Catalysts

About Beamtree Holdings

Beamtree Holdings develops AI powered clinical coding, analytics and pathology automation solutions for hospitals and laboratories globally.

What are the underlying business or industry changes driving this perspective?

- Rollout of fully hands off autonomous coding in Australia, the U.K. and Canada is set to convert pilot programs into scalable commercial contracts, increasing recurring software revenue and supporting earnings growth through high gross margins.

- Adoption of integrated coding platforms and automation by hospitals seeking efficiency and cost reduction is expected to lift demand across Beamtree’s coding suite, driving top line growth and improving operating leverage over time.

- Global push for data driven healthcare performance and benchmarking, particularly via NHS and other system wide initiatives, should expand Beamtree’s analytics and knowledge network subscriptions, supporting recurring revenue and stabilising net margins.

- Deepening partnerships with large industry players such as Abbott and regional distributors in Saudi Arabia and the Middle East are likely to open new geographies at low incremental cost, accelerating international revenue growth and enhancing profitability.

- Improving product mix toward higher value, AI enabled software and the scheduled reduction in amortisation charges from FY 2027 are expected to enhance reported earnings and net margins, making current valuation metrics look undemanding.

Assumptions

How have these above catalysts been quantified?

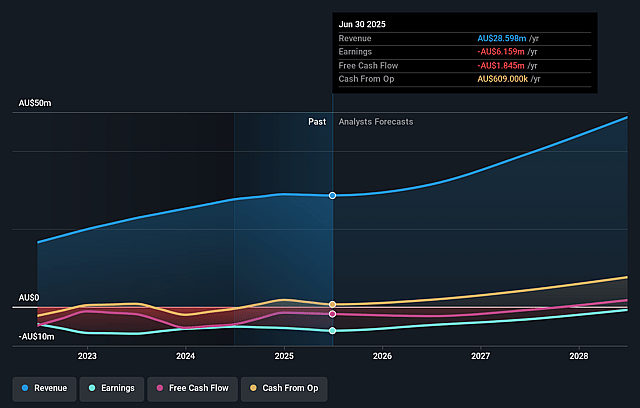

- Analysts are assuming Beamtree Holdings's revenue will grow by 19.4% annually over the next 3 years.

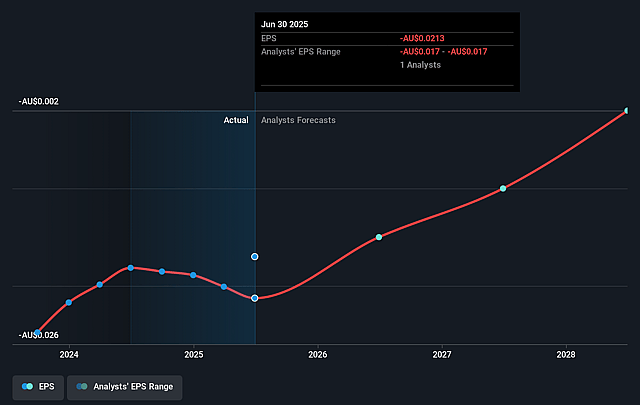

- Analysts are not forecasting that Beamtree Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Beamtree Holdings's profit margin will increase from -21.5% to the average AU Healthcare Services industry of 16.8% in 3 years.

- If Beamtree Holdings's profit margin were to converge on the industry average, you could expect earnings to reach A$8.2 million (and earnings per share of A$0.03) by about December 2028, up from A$-6.2 million today.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, up from -10.1x today. This future PE is lower than the current PE for the AU Healthcare Services industry at 67.1x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Autonomous coding is still at the minimum viable product stage with sales paused and no new Q4 contribution. Delays or technical setbacks in moving from pilots in Australia, the U.K. and Canada to scalable deployment could slow adoption and materially cap future revenue growth and operating leverage.

- The Saudi integrated coding platform and ICP diagnostics contracts, along with a major diagnostics deal, have already slipped into the first half of FY 26. Further deferrals or cancellations in these large, complex healthcare projects could reduce the expected uplift from international expansion and limit improvements in total earnings.

- Nonrecurring revenue fell 16 percent in FY 25 and Australian revenue went backwards despite record ARR. If project based work remains weak or local customers further reduce spending, overall top line growth could remain low and constrain margin expansion in the medium term.

- Cash on a like for like basis has declined while the company relies on debt facilities and ongoing capitalised product investment. If sales conversion does not keep pace with this spending, Beamtree may face funding pressure that could restrict product development, weighing on long term earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of A$0.6 for Beamtree Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be A$48.7 million, earnings will come to A$8.2 million, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$0.21, the analyst price target of A$0.6 is 64.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.