Key Takeaways

- Tight labor supply and regulatory pressures may constrain growth, compress margins, and cap revenue expansion despite improvements in platform efficiency and customer engagement.

- Competition from global tech giants and reliance on traditional trade services expose hipages to market share risks and potential limits on its long-term addressable market.

- Underutilization of new features, customer attrition from pricing changes, and geographic concentration pose risks to growth, margins, and long-term sustainability.

Catalysts

About hipages Group Holdings- Operates as an online tradie marketplace in Australia and New Zealand.

- Although hipages Group has completed the migration of its entire customer base to new subscription platforms in both Australia and New Zealand-enabling higher ARPU, greater usage of SaaS features, and improved operating leverage which could support future revenue growth-the company faces persistent headwinds from rising worker and contractor shortages in its core markets. This tight labor supply limits platform liquidity and could ultimately constrain both marketplace activity and subscription adoption, risking slower revenue expansion.

- While investments in AI-powered job matching and automation signal opportunities for platform efficiency gains and future margin expansion, emerging advanced AI tools may also reduce demand for traditional trade services on which hipages relies. If widespread automation diminishes the need for physical trades, the addressable revenue base for hipages may decrease, restricting the long-term upward trajectory of both top-line and bottom-line growth.

- Despite operational improvements and a clear path to increased engagement and retention-especially among tradies actively using new job management features-the company is exposed to growing regulation and compliance costs associated with gig economy platforms. These elevated expenses could erode operating margins, particularly as hipages continues to invest heavily in technology and brand, potentially compressing net earnings.

- Although transitioning to a full subscription model in New Zealand mirrors past success in Australia and has driven higher-value customer cohorts with improving ARPU, hipages may struggle to materially expand beyond its existing domestic markets. Regulatory and cultural barriers to international expansion or saturation within Australia and New Zealand may cap long-term addressable market size, placing a ceiling on future revenue growth.

- While sector trends suggest digital transformation and the shift to online service marketplaces will continue, hipages remains vulnerable to increasing competition from global tech platforms such as Google, Meta, or Amazon. These larger players could outcompete or commoditize the marketplace model, placing downward pressure on pricing and threatening hipages' market share, ultimately weighing on future earnings potential.

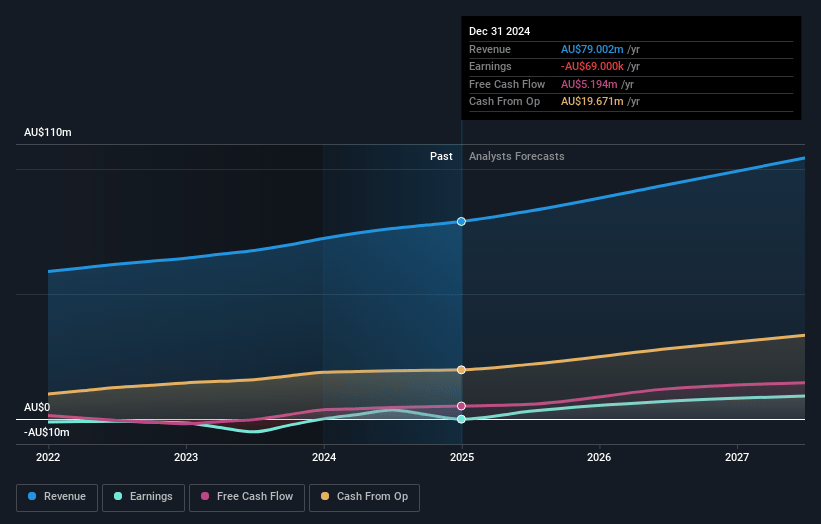

hipages Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on hipages Group Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming hipages Group Holdings's revenue will grow by 11.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.1% today to 10.4% in 3 years time.

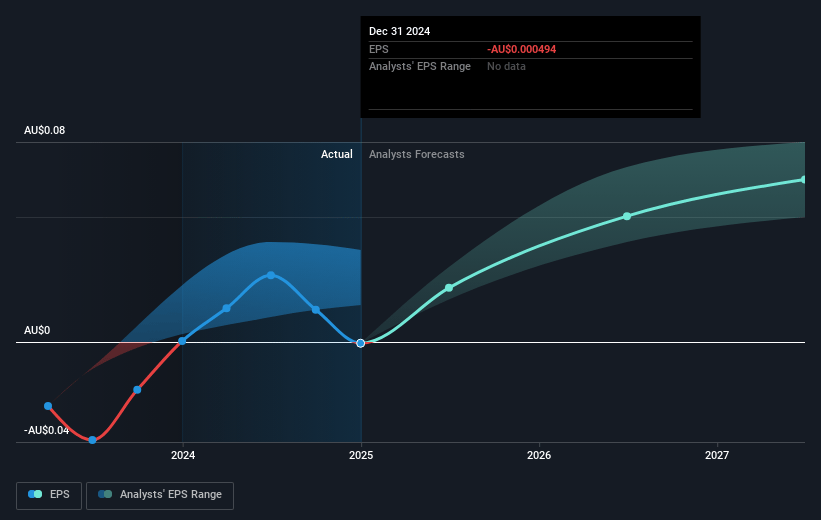

- The bearish analysts expect earnings to reach A$11.4 million (and earnings per share of A$0.09) by about July 2028, up from A$-69.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, up from -1933.0x today. This future PE is lower than the current PE for the AU Interactive Media and Services industry at 51.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

hipages Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing challenges in driving wide adoption of its new tradiecore app features, with over 90 percent of customers in Australia not yet using the enhanced platform functionalities, indicating a significant risk of underutilization that could affect long-term customer engagement, retention rates, and thus recurring revenues as well as net earnings potential.

- The migration of New Zealand and Australian customers to higher-priced, longer-term subscription models has resulted in short-term customer attrition, and the success of rebuilding a larger, engaged tradie base is uncertain; failure to fully recover customer numbers could result in stalled or declining revenues over time.

- Intensified ongoing investment in technology development and marketing is required to support new product rollouts, customer migrations, and wider platform adoption, creating a risk that, if these investments do not translate into higher uptake or ARPU, operating costs may rise faster than revenue growth and compress net margins.

- A reliance on continued ARPU growth, rather than expanding the overall tradie base, may not be sustainable in a price-sensitive market, especially if economic conditions lead to lower household spending on trades, which could place downward pressure on both revenues and earnings.

- The company's core growth currently depends on execution in Australia and New Zealand, with little indication of global expansion opportunities being viable; this creates geographic concentration risk, and if regulatory changes, labor shortages, or new competitive entrants occur in these markets, the group's addressable market, revenues, and long-term earnings could all be constrained.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for hipages Group Holdings is A$1.35, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of hipages Group Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.14, and the most bearish reporting a price target of just A$1.35.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$109.7 million, earnings will come to A$11.4 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$1.0, the bearish analyst price target of A$1.35 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.