Key Takeaways

- Strong Asian demand and favorable global trends in decarbonization and lightweight materials are driving consistent sales growth and long-term demand for Metro Mining's bauxite.

- Expanded production, operational efficiencies, and a strengthened financial position enhance the company's profitability, scale, and flexibility for future growth initiatives.

- Overdependence on Chinese demand, weather disruptions, single-asset risk, volatile bauxite prices, and rising environmental compliance threaten long-term revenue stability and growth.

Catalysts

About Metro Mining- Operates as an exploration and mining company in China.

- Metro Mining is benefiting from persistently strong Asian demand for aluminum, as evidenced by record shipments, growing Chinese coastal refinery capacity exposed to imported bauxite, and four consecutive years of record bauxite imports into China-suggesting continued sales growth and revenue stability moving forward.

- Global trends in decarbonization, electrification, and the use of lightweight materials (like aluminum) in vehicles, renewables, and packaging are expected to structurally support bauxite demand, potentially driving long-term volume and price tailwinds for Metro, uplifting revenues and forward earnings.

- The successful ramp-up to the 7 million tonne annual production rate and ongoing exploration (including new tenements and pit expansions) materially expand output and resource life, supporting future revenue growth and improving scale economies that should enhance net margins.

- Improved cost structure-via lower freight rates from recently signed long-term contracts, reduced operational penalties, and site cost improvements through operational efficiencies-positions Metro to achieve sustainably higher margins and improved profitability even during periods of price volatility.

- Metro's strong cash generation, royalty obligations now cleared, and movement towards a net cash balance sheet provide financial flexibility for reinvestment and growth initiatives, further supporting long-term earnings and potential market rerating.

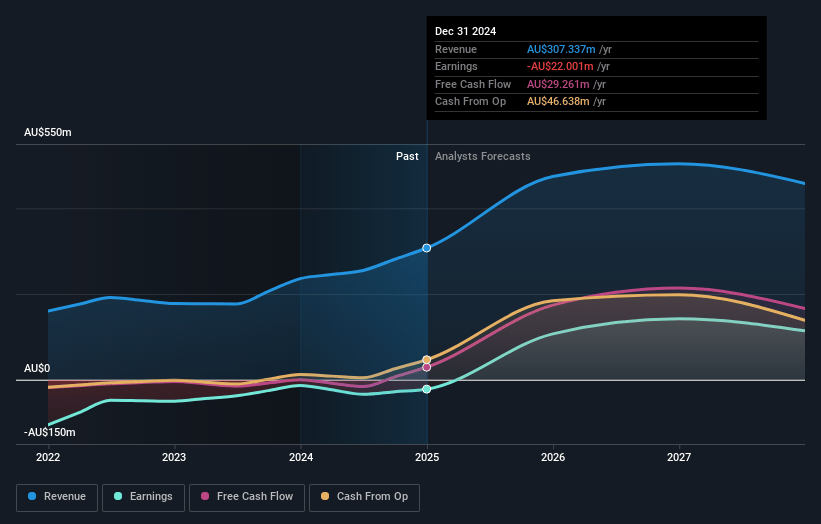

Metro Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Metro Mining's revenue will grow by 14.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.2% today to 25.4% in 3 years time.

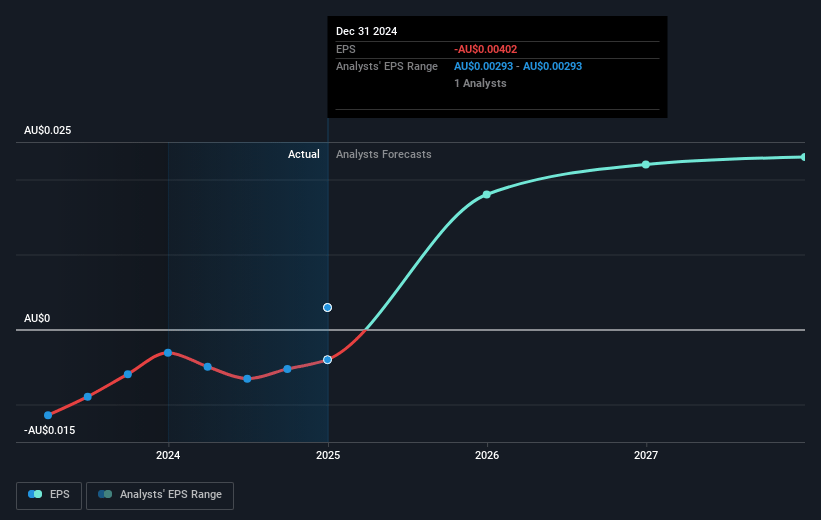

- Analysts expect earnings to reach A$118.0 million (and earnings per share of A$0.02) by about July 2028, up from A$-22.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$144.9 million in earnings, and the most bearish expecting A$91 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from -18.6x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 2.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Metro Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Metro Mining remains heavily reliant on Chinese customers for offtake agreements, leaving the company highly exposed to fluctuations in Chinese demand, trade policy changes, or structural shifts in China's alumina and bauxite market

- risking future revenue consistency and pricing power.

- Severe weather events (such as tropical storms and monsoons) regularly disrupt shipping channels and operations, highlighting the company's ongoing exposure to logistics bottlenecks and the risk of lost volume, higher site costs, and sustained margin compression in future quarters.

- Ongoing reliance on a single main asset (Bauxite Hills) with uncertain mine life and limited mention of confirmed long-term reserves, coupled with the need for successful exploration and approvals on new tenements, introduces resource depletion risk and the possibility of declining production and earnings unless new deposits are rapidly developed.

- High sensitivity to global bauxite price volatility-driven by factors such as Chinese alumina swings, Guinea's regulatory uncertainties, and the overhang of legacy contracts at lower fixed prices-creates the risk of future price declines, which could depress net margins and overall earnings even as operating costs fall.

- Increasing environmental concerns, weather-related logistical challenges (e.g., silt build-up requiring potential channel dredging with lengthy regulatory approvals), and the need to manage community and traditional owner agreements for exploration expansion could drive up compliance costs and delay growth projects, ultimately impacting both revenue growth and margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.133 for Metro Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$0.17, and the most bearish reporting a price target of just A$0.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$464.5 million, earnings will come to A$118.0 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$0.07, the analyst price target of A$0.13 is 49.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.