Last Update 08 Nov 25

PLT: Future Inclusion In All Ordinaries Index Will Increase Market Interest

Analysts have maintained their price target for Plenti Group at $1.75, citing stable underlying assumptions. This comes despite slight adjustments in the discount rate and future price-to-earnings estimates.

What's in the News

- Plenti Group Limited (ASX:PLT) was added to the S&P/ASX All Ordinaries Index (Key Developments).

Valuation Changes

- Fair Value: Remains unchanged at A$1.75.

- Discount Rate: Increased slightly from 11.53% to 11.72%.

- Revenue Growth: Essentially unchanged, staying at approximately 62.62%.

- Net Profit Margin: No material change, steady at just under 4.75%.

- Future P/E: Edged up modestly from 21.57x to 21.68x.

Key Takeaways

- Expansion into new markets, strategic partnerships, and ESG-focused initiatives are set to boost customer growth, revenue potential, and market position.

- Investment in proprietary technology and new funding sources lowers risk, improves margins, and enhances profitability and scalability.

- Heavy investment, external funding reliance, and exposure to policy and economic changes pose significant risks to Plenti's profitability and revenue growth.

Catalysts

About Plenti Group- Engages in the fintech lending and investment business in Australia.

- Strong acceleration in loan originations and a clear goal to reach a $3 billion loan book by March 2026, supported by continued digital adoption in financial services and expansion into large, underpenetrated markets, point to significant revenue growth potential.

- Strategic partnership with NAB offers access to a vast customer base and the ability to drive material origination volumes in coming quarters, expanding addressable market and boosting future revenue and earnings.

- Winning and administering the WA government's home battery rebate scheme strengthens Plenti's position in clean energy finance, aligning with surging demand for sustainable solutions and ESG-focused lending, which is likely to expand customer segments and improve long-term revenue and funding options.

- Ongoing investment in proprietary technology and machine learning has driven annualized loss rates down by 28% year-on-year, indicating lower credit losses, increased efficiency, and the prospect for improved net margins and overall profitability.

- Enhanced funding capacity demonstrated by successful ABS issuances provides access to lower-cost capital and positions Plenti to maintain or grow net interest margins, positively impacting future earnings and supporting scalability.

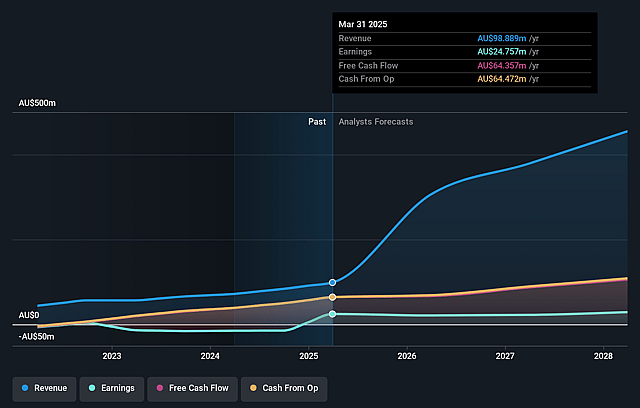

Plenti Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plenti Group's revenue will grow by 60.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.0% today to 5.6% in 3 years time.

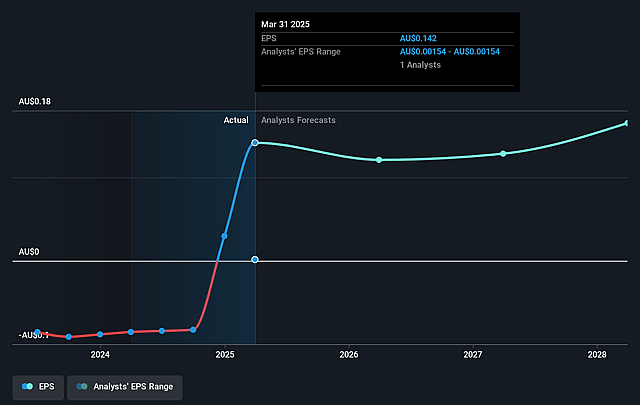

- Analysts expect earnings to reach A$22.9 million (and earnings per share of A$0.16) by about September 2028, down from A$24.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$29.0 million in earnings, and the most bearish expecting A$16.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the AU Consumer Finance industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.53%, as per the Simply Wall St company report.

Plenti Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Plenti's growth strategy is tied to significant ongoing investments in technology platforms, operations, underwriting, and staff expansion; if economic conditions turn or origination momentum falters, these higher operating costs could erode earnings and net margins, weakening the foundation for future profitability.

- Their heavy reliance on funding from asset-backed securities (ABS) markets and maintaining robust investor demand exposes Plenti to the risk of higher wholesale funding costs or tightening credit conditions, which could compress net interest margins and directly impact earnings in a rising rate or less liquid environment.

- The company's exposure to mostly prime, unsecured, and lightly collateralized lending, particularly in personal loans, could make it vulnerable to increased credit losses during future economic downturns or a reversal of current strong credit conditions, undermining revenue quality and reducing net profit margins through higher provisioning.

- Plenti faces intensifying competition from incumbent banks, larger fintechs, and potential new entrants leveraging embedded finance or open banking, which could pressure loan rates and fees, potentially slowing revenue growth and reducing profitability as margins are squeezed.

- Its long-term growth assumptions rest in part on government policies and programs in renewables (e.g., battery rebate schemes), which are susceptible to shifts in political priorities or regulation, creating uncertainty for future revenue streams and investment returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.485 for Plenti Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$412.1 million, earnings will come to A$22.9 million, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 11.5%.

- Given the current share price of A$1.22, the analyst price target of A$1.48 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.