Key Takeaways

- Regulatory support, new contracts, and strong recurring revenues position Calix for stable long-term growth and market expansion in industrial decarbonization technologies.

- Completed investment cycle and cost reductions set the stage for higher profitability, while R&D focus aligns with global demand for low-carbon, flexible solutions.

- Heavy dependence on a single revenue source, delayed project funding, and policy uncertainties threaten diversification, commercialization efforts, and future earnings stability.

Catalysts

About Calix- An environmental technology company, provides industrial solutions to address global decarbonisation and sustainability challenges in Australia, Europe, the United States, and Southeast Asia.

- Global regulatory momentum and increased government funding for industrial decarbonization-especially in Europe, Asia, and Australia-are set to accelerate adoption of Calix's carbon capture and green processing technologies, providing long-term revenue growth opportunities.

- Expansion and strong performance in the magnesia (water) business, with new contracts in both Australia and the US and investments in production capacity, support a resilient, high-margin recurring revenue stream that is expected to underpin earnings and cash flow stability.

- Commercial validation and new funding awards for major projects in lithium, iron & steel, and cement (including the lithium midstream JV and ZESTY demonstration plant), indicate increasing market traction and de-risking, which should lift forward earnings potential as these projects scale and transition to royalty/license models.

- Aggressive cost base reductions and the completion of a heavy investment cycle have set the stage for improved operating leverage and net margin expansion, positioning Calix for higher profitability as revenue continues to increase.

- Ongoing investments in R&D and technology that enable energy flexibility (switching between fossil fuels and renewables) align with global industry trends toward electrification and low-carbon production, expanding the company's addressable market and supporting sustainable top-line growth.

Calix Future Earnings and Revenue Growth

Assumptions

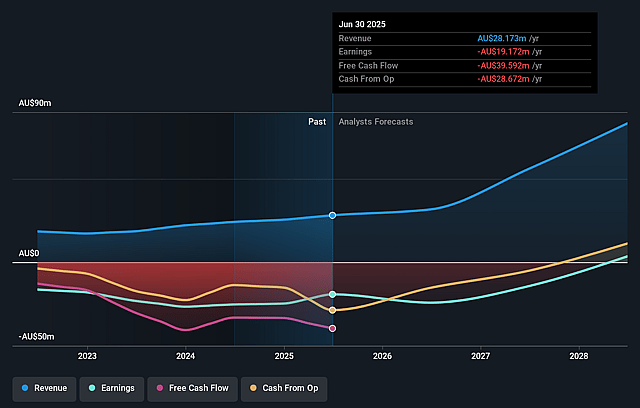

How have these above catalysts been quantified?- Analysts are assuming Calix's revenue will grow by 43.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -68.1% today to 4.3% in 3 years time.

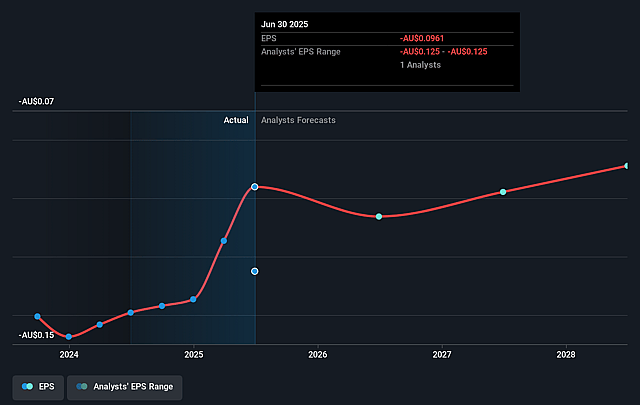

- Analysts expect earnings to reach A$3.6 million (and earnings per share of A$-0.09) by about September 2028, up from A$-19.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$26.3 million in earnings, and the most bearish expecting A$-19.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 137.9x on those 2028 earnings, up from -4.8x today. This future PE is greater than the current PE for the AU Chemicals industry at 55.7x.

- Analysts expect the number of shares outstanding to grow by 1.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Calix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness and volatility in capital markets, especially within the cleantech sector, have made it difficult for Calix to secure necessary sub-level or project funding for major commercialization stages (e.g., ZESTY and Zeta). This funding constraint could impede technology scale-up, delay project delivery, and limit future revenue growth, putting pressure on the company's long-term earnings outlook.

- Significant dependence on magnesia for current revenues (~85% of total revenue), while the high-potential lines (iron & steel, cement & lime, lithium) are still largely pre-commercial and reliant on achieving demonstration milestones and securing external capital; failure to diversify revenue sources may constrain revenue growth and lead to significant earnings volatility.

- Ongoing permitting and grant disbursement delays, especially for large-scale projects (e.g., Leilac-2 plant in Europe, U.S. DOE grant) due to administrative or macro-political factors, create uncertainty in project timelines. Persistent delays may stall growth initiatives, push back cost synergies, and negatively affect revenue recognition and cash flow.

- Market timing risk surrounding end-user demand (especially for lithium projects), with the company's near-term lithium revenue (e.g., from the Pilbara JV) highly sensitive to commodity price cycles; if lithium prices do not recover to historical averages, Calix may be forced to defer commissioning and revenue generation, impacting top-line growth and net margins.

- Increasing reliance on public funding (government grants, match funding requirements) exposes Calix to policy and regulatory risk; changes in administration, funding priorities (e.g., in the U.S.), or environmental regulations can disrupt the expected inflow of funds, hinder commercialization, and thus adversely affect medium

- and long-term revenue projections and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.825 for Calix based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$83.3 million, earnings will come to A$3.6 million, and it would be trading on a PE ratio of 137.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of A$0.42, the analyst price target of A$1.82 is 76.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.