Key Takeaways

- Structural oversupply in lithium and technological shifts threaten core earnings and revenue growth, while resource nationalism raises compliance risks and project delays.

- Heavy debt burden and exposure to declining iron ore markets increase earnings volatility and constrain the company's ability to invest and deleverage.

- Sustained operational improvements, project ramp-ups, and diversified assets position Mineral Resources for stable growth and resilience amid rising long-term lithium and iron ore demand.

Catalysts

About Mineral Resources- Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

- Structural oversupply risk in lithium is intensifying as new entrants aggressively ramp production, threatening to drive down lithium prices over the next several years; this could cause a prolonged decline in revenues and compress margins in Mineral Resources' lithium operations, undermining long-term earnings growth.

- Ongoing heavy reliance on Pilbara iron ore exposes the company to a secular decline in steel demand in carbon-intensive sectors, as the global shift to decarbonisation gathers pace; faltering iron ore volumes and lower price realizations may lead to weaker cash flows and heightened earnings volatility.

- Rising debt levels, with net debt already above $5.4 billion and interest costs projected to surge if refinancing occurs at rates nearing 10 to 12 percent, threaten to significantly erode net profit and constrain the company's ability to fund new initiatives or deleverage, especially if major asset sales fail to materialize in time.

- Unpredictable resource nationalism and growing regulatory scrutiny across strategic commodity export markets materially increase the risk of project delays, higher compliance and remediation costs, and supply chain disruptions, weighing on margins and impairing free cash flow.

- Rapid advancements in battery technology, including substitution away from lithium or strides in recycling, could diminish long-term demand for Mineral Resources' existing portfolio, resulting in structurally lower revenue growth and putting pressure on the sustainability of future returns.

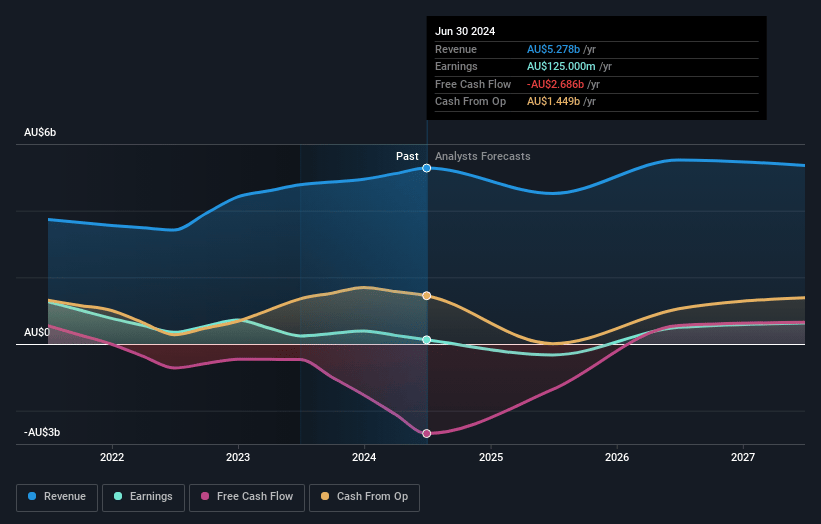

Mineral Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mineral Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mineral Resources's revenue will decrease by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -24.4% today to 12.5% in 3 years time.

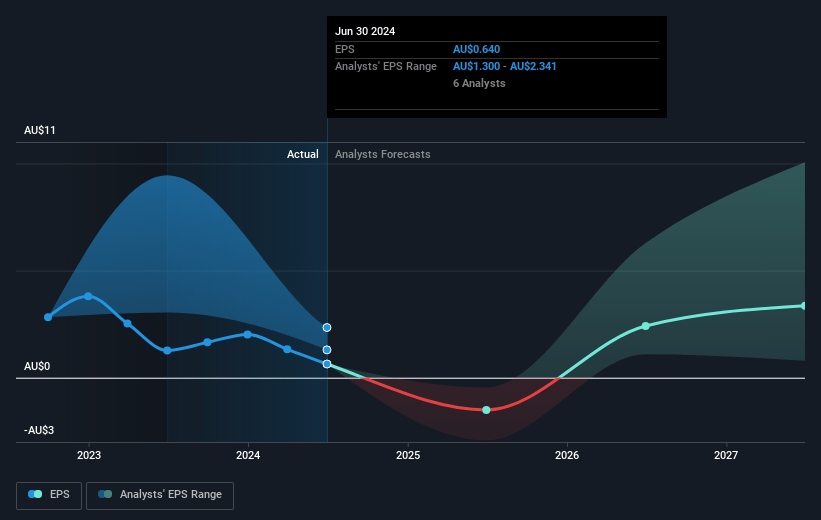

- The bearish analysts expect earnings to reach A$598.9 million (and earnings per share of A$3.04) by about July 2028, up from A$-1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, up from -4.9x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

Mineral Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained strong operational performance in lithium assets, with increasing production volumes, improved plant recoveries, and substantial reductions in operating costs, positions Mineral Resources to capitalize on rising long-term lithium demand and sustain or grow its future revenue and earnings.

- Ramp-up of the Onslow Iron project is progressing ahead of schedule, with shipping volumes and operational capacity increasing month-on-month; as infrastructure upgrades are completed, this is likely to drive higher iron ore volumes and improved EBITDA margins over the long term.

- Structural growth in the global electrification and decarbonization push-reflected in robust demand from customers like Baowu and positive market reception to MinRes products-could underpin elevated commodity prices for lithium and iron ore, supporting top-line revenue and shareholder returns.

- The company's diversified asset base, including lithium, iron ore, mining services, and energy projects, provides resilience against individual commodity price swings and underpins more stable long-term cash flows and net profit after tax.

- Ongoing investment in mining efficiencies, infrastructure, and the successful streamlining of its cost structure-coupled with a strong liquidity position and ready access to asset monetization options-enhances Mineral Resources' ability to deliver improved free cash flow, reduce net debt, and support stable or improving margins in future financial periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mineral Resources is A$14.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mineral Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$58.0, and the most bearish reporting a price target of just A$14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$4.8 billion, earnings will come to A$598.9 million, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of A$30.66, the bearish analyst price target of A$14.0 is 119.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.