Key Takeaways

- Conservative project assumptions may understate reserve and production growth potential, with ongoing optimizations pointing to higher margins and long-term cash flow outperformance.

- Exceptional financial discipline, robust gold market dynamics, and leading ESG credentials uniquely position Perseus for accelerated growth, capital access, and valuation upside over peers.

- Exposure to West African geopolitical risk, operational challenges, ESG pressures, and reliance on gold prices threaten profitability, cost control, and earnings stability for Perseus Mining.

Catalysts

About Perseus Mining- Explores, evaluates, develops, and mines for gold properties in West Africa.

- Analyst consensus expects the Nyanzaga and CMA underground projects to increase production and revenues, but this likely understates the potential: Nyanzaga's initial open-pit design is conservative, and ongoing drilling and optimization could expand reserves, boost throughput above nameplate, and extend mine life or raise grades, underpinning sustained production growth and materially higher long-term free cash flow than currently modeled.

- While analysts acknowledge margin expansion from stable costs and strong gold prices, Perseus's exceptionally disciplined cost control, frequent outperformance versus cost guidance, and proven ability to deliver projects under budget position it for top-tier net margin growth and industry-leading cash accumulation, especially if the gold price stays elevated or rises further.

- Global macro trends such as rising infrastructure investment, continued inflation, and heightened geopolitical tensions are set to keep investment demand for gold robust-if gold prices enter a structural upcycle, Perseus's unhedged upside and substantial production leverage could unlock outsized increases in revenue and earnings relative to peer gold miners, multiplying valuation upside.

- Perseus's operational track record and expanding multi-country asset base allow it to quickly seize value-accretive M&A or organic growth opportunities; with over $800 million in net cash, an undrawn $300 million credit line, and $100 million in listed investments, the company is uniquely positioned to pursue transformative acquisition(s) or rapid project development without risking financial health, which could accelerate top-line and earnings growth beyond market expectations.

- As ESG considerations become core to capital allocation, Perseus's strong safety record, consistent community engagement, local hiring focus, and solid environmental compliance provide strategic advantages-opening access to new pools of capital and premium valuations, potentially lowering its cost of capital and further supporting long-term net profit and share price re-rating.

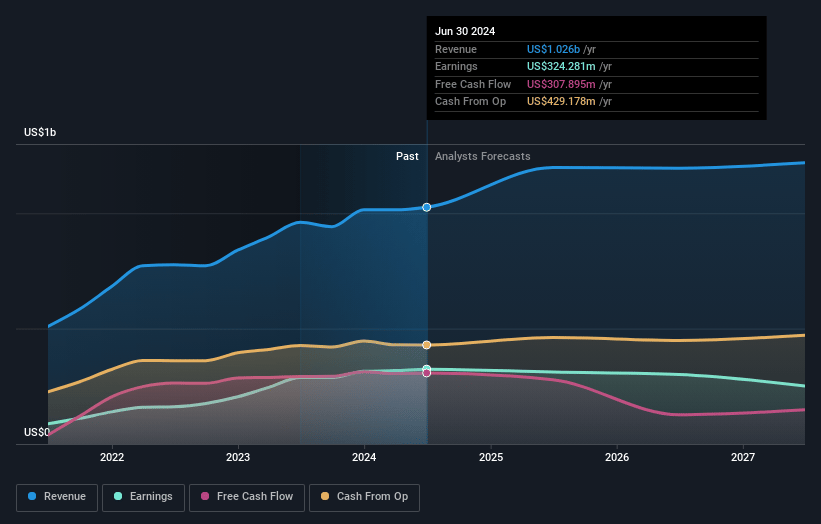

Perseus Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Perseus Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Perseus Mining's revenue will grow by 25.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 31.9% today to 20.1% in 3 years time.

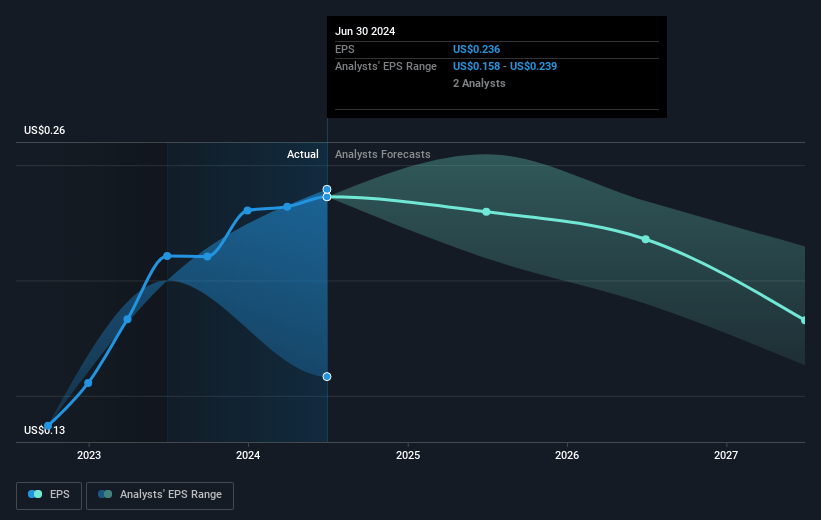

- The bullish analysts expect earnings to reach $443.1 million (and earnings per share of $0.33) by about July 2028, up from $357.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 9.1x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Perseus Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Perseus Mining's operational concentration in West African countries such as Côte d'Ivoire, Ghana, Tanzania, and Sudan exposes it to significant geopolitical risk, including possible regulatory changes, political instability or civil unrest, which could disrupt mining activities and negatively impact revenue and production consistency.

- The company has acknowledged challenges with declining ore grades, complicated geology (particularly at the Yaoure and Sissingue sites), and increasing complexity in grade reconciliation, all of which can lead to rising production costs over time and compress net margins.

- Perseus Mining's business model is heavily reliant on the continued strength of gold prices, but long-term trends such as the rise of alternative safe-haven assets and a global push for decarbonization could decrease gold's appeal, leading to lower gold prices and reduced revenue and margins.

- The growing burden of environmental, social, and governance (ESG) compliance, combined with the proximity of the new Nyanzaga project and other operations to environmentally sensitive areas, may result in escalating compliance costs and stricter regulations, putting further pressure on the company's profitability as operational costs rise.

- Lengthening mine lives and ambitious projects like Nyanzaga carry the risk of increased capital intensity and the potential for unpredictable sustaining or expansion capex, which could reduce free cash flow and constrain the company's ability to consistently return capital to shareholders, ultimately affecting earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Perseus Mining is A$5.8, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Perseus Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.8, and the most bearish reporting a price target of just A$2.55.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $443.1 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of A$3.65, the bullish analyst price target of A$5.8 is 37.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.