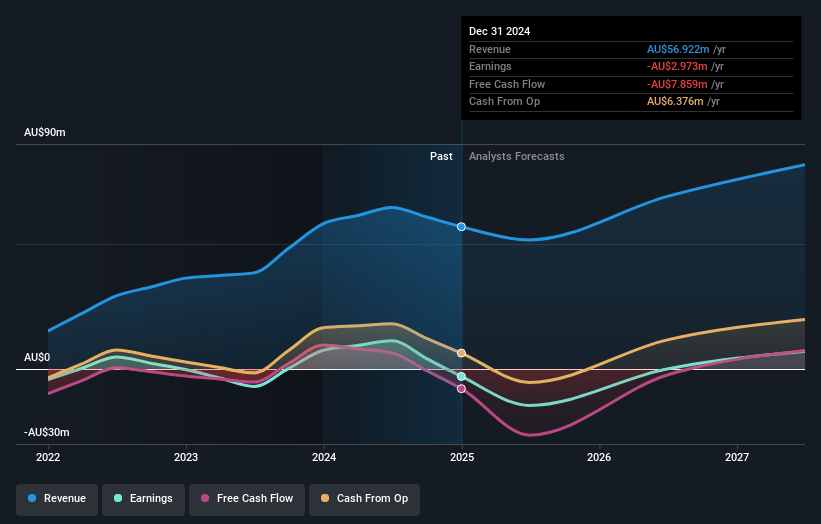

PlaySide Studios Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PlaySide Studios's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.2% today to 9.9% in 3 years time.

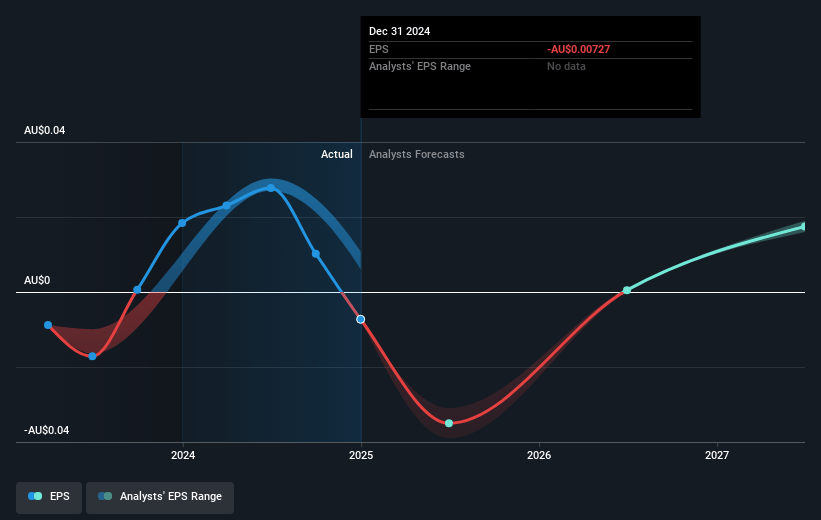

- Analysts expect earnings to reach A$8.2 million (and earnings per share of A$0.02) by about July 2028, up from A$-3.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.4x on those 2028 earnings, up from -26.2x today. This future PE is lower than the current PE for the AU Entertainment industry at 159.6x.

- Analysts expect the number of shares outstanding to grow by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

PlaySide Studios Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delay in securing new Work for Hire contracts has led to a revenue guidance downgrade, indicating potential instability in future revenue streams.

- The increased marketing expenses for upcoming titles, which cannot be capitalized, have contributed to an EBITDA loss, suggesting a strain on net margins.

- The moderate success of KILL KNIGHT, despite positive reviews, highlights potential challenges in translating critical acclaim into substantial earnings.

- Dependence on high investment and the long lead times for original IP games may impact cash flow negatively while projects are still in development.

- Uncertainty surrounding the timing and finalization of major Work for Hire contracts with large partners poses risk to revenue predictability and growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.5 for PlaySide Studios based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$82.7 million, earnings will come to A$8.2 million, and it would be trading on a PE ratio of 32.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of A$0.19, the analyst price target of A$0.5 is 62.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.