Key Takeaways

- Capacity expansions, operational efficiencies, and exclusive builder partnerships position James Hardie for sustained volume growth, operating leverage, and margin stability across market cycles.

- The AZEK merger, focus on sustainable innovation, and a scalable salesforce enable market dominance, premiumization, and accelerated share gains in new and existing markets.

- Ongoing demand softness, cost inflation, and heightened regulatory pressures threaten revenue growth, margin stability, and the effectiveness of new market and product expansion efforts.

Catalysts

About James Hardie Industries- Engages in the manufacture and sale of fiber cement, fiber gypsum, and cement bonded boards in the United States, Australia, Europe, and New Zealand.

- Analyst consensus recognizes James Hardie's capacity expansions and improved efficiencies as enablers of revenue and margin growth, but this may be understated: with the completion of major projects like Prattville Sheet Machine 4, James Hardie now has the infrastructure to double its addressable output as latent demand in both R&R and new construction recovers, potentially delivering step-change volume growth and significant operating leverage upside, driving both revenues and net margins higher for years rather than just through the next cycle.

- While analyst consensus highlights partnership agreements with large U.S. homebuilders as a strong driver, it may underappreciate the snowballing effect of James Hardie's exclusivity wins: by capturing multiyear commitments from the largest homebuilders, James Hardie is not only securing predictable, recurring revenue but is also structurally embedding its products in future housing stock-supporting compounding share gains and superior revenue visibility and margin stability through market cycles.

- The recent merger with AZEK positions the combined entity to dominate the transition away from legacy materials in the enormous siding, trim, and decking markets; the company expects over $500 million in baseline revenue synergies and $125 million in cost synergies with clear potential for upside, radically expanding the total addressable market and accelerating top-line revenue growth and free cash flow generation to best-in-class industry levels.

- James Hardie's leadership in sustainable, innovative fiber cement solutions aligns it directly with the accelerating demand for durable, energy-efficient building products as urbanization, climate resilience, and regulatory changes drive material specification in new and remodeled housing-supporting long-term pricing power, margin expansion, and market share capture as sustainability premiums become standard in the industry.

- With a purpose-built, highly scalable salesforce and branded value proposition, James Hardie is uniquely positioned to rapidly onboard thousands of new contractors annually and penetrate under-penetrated regions, enabling outsized brand-driven market share gains, faster premiumization through high-value products like ColorPlus, and structurally higher gross margins and EBIT over the long term.

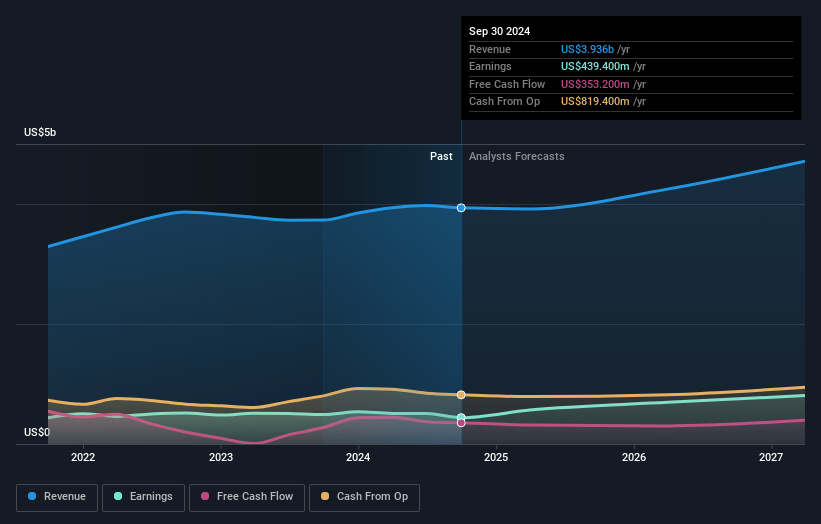

James Hardie Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on James Hardie Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming James Hardie Industries's revenue will grow by 24.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.9% today to 16.3% in 3 years time.

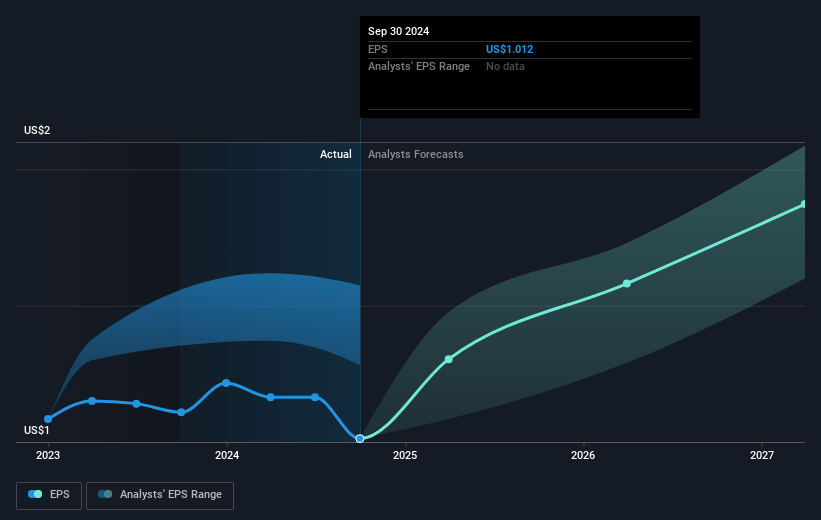

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $2.0) by about July 2028, up from $424.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, down from 27.9x today. This future PE is lower than the current PE for the US Basic Materials industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

James Hardie Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness in large-ticket repair and remodel activity, as well as contractions in new home construction due to broader macroeconomic uncertainty and rising costs of home construction, could lead to sustained declines or stagnation in volumes sold, thereby negatively impacting revenue growth over the long term.

- Despite proclamations of a significant material conversion opportunity, annual share gains in the core North American market have been described as positive but below target levels, which may signal market saturation and intensifying competition are impairing James Hardie's ability to drive above-market growth and defend pricing power, ultimately risking topline revenue and market share stability.

- Headwinds from raw material inflation, particularly in pulp and cement, combined with higher energy and operational costs, are noted as continuing challenges that may not be fully offset by price increases or cost savings initiatives, thus creating pressure on net margins and possibly eroding earnings.

- The company's ongoing investment in scaling operations, coupled with increased expenditures to expand into new product categories and geographies-as well as the integration execution risks associated with the AZEK acquisition-could drive up costs substantially without ensuring proportional revenue synergies, undermining net income and return on capital.

- Greater scrutiny of ESG criteria and evolving regulatory requirements around carbon emissions and sustainability in building materials could necessitate costly changes to production methods, increase compliance expenditures, and pose reputational or financial risks, resulting in long-term operating margin compression and additional downward pressure on profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for James Hardie Industries is A$52.92, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of James Hardie Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$52.92, and the most bearish reporting a price target of just A$32.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.6 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$41.79, the bullish analyst price target of A$52.92 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.