Key Takeaways

- Strategic expansion into decarbonization markets and diversification away from coal are strengthening revenue stability, margin improvement, and long-term growth prospects.

- Ongoing investment in technology and rig modernization enables capture of higher-value contracts, boosting competitiveness and supporting sustained earnings resilience.

- Heavy reliance on coal exposes the company to sector decline, underutilized assets, competitive pressures, and uncertain new business initiatives, all straining profitability and cash flow.

Catalysts

About Mitchell Services- Provides exploration, and mine site and geotechnical drilling services to the exploration, mining, and energy industries in Australia.

- The global shift towards electrification and energy transition is sustaining high demand for key battery metals like lithium, copper, and gold, directly driving increased exploration budgets and drilling activity-Mitchell Services is well-positioned to benefit, supporting revenue growth and improved rig utilization.

- The company's entry into new decarbonization-driven drilling markets via the Loop business, in response to government-mandated emissions reduction, presents a significant, under-penetrated growth area where Mitchell retains early-mover advantage; this will likely increase both revenue and EBITDA margin over time, especially as trial projects convert into long-term contracts.

- Diversification efforts, notably pivoting from coal to gold and minerals, are reducing dependency on coal markets and mitigating revenue volatility, stabilizing earnings and yielding greater pricing power as the rig mix shifts toward higher-margin, lower-competition geological work.

- Technological innovation in drilling services, specialist technical work (such as geotech and decarbonization projects), and sustained investment in fleet modernization position Mitchell Services to capture higher-value, multi-year contracts, supporting margin expansion and enhanced long-term free cash flow.

- Heightened focus on critical mineral supply security and ongoing urbanisation/infrastructure demand-particularly from major mining houses and global majors-are resulting in a robust contracted work pipeline and higher client retention, providing resilience for future revenue and earnings growth.

Mitchell Services Future Earnings and Revenue Growth

Assumptions

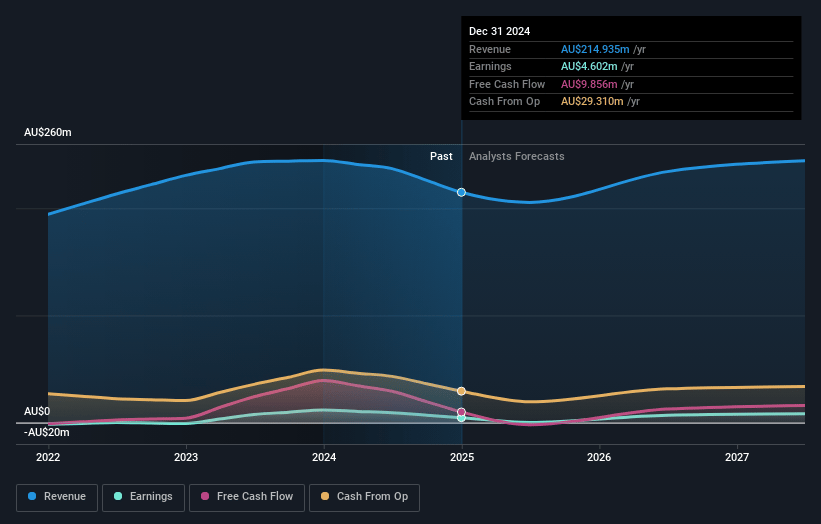

How have these above catalysts been quantified?- Analysts are assuming Mitchell Services's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 3.0% in 3 years time.

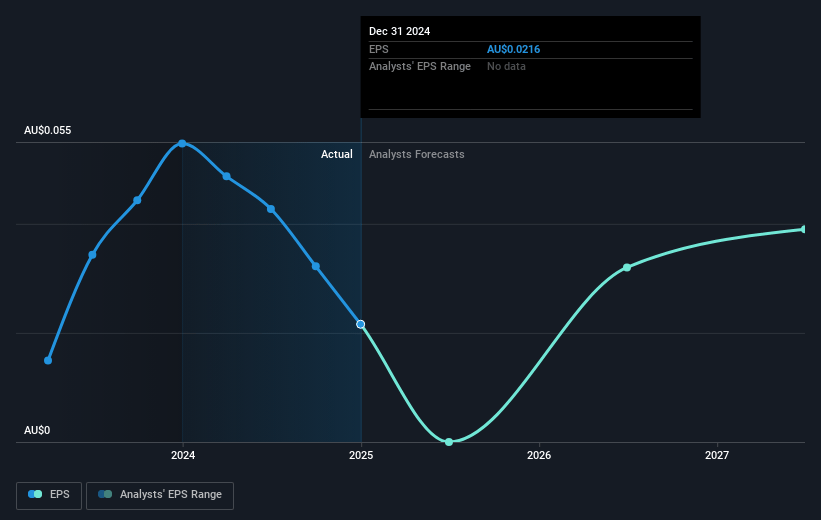

- Analysts expect earnings to reach A$7.5 million (and earnings per share of A$0.04) by about July 2028, up from A$4.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, up from 12.9x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Mitchell Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to coal sector volatility and structural decline: The company's coal drilling business is facing a challenging market due to declining coal prices and increased government royalties, with no sign of short-term recovery, reflecting a long-term global shift away from coal. This decreases rig utilization rates and poses risk to revenue and earnings if gold and minerals cannot offset coal sector softness.

- Unproven growth and early-stage risk in Loop business: The decarbonization-focused Loop segment is at its infancy, with a new, untested market reliant on regulatory frameworks. Its ramp-up will be slow and "choppy," with stop-start demand and uncertain contract wins, making near

- and long-term contributions to group earnings unpredictable and subject to execution risk.

- Underutilization of fleet and dependence on commodity cycles: Sustained use of only 65–68 rigs out of a 90-rig fleet signals operational underutilization, with profitability highly sensitive to rig deployment. Persistent industry or commodity sector weakness (especially in coal) could drive lower asset utilization, pressuring EBITDA margins and overall earnings.

- Sustained pricing pressure and competitive intensity: The company alludes to ongoing competitive bidding and price-cutting, especially in the coal market, and while management claims margin discipline, any prolonged market softness or aggressive competition could force downward pressure on pricing, threatening net margins and profitability.

- Continued capital intensity and working capital demands: Substantial and ongoing requirements to manage inventory, fleet maintenance, and the capital cost of project/contract mobilization stretch the company's cash conversion and free cash flow. If rig utilization fails to recover or new growth engines (like Loop) stall, high capex burdens could weigh on net margins and throttle the ability to return capital to shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.45 for Mitchell Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$252.0 million, earnings will come to A$7.5 million, and it would be trading on a PE ratio of 15.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$0.28, the analyst price target of A$0.45 is 37.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.