Key Takeaways

- Diversified growth in loan origination and strategic partnerships, particularly in auto and renewables, promises enhanced earnings stability and revenue increase.

- Advanced operational efficiencies and investor confidence in successful funding strategies could improve margins and drive future loan growth.

- Heavy reliance on capital for loan book growth, strategic partnerships, and market volatility could impact earnings, margins, and revenue growth.

Catalysts

About Plenti Group- Engages in the fintech lending and investment business in Australia.

- The company's loan origination growth reached a record $407 million in the quarter, with a 42% increase from the prior corresponding period (PCP) and a 6% increase over the previous quarter, showcasing strong demand and operational efficiency likely to boost future revenue.

- Plenti's partnership with NAB and the introduction of the NAB Auto by Plenti product is expected to grow significantly in the future, contributing to loan origination numbers and potentially increasing revenue streams.

- Improved operational technology has enabled greater volumes of straight-through processing, reducing fulfillment costs and potentially improving net margins as cost efficiencies increase.

- Strong performance and growth across all lending verticals, especially with contributions from auto, renewables, and personal loans, indicate a diversified income stream that could enhance earnings stability and overall revenue.

- A successful funding strategy, including a $509 million auto ABS, shows strong investor confidence and available capital to support future loan growth, which can drive revenue and earnings expansion.

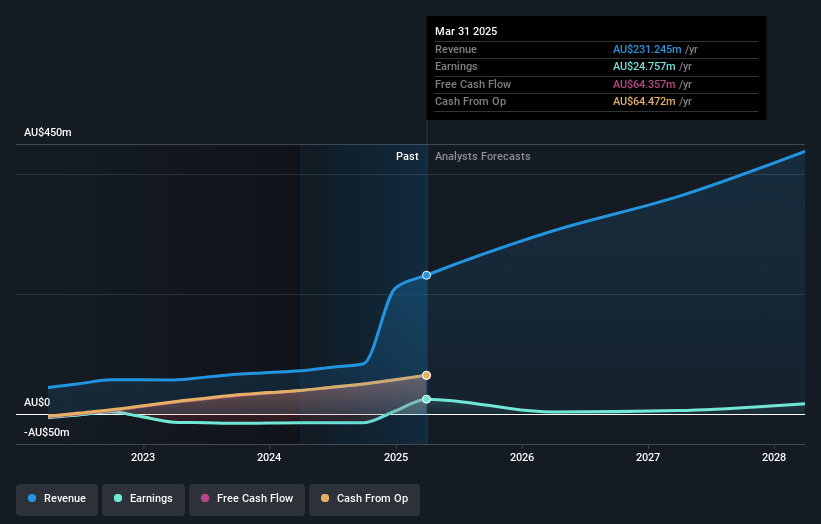

Plenti Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plenti Group's revenue will grow by 63.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.0% today to 3.7% in 3 years time.

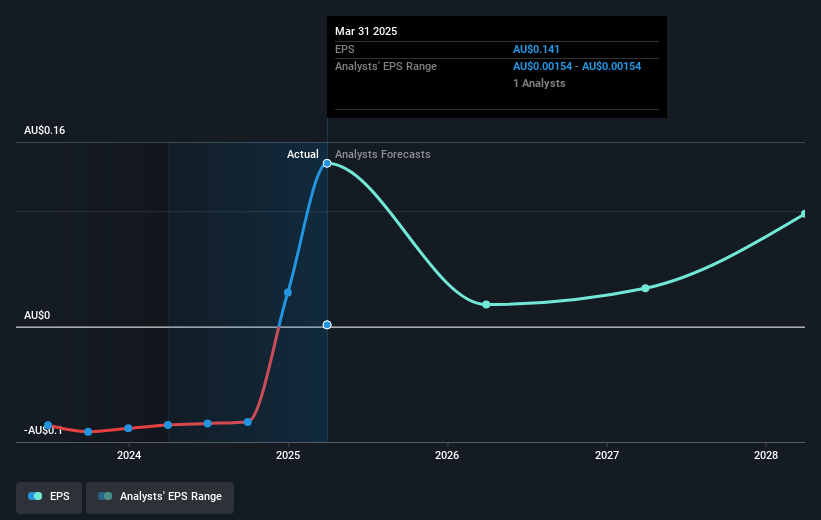

- Analysts expect earnings to reach A$16.2 million (and earnings per share of A$0.09) by about July 2028, down from A$24.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 6.7x today. This future PE is greater than the current PE for the AU Consumer Finance industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.61%, as per the Simply Wall St company report.

Plenti Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The commitment to growing the loan book could necessitate substantial ongoing use of capital, potentially delaying the payment of dividends to shareholders and affecting profit distribution. This could impact earnings.

- The reliance on the strategic relationship with Tesla and the impact of government incentives like FBT rebates for EVs may limit the growth of their electric vehicle loans, affecting future revenue from this segment.

- The company noted potential global market volatility effects on funding, such as disruptions in capital markets and changes in investor demand, which could impact their capital costs and ultimately affect net margins.

- Strong competition in the auto loan sector might pressure Plenti Group's differentiated offerings, risking their ability to maintain pricing power and potentially impacting future revenue.

- The aim to improve repeat lending to existing customers indicates a historical weakness in customer retention, which, if not effectively addressed, could impact future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.32 for Plenti Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$434.4 million, earnings will come to A$16.2 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 11.6%.

- Given the current share price of A$0.94, the analyst price target of A$1.32 is 28.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.