Key Takeaways

- High-grade resource extensions, operational synergies, and rising gold prices position Ramelius for significant upside in revenue, margins, and production sustainability.

- Proactive decarbonization and sustainability initiatives enhance access to capital and could yield valuation premiums from ESG-focused investors.

- Declining reserves, rising production costs, environmental pressures, and gold price volatility threaten profitability, cash flow, and long-term growth prospects.

Catalysts

About Ramelius Resources- Engages in the exploration, evaluation, mine development and operation, production, and sale of gold.

- Analyst consensus sees resource model reconciliation at Cue as a one-off boost, but with further drilling indicating significant high-grade extensions beyond current models, there is potential for a structural step-change in overall resource estimates and production run-rate, creating material upside to future revenue and earnings.

- While analysts broadly expect meaningful synergies from the transformational Spartan combination, the current market likely underestimates the scale of operating leverage and cost base optimization that could occur, particularly as Ramelius rapidly integrates and applies its proven low-cost management across the expanded asset base, potentially driving sustained margin expansion well above peers.

- Sharply rising global gold prices driven by ongoing inflation, central bank accumulation, and demand from emerging-market investors are already translating into record realised prices for Ramelius, a dynamic that could accelerate and drive operating cash flow and net margins far above current market expectations.

- The company's 17-year Mt Magnet mine plan, underpinned by low costs and newly identified high-grade lodes, combined with an aggressive exploration approach, sets a credible path to not just sustain but potentially grow long-term production well beyond current guidance, creating substantial upside to revenue visibility and asset valuations.

- Ramelius' proactive decarbonization efforts-including 15-year renewable power agreements and anticipated sustainability-linked reporting-position the company for privileged access to capital and premiums from gold buyers focused on ESG, which may support reduced funding costs, improved net margins, and a rerating of the stock as responsible production becomes more highly valued.

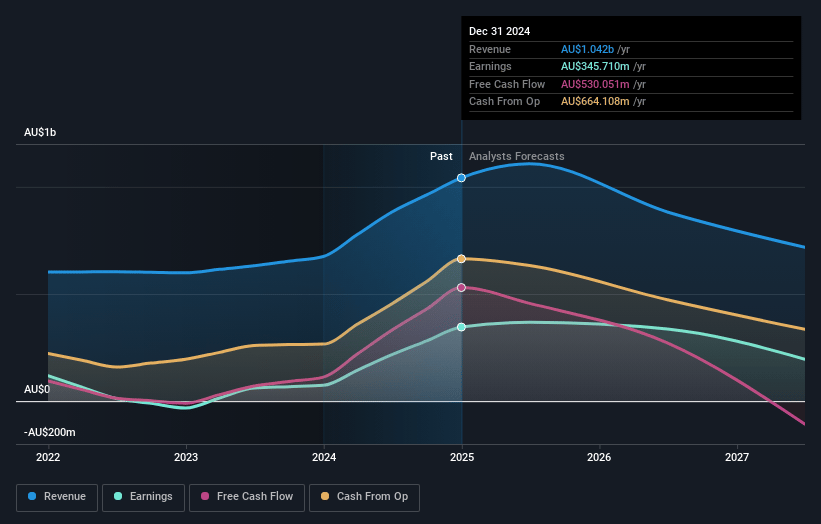

Ramelius Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ramelius Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ramelius Resources's revenue will grow by 17.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 33.2% today to 26.5% in 3 years time.

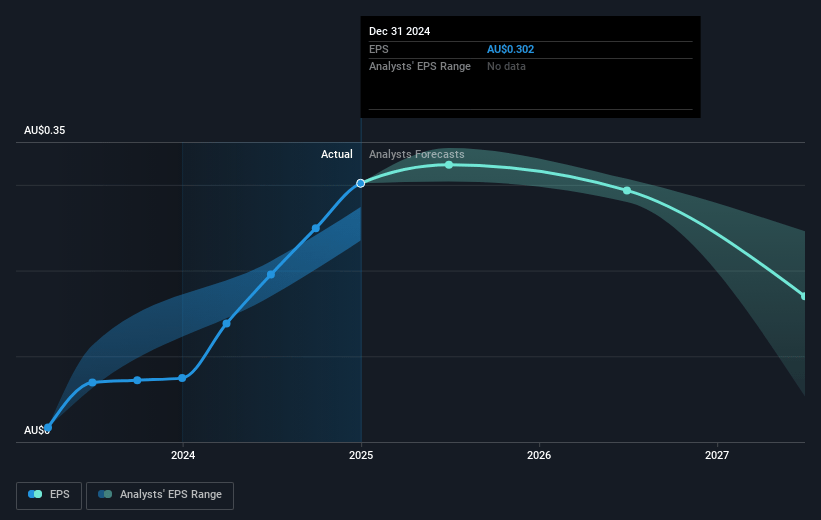

- The bullish analysts expect earnings to reach A$446.7 million (and earnings per share of A$0.23) by about July 2028, up from A$345.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from 9.1x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

Ramelius Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The depletion and transition of key assets such as Edna May to care and maintenance signifies Ramelius is facing the risk of running down its existing gold reserves, which could increase future exploration and development costs and negatively affect net margins if replacement reserves are not discovered or acquired in time.

- Rising all-in sustaining costs at certain operations, particularly as lower grade stockpiles are depleted and production increasingly depends on higher-cost ounces, pose a risk of margin compression and ultimately could result in lower cash flow and profitability, even if headline revenues remain solid.

- The company's high dependence on gold prices for its revenue stream, alongside its exposure to the volatility in global gold pricing, means any prolonged downturn in gold prices or increased price competition would significantly impact its revenues and earnings.

- Increasing industry-wide scrutiny from environmental regulators and the greater focus on ESG investing may raise compliance burdens and capital costs for Ramelius, potentially leading to reduced market valuation and a higher cost of capital that would negatively impact net margins and long-term returns.

- The transition toward decarbonisation and global energy shifts, paired with rising geopolitical tensions and cost inflation in mining inputs, could drive up operational costs, disrupt supply chains, and lower the long-term demand for gold, eroding both net margins and the company's ability to sustain strong earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ramelius Resources is A$4.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ramelius Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$4.2, and the most bearish reporting a price target of just A$2.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.7 billion, earnings will come to A$446.7 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of A$2.72, the bullish analyst price target of A$4.2 is 35.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives