Last Update01 May 25

Key Takeaways

- Strong growth in purchase orders and a new financing facility are expected to enhance revenue and facilitate market expansion.

- Progressing towards cash flow positivity and revenue expansion via product innovation and new SaaS offerings could establish leadership in the market.

- Delays in room readiness and vendor validations impact revenue recognition, while competitive market dynamics threaten future revenue and market share growth.

Catalysts

About CurveBeam AI- Engages in the development and manufacture of point-of care specialized weight bearing medical imaging equipment in Europe and North America.

- The company is seeing strong growth in purchase orders, with a 40% increase in Q3 and a 67% year-to-date increase, indicating a positive trend and strong future pipeline, which is expected to enhance future revenue growth.

- The introduction of a vendor financing facility is expected to reduce entry hurdles, particularly in Europe, thereby likely accelerating revenue growth by facilitating device placements in markets like Germany and France.

- The Enhanced HiRise submission is awaiting vendor validation, which, once cleared, can significantly boost revenues as it caters to larger patient populations and enhances product competitiveness against MDCT.

- The company is moving towards being cash flow positive by Q4 due to expected receipts from delayed sales, which should positively impact cash flow and profitability.

- Introduction of a SaaS platform and leveraging its FDA and CE-cleared stature could establish CurveBeam AI as a market leader, driving future revenue expansion and improving margins with higher-value technology offerings.

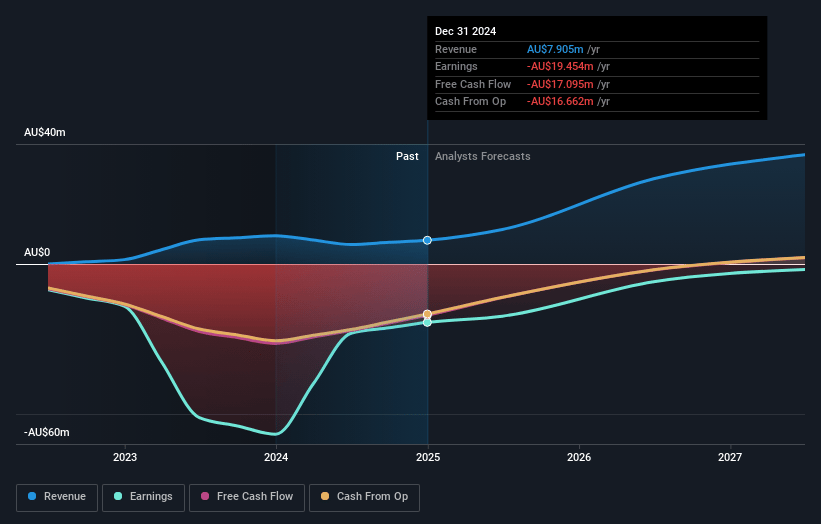

CurveBeam AI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CurveBeam AI's revenue will grow by 86.3% annually over the next 3 years.

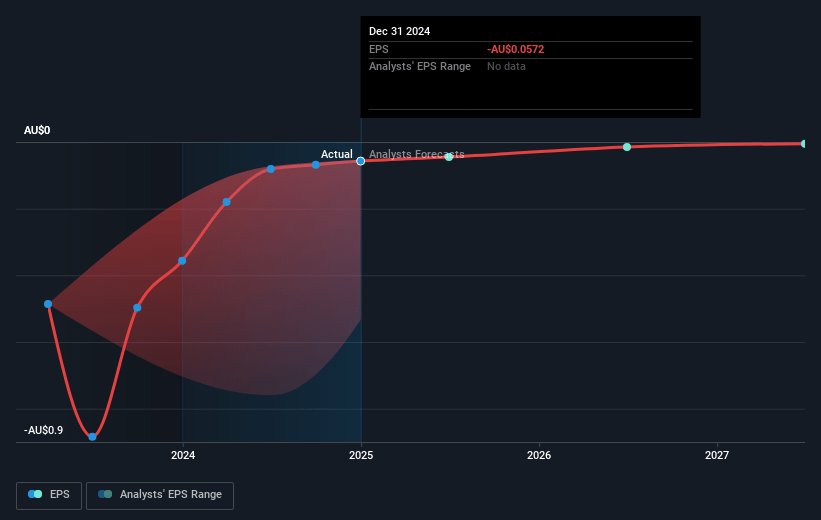

- Analysts are not forecasting that CurveBeam AI will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CurveBeam AI's profit margin will increase from -246.1% to the average AU Medical Equipment industry of 9.4% in 3 years.

- If CurveBeam AI's profit margin were to converge on the industry average, you could expect earnings to reach A$4.8 million (and earnings per share of A$0.01) by about May 2028, up from A$-19.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the AU Medical Equipment industry at 37.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

CurveBeam AI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delay in securing room readiness for device installation can impact the timely recognition of revenue and lead to delayed cash receipts, thus affecting cash flow and operational efficiency.

- The company's reliance on vendor validation processes, which are subject to external pressures and delays, can postpone revenue generation from new product lines, impacting earnings growth projections.

- The competition in the CT market, despite CurveBeam's current leadership, could intensify, potentially affecting future revenue streams and market share if competitors introduce similar or superior products.

- The company's current cash position of around $13.8 million, reliant on future receipts, suggests a risk if there are further unforeseen delays in cash inflows, which could strain operational funding.

- Any significant governmental or policy changes, such as tariff implementations affecting international sales, could impact cost structure and net margins if they lead to increased expenses or sales disruptions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.18 for CurveBeam AI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$51.1 million, earnings will come to A$4.8 million, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$0.09, the analyst price target of A$0.18 is 50.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.