Key Takeaways

- Heavy concentration of assets in Burkina Faso exposes the company to heightened geopolitical and regulatory risks that could disrupt revenues and profitability.

- Rising ESG and compliance costs, combined with regulatory changes and operational transitions, may erode margins and threaten future earnings stability.

- Heightened geopolitical risk, execution delays, regulatory pressures, and rising costs threaten operational stability, revenue growth, and the ability to maintain future production levels.

Catalysts

About West African Resources- Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

- Although West African Resources is nearing completion of the Kiaka project and anticipates more than doubling gold production to over 420,000 ounces annually within six months, the company faces significant country concentration risk with all major assets located in Burkina Faso, exposing future revenues and earnings to heightened geopolitical, regulatory, and security threats.

- While the long-term global drive for gold investment, amid ongoing inflation and economic uncertainty, is supportive of higher realized gold prices and revenue growth, increasing adoption of alternative stores of value such as digital currencies could undermine gold's traditional demand and create unpredictable downward pressure on sales and cash flows.

- Despite strong recent operating performance at Sanbrado, including cost control and consecutive years of meeting guidance, upcoming transitions in mining contractors due to local content regulations and potential reliance on new partners may result in operational disruptions or increased expenses, negatively impacting net margins and earnings stability.

- While ESG credentials such as government recognition and safety records help position West African Resources favorably for institutional capital, the broader intensification of ESG requirements is driving up compliance, remediation, and reporting costs which could begin to erode margins and cap the company's ability to expand profitably.

- Although ongoing investment in exploration and resource extension at Sanbrado and Kiaka may increase mine life and long-term revenue, failure to make substantial new discoveries or delays in drilling results could shorten the production profile, reducing future cash flows and putting longer-term earnings projections at risk.

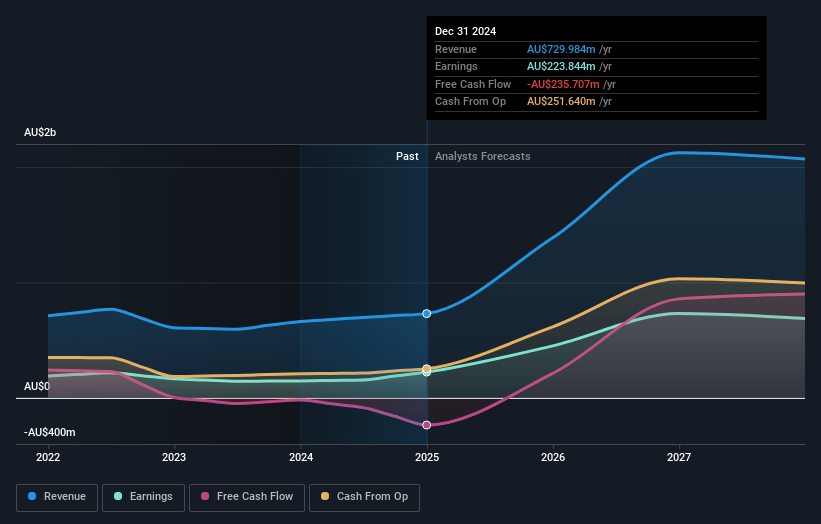

West African Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on West African Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming West African Resources's revenue will grow by 39.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 30.7% today to 22.4% in 3 years time.

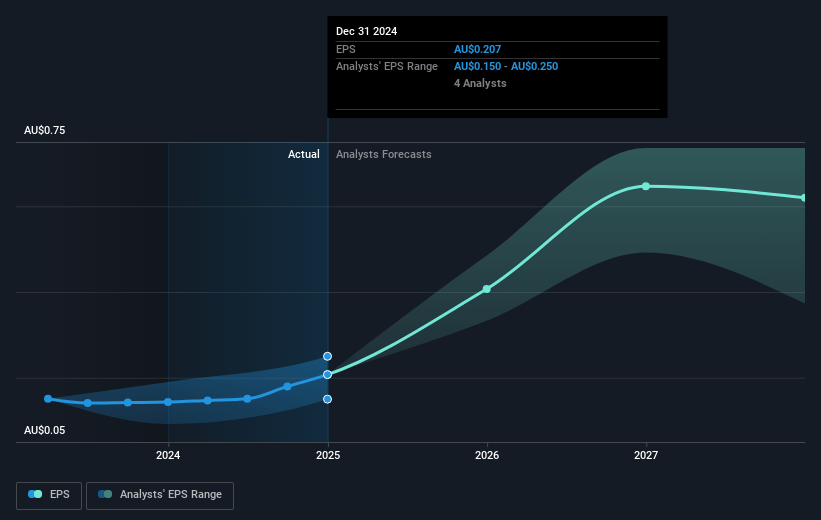

- The bearish analysts expect earnings to reach A$446.9 million (and earnings per share of A$0.39) by about July 2028, up from A$223.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 12.3x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

West African Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- West African Resources' heavy operational concentration in Burkina Faso exposes it to heightened geopolitical and sovereign risks, with any escalation of local instability, regulatory changes, or loss of key mining contracts potentially disrupting operations and leading to interruptions in production and reductions in revenue and earnings.

- The company's reliance on timely development and ramp-up of the Kiaka project introduces execution risk, particularly with reported delays in delivery of critical equipment like the backup diesel power station, which could result in slower production growth and delayed cash flow generation, ultimately impacting revenue targets.

- Increased local content regulations have forced the company to reconsider its relationship with AMS, its main mining contractor, which could result in higher operating costs or operational disruptions as new contractors are onboarded, thus squeezing net margins.

- While exploration and resource upgrades at sites such as Sanbrado and Kiaka are emphasized, there is no guarantee of successful discoveries or reserve extensions, and any failure to replace depleted reserves may result in declining production over time, ultimately reducing future revenues and cash flows.

- Intensifying global ESG standards and compliance requirements, along with rising input cost inflation due to competition for skilled labor and materials, could significantly increase operating expenditures for West African Resources and put pressure on long-term profitability and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for West African Resources is A$3.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of West African Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$4.7, and the most bearish reporting a price target of just A$3.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$2.0 billion, earnings will come to A$446.9 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$2.42, the bearish analyst price target of A$3.3 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.