Key Takeaways

- Strategic acquisitions, partnerships, and regulatory approvals are poised to enhance market presence, revenue, and net margins through expanded distribution and high-margin services.

- Geographic expansion and new technology development aim to increase market penetration, scan volumes, and capture significant market share, improving overall financial performance.

- Cash burn outpaces revenue, revealing potential financial instability, dependence on short-term funding, and execution risks tied to new products and market expansion.

Catalysts

About 4DMedical- Operates as a medical technology company in the United States and Australia.

- The acquisition and integration of Imbio and partnerships with major players like Philips, alongside a strong portfolio of technologies, are expected to enhance 4DMedical's market presence, leading to increased revenue from expanded market share and product distribution.

- Recent FDA approvals and Medicare reimbursements for key products like IQ-UIP are set to catalyze revenue growth by facilitating wider adoption and insurance coverage, potentially boosting net margins as more high-margin services are provided.

- The expansion into underutilized regions such as North and South Australia and potentially Canada, coupled with the new hire of Philips' sales force presence, could lead to increased site penetration and scan volume, directly impacting revenue and future earnings positively.

- The development and expected FDA approval of the CT:VQ technology, which offers logistical improvements over current nuclear medicine solutions, present a significant opportunity to capture a share of the $1 billion market, potentially enhancing net margins through the provision of superior cost-saving technology.

- Ongoing cost management efforts, as evidenced by an 11% reduction in operating expenditure, may improve profitability and contribute to better net margins, leading to improved financial health despite the current cash burn rate.

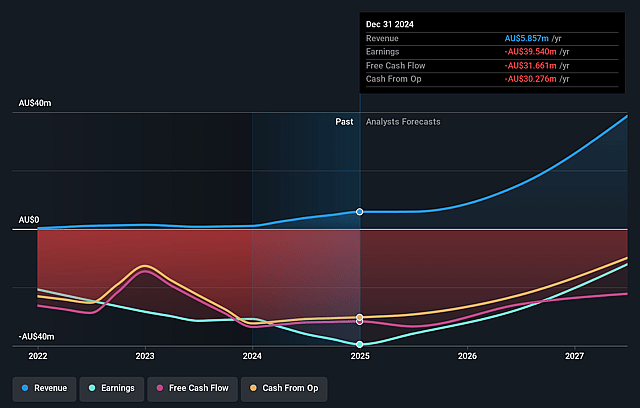

4DMedical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming 4DMedical's revenue will grow by 102.3% annually over the next 3 years.

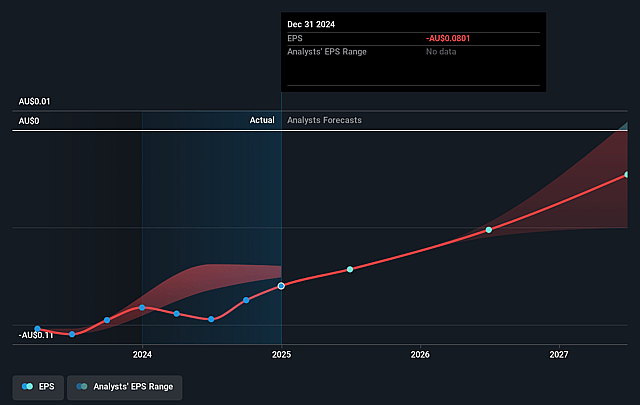

- Analysts are not forecasting that 4DMedical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate 4DMedical's profit margin will increase from -675.1% to the average AU Healthcare Services industry of 36.0% in 3 years.

- If 4DMedical's profit margin were to converge on the industry average, you could expect earnings to reach A$17.4 million (and earnings per share of A$0.04) by about August 2028, up from A$-39.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.5x on those 2028 earnings, up from -6.2x today. This future PE is lower than the current PE for the AU Healthcare Services industry at 170.6x.

- Analysts expect the number of shares outstanding to grow by 0.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

4DMedical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cash burn is significantly outweighing revenue, suggesting that the company is not making a profit and may face challenges in achieving financial sustainability in the short term. This impacts net margins and earnings.

- The Australian revenue has decreased due to a legacy contract rolling off the books, indicating reliance on non-recurring revenue streams, which could affect future revenue stability.

- Engagement with the VA has been difficult due to administrative changes and budget constraints, which could delay or hinder revenue from these potentially significant contracts.

- The company has only secured funding for 1 to 2 quarters, indicating a potential liquidity risk and a dependence on future capital raises to sustain operations, impacting cash flow and financial planning.

- 4DMedical's financial position is heavily dependent on the success of new products and expansion strategies, like the Philips reseller agreement and VQ market replacement, which involve execution risks that could impact future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.725 for 4DMedical based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$48.5 million, earnings will come to A$17.4 million, and it would be trading on a PE ratio of 24.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$0.53, the analyst price target of A$0.72 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.