Last Update 15 Sep 25

Fair value Decreased 5.83%Despite improved revenue growth forecasts and a lower future P/E ratio, analysts have reduced Paragon Care’s consensus price target from A$0.515 to A$0.485.

What's in the News

- Full year 2026 revenue expected to remain at 2025 trend growth rates.

- Profitability forecasted to improve as merger synergies are fully realised.

Valuation Changes

Summary of Valuation Changes for Paragon Care

- The Consensus Analyst Price Target has fallen from A$0.515 to A$0.485.

- The Future P/E for Paragon Care has significantly fallen from 24.91x to 21.15x.

- The Consensus Revenue Growth forecasts for Paragon Care has significantly risen from 4.7% per annum to 5.3% per annum.

Key Takeaways

- Expansion into high-growth Asia-Pacific markets and targeting demographic-driven healthcare demand are expected to drive sustainable long-term revenue and margin growth.

- Acquisitions integration, investment in higher-margin areas, and improved cost structures are set to enhance profitability and operational efficiency.

- High debt, integration risks, persistent cash flow issues, intense competition, and unproven expansion strategies threaten Paragon Care's margins, liquidity, and long-term growth prospects.

Catalysts

About Paragon Care- Distributes medical equipment, devices, and consumable products in Australia, New Zealand, and Asia.

- The company's continued expansion into fast-growing Asia-Pacific markets, particularly with robust revenue growth in Thailand and Vietnam and a strong pipeline of M&A opportunities in the region, is expected to provide exposure to higher-growth economies-supporting future revenue growth.

- Demographic shifts in the Asia-Pacific region, such as an aging population and increasing prevalence of chronic diseases, are driving consistent demand for healthcare services, devices, and medical consumables-underpinning sustainable long-term revenue and margin growth.

- The integration of recent acquisitions and ongoing operational synergies (with a target of $12 million annual run-rate in FY '26), coupled with the consolidation of business functions onto a unified JDE platform, are likely to improve cost efficiencies and structurally enhance net margins and EBITDA.

- Increased investment in proprietary consumables, new business units (aesthetics, robotics, dental), and contract manufacturing are expected to shift the sales mix toward higher-margin products and services-positively impacting gross profit margins and EBITDA.

- The refinancing of debt facilities at lower rates and elimination of line fees provide greater funding flexibility for both organic and inorganic growth, while lowering interest expenses and improving net earnings.

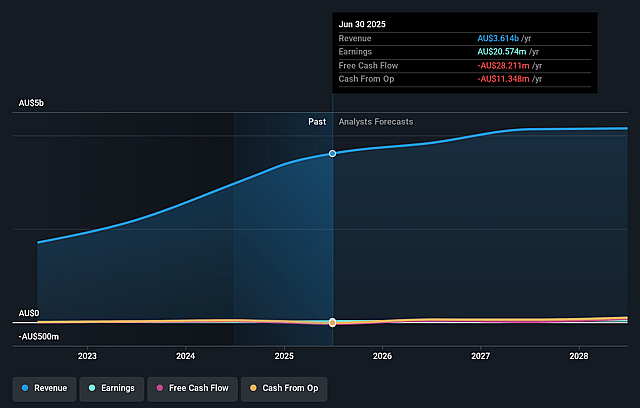

Paragon Care Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paragon Care's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 1.0% in 3 years time.

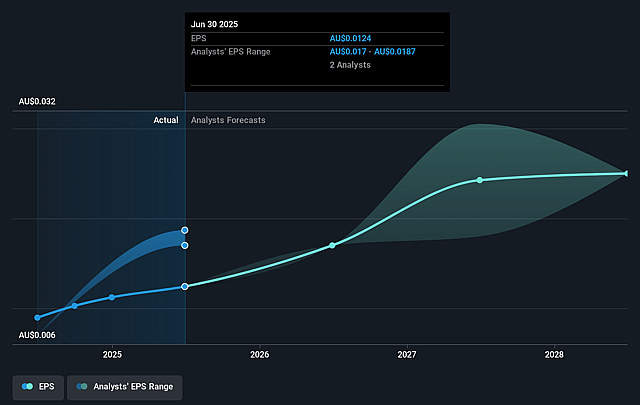

- Analysts expect earnings to reach A$41.3 million (and earnings per share of A$0.02) by about September 2028, up from A$20.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.9x on those 2028 earnings, down from 26.6x today. This future PE is lower than the current PE for the AU Healthcare industry at 57.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Paragon Care Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's high and increasing debt levels (with net debt averaging $251 million and a new $400 million mandatory-draw facility) expose Paragon Care to elevated interest expenses and refinancing risk over the long term; these could erode future net margins and constrain the company's ability to invest or weather industry downturns, especially if borrowing costs rise or cash flow lags.

- The complexity and operational execution risk associated with recent large-scale mergers and ongoing integration efforts (three businesses combined, restructuring of channels, ERP migrations, and pursuit of $12 million in targeted synergies) may result in unforeseen disruptions, inefficiencies, or cost overruns-negatively impacting earnings if integration does not yield expected benefits or leads to customer attrition.

- Persistent working capital issues, showcased by the $57 million overdue from a group of 103 pharmacies leading to negative $11 million in free operating cash flow, highlight ongoing credit risk and difficulty converting revenues to cash; if these challenges persist, they could impair liquidity and ultimately pressure profit and dividend payouts.

- High exposure to competitive and consolidating healthcare distribution and retail pharmacy markets (notably in Australia and New Zealand), with management noting unpredictable competitive dynamics (e.g., Sigma–Chemist Warehouse merger) and contract losses in orthopedics and service revenues in the Philippines; this raises risk of revenue concentration, margin compression, and lower long-term top-line growth if large customers or suppliers shift to rivals.

- Ambitious expansion in Asia relies on the success of new business lines (aesthetics, dental, robotics) where Paragon lacks a proven track record and admits slower uptake for high-capital offerings like robotics-if these initiatives underperform, fail to gain scale, or if regulatory, market, or geopolitical headwinds arise regionally, expected earnings and revenue diversification may not materialize, limiting the company's long-term growth trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.515 for Paragon Care based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$4.2 billion, earnings will come to A$41.3 million, and it would be trading on a PE ratio of 24.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$0.33, the analyst price target of A$0.52 is 35.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.