Key Takeaways

- Growth in plant-based products and international expansion is diversifying revenue streams and supporting margin improvement.

- Focus on innovation, efficiency, and sustainability is strengthening brand value and long-term profitability.

- Heavy refinancing risks, ongoing net losses, margin vulnerability from commodity prices, export competition, and weakening plant-based sales could suppress profitability and investor confidence.

Catalysts

About Noumi- Develops, sources, manufactures, markets, sells, and distributes plant-based and dairy beverages and dairy and nutritional products in Australia, New Zealand, China, Southeast Asia, South Africa, and the Middle East.

- Strong and sustained growth in the plant-based and dairy alternative segments, driven by increasing consumer demand for health and sustainability-focused products and the global expansion of coffee culture-likely to deliver higher long-term revenue and support top-line growth.

- Strategic focus on international expansion, particularly in high-growth Asia-Pacific markets (Indonesia, Thailand, South Korea), alongside increased penetration in existing export channels, provides geographic diversification and new revenue streams, supporting both revenue growth and operating margin enhancement.

- Company investment in innovation, new product development (e.g., lactose-free, long-life cream, improved lactoferrin yield), and brand building (especially for MILKLAB) positions Noumi to capitalize on premium trends and value-added offerings, which can improve gross and net margins over time.

- Improved cost efficiency from completed transformation initiatives-removal of legacy legal and operational issues, upgraded ERP, and streamlined operations-should drive stronger earnings and margin expansion moving forward.

- Embedded ESG strategy, including waste reduction and sustainable packaging targets, enhances brand value and aligns with growing regulatory and consumer sustainability expectations, potentially increasing pricing power, market share, and investor appeal, which can lead to improved earnings and enhanced capital access.

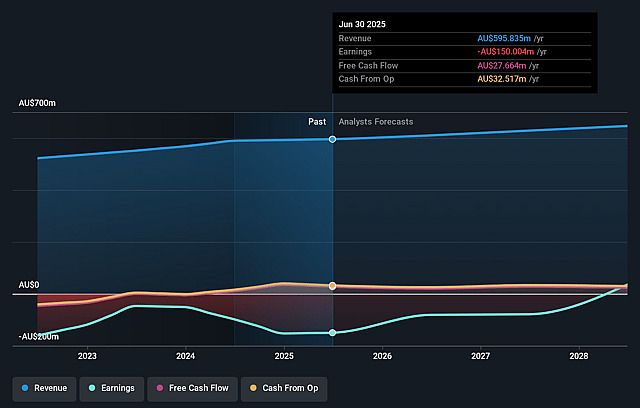

Noumi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Noumi's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -25.2% today to 5.5% in 3 years time.

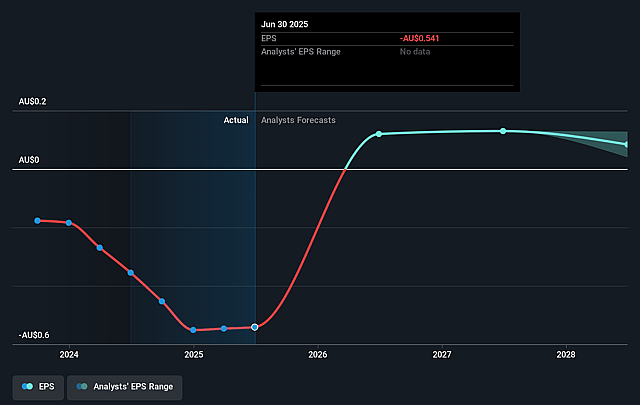

- Analysts expect earnings to reach A$35.4 million (and earnings per share of A$0.08) by about September 2028, up from A$-150.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.9x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the AU Food industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.53%, as per the Simply Wall St company report.

Noumi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The requirement to refinance or repay $610 million in convertible notes by May 2027 creates significant financial risk; if Noumi cannot secure favorable refinancing terms or generate sufficient free cash flow, this could result in dilution for shareholders, increased interest costs, or even financial distress-directly impacting net earnings and shareholder equity.

- The statutory net loss after tax of $150 million (due primarily to convertible note fair value adjustment and impairment charges) highlights ongoing vulnerability in the underlying business model and capital structure; persistent large adjustments could erode investor confidence and ultimately pressure long-term share price performance through lower reported net margins.

- Dairy & Nutritionals growth remains partly reliant on volatile global commodity prices (bulk cream, protein inputs, etc.), and while some price recovery occurred in FY25, any future downturn in commodity markets or spikes in agricultural input costs (including for almonds and other plant-based ingredients) could compress sector-wide margins and reduce Noumi's earnings.

- Export market growth, particularly in highly competitive Asian markets (Indonesia, Thailand, South Korea), faces elevated risks from intensifying competition with both established multinationals and nimble local startups; inability to establish or grow profitable high-margin sales channels abroad could cap revenue growth and limit operating leverage.

- The slowdown in plant-based milk sales growth in the second half, attributed to cost-of-living pressures and contraction in contract/retail private-label volumes, suggests potential sensitivity to shifting consumer spending priorities; in a prolonged high-inflation or economic downturn environment, Noumi's top-line growth and pricing power in premium segments could remain under pressure, leading to lower revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.175 for Noumi based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$646.7 million, earnings will come to A$35.4 million, and it would be trading on a PE ratio of 1.9x, assuming you use a discount rate of 11.5%.

- Given the current share price of A$0.16, the analyst price target of A$0.18 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.