Key Takeaways

- U.S. market traction, rising respiratory disease demand, and updated guidelines position the company for strong recurring revenue and margin expansion via Technegas adoption.

- Operational leverage from earlier investments and expanding Technegas indications drive volume growth, improved earnings, and higher annuity-like income streams.

- Over-reliance on Technegas, difficult U.S. expansion, pricing pressures, regulatory costs, and lower-margin products threaten Cyclopharm's revenue growth and earnings stability.

Catalysts

About Cyclopharm- Cyclopharm Limited manufacture and sells medical equipment and radiopharmaceuticals in the Asia Pacific, Europe, Canada, the United States, and internationally.

- Cyclopharm's U.S. market entry is now gaining traction, with infrastructure, regulatory approvals, reimbursement, and a dedicated sales force all in place-positioning the company to rapidly expand installations and recurring consumable revenue in the world's largest healthcare market, likely driving accelerated top-line growth and improving earnings visibility.

- The company is set to benefit from the global rise in chronic respiratory diseases (COPD, asthma, long COVID) and an aging population, both of which are sharply increasing demand for advanced diagnostic imaging-directly supporting multi-year increases in Technegas system sales and consumable usage, boosting revenues and annuity-like income streams.

- Growing clinical acceptance and updated diagnostic guidelines that name Technegas as standard of care are anticipated to shift significant market share from older or less effective solutions (like Xenon planar imaging and CT), supporting both revenue growth and net margin expansion as hospitals adopt higher-value recurring consumables.

- The company's Beyond PE strategy, expanding Technegas indications to additional respiratory and transplant applications, is progressing with new supporting clinical data and use cases, widening the addressable market and creating long-term opportunities for volume growth and higher net margins.

- Operational leverage is beginning to materialize, with expense growth now lagging revenue gains due to earlier investments in sales and regulatory infrastructure; as recurring U.S. revenues scale, fixed costs are expected to yield meaningful improvement in earnings and operating margins over time.

Cyclopharm Future Earnings and Revenue Growth

Assumptions

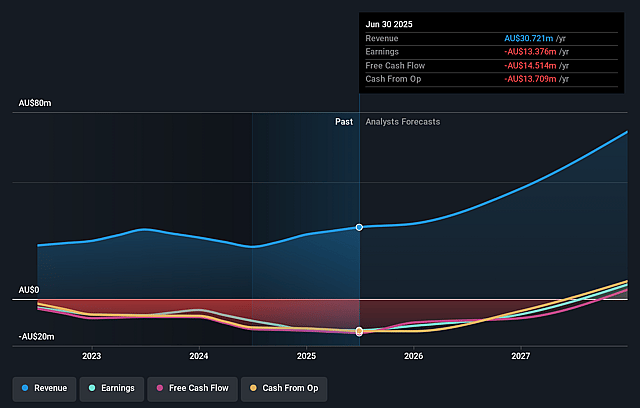

How have these above catalysts been quantified?- Analysts are assuming Cyclopharm's revenue will grow by 38.2% annually over the next 3 years.

- Analysts are not forecasting that Cyclopharm will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cyclopharm's profit margin will increase from -43.5% to the average AU Medical Equipment industry of 9.1% in 3 years.

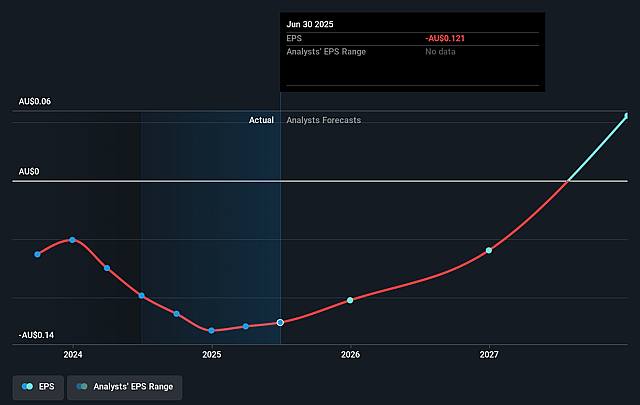

- If Cyclopharm's profit margin were to converge on the industry average, you could expect earnings to reach A$7.4 million (and earnings per share of A$0.07) by about September 2028, up from A$-13.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.5x on those 2028 earnings, up from -7.2x today. This future PE is lower than the current PE for the AU Medical Equipment industry at 32.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

Cyclopharm Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cyclopharm's heavy reliance on Technegas as its primary revenue driver exposes the company to technological obsolescence and disruptive competitive innovations, especially since alternative lung imaging modalities (e.g., dual-energy CT, MRI, and advanced software like 4DMedical) continue to improve; this could erode future revenues and compress net margins if medical practices shift away from nuclear medicine ventilation imaging.

- Growth in the U.S. market, while promising, faces structural risks due to long and non-linear sales cycles, hospital procurement delays, and challenges in converting pipeline interest into installations; slower-than-expected adoption could delay or lower recurring consumable revenues and prolong operating losses, impacting earnings stability.

- Global trends toward healthcare cost containment and increased price controls may push hospitals and clinics to favor cheaper diagnostic alternatives, potentially capping Cyclopharm's pricing power for both Technegas systems and consumables, thus limiting revenue growth and downward-pressuring margins long term.

- Industry and regulatory pressures related to radioactive materials-stemming from stricter compliance, environmental considerations, and complex radiopharmaceutical supply chains-could increase operational costs and slow the expansion of nuclear medicine-based solutions, negatively affecting both revenues and net profit margins.

- The company's expansion into third-party distribution and "business partner products" increases its exposure to operational risks outside its core expertise, and a shift in revenue mix toward lower-margin or less differentiated offerings could dilute overall profitability and slow future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.491 for Cyclopharm based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$81.0 million, earnings will come to A$7.4 million, and it would be trading on a PE ratio of 27.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of A$0.87, the analyst price target of A$1.49 is 41.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Cyclopharm?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.