Key Takeaways

- Next-generation tech investment and structural industry shifts may accelerate revenue and margin growth beyond current forecasts, yielding substantial upside and market outperformance.

- HUB24's open architecture, innovation, and data monetization uniquely position it to benefit from adviser migration and regulatory change, driving recurring, diversified high-margin revenues.

- Rising compliance costs, industry consolidation, adviser demographics, fee compression, and client concentration risk threaten HUB24's margins, growth, and long-term earnings stability.

Catalysts

About HUB24- A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

- Analysts broadly agree HUB24's adviser and FUA gains will propel revenue expansion, but this trajectory could accelerate beyond expectations as the structural shifts from bank-aligned channels and industry consolidation drive a step-change in platform migration, setting up multiple years of above-trend inflows and dramatic compounding of total revenue.

- Analyst consensus expects automation and AI to support steady margin improvement, yet HUB24's deep investment in next-generation tech, coupled with early proven FTE savings and reinvestment into productivity, may unlock a non-linear leap in operating leverage, driving group EBITDA margins into the high 40% range more rapidly than modeled, with substantial earnings upside.

- The accelerating migration of intergenerational wealth, combined with a record influx of new advisers leveraging HUB24 as the preferred platform for transferring assets between generations, could catalyze a massive multi-year tailwind for platform flows and fee income, positioning HUB24 for earnings growth well above sector norms even in cyclical downturns.

- HUB24's scale and continuous innovation are establishing it as the only open architecture solution able to fully capitalize on rapid regulatory change-its broadening suite of retirement, alternative investment, and compliance offerings positions it as the default hub for both new and existing advisers, expanding wallet share and cross-selling revenue per user at an accelerating pace.

- The company's unique ability to aggregate and monetize data-driven insights across both its platform and high-growth Tech Solutions business is still underappreciated by analysts, and could unlock high-margin, recurring revenue streams as it creates new SaaS and analytics offerings for advisers and wealth managers, further elevating group returns and diversifying earnings.

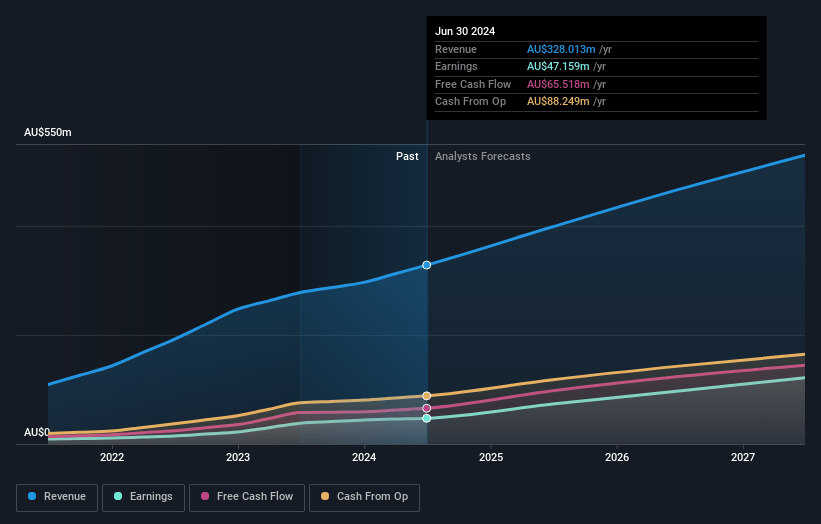

HUB24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on HUB24 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming HUB24's revenue will grow by 21.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.1% today to 27.4% in 3 years time.

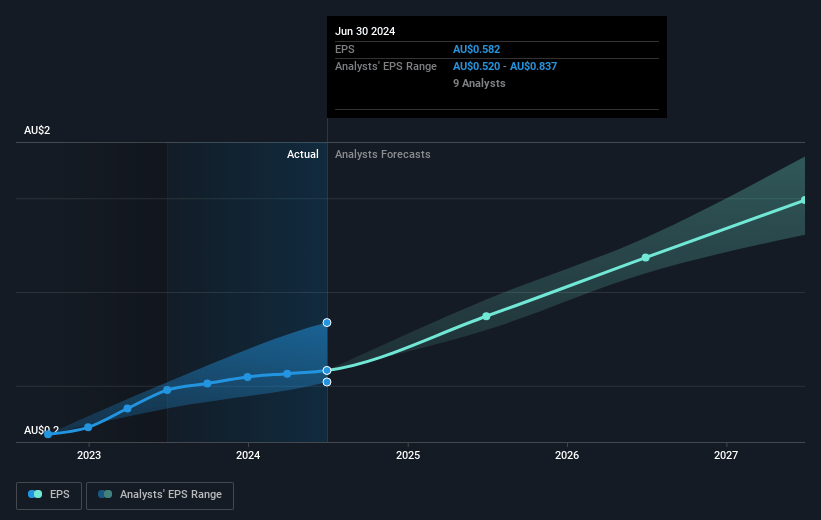

- The bullish analysts expect earnings to reach A$180.0 million (and earnings per share of A$1.58) by about July 2028, up from A$58.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 63.7x on those 2028 earnings, down from 144.4x today. This future PE is greater than the current PE for the AU Capital Markets industry at 15.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

HUB24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and compliance costs, particularly around data privacy, open banking, and adviser fee consent reforms, are driving investments in risk, compliance, and IT systems, which could compress net margins due to rising operating expenses and CapEx over time.

- Industry consolidation and the emergence of several larger, more powerful competitors through mergers and acquisitions may limit HUB24's negotiating leverage, put pressure on pricing, and potentially reduce its pool of available adviser relationships, negatively impacting both revenues and long-term market share growth.

- An ageing population of financial advisers and slow digital adoption among older cohorts may dampen adviser network expansion, while HUB24 already notes that a significant majority of net inflows come from existing adviser groups; if market share gains plateau, long-term growth in funds under administration and revenue could decelerate.

- Persistent industry fee compression, evidenced by 1 basis point margin declines in platform revenue and competition from lower-cost, technology-driven fintechs and direct-to-consumer investment platforms, could erode HUB24's profit margins and lead to slower revenue growth.

- High dependence on large adviser groups, major client migrations, and a small number of dominant relationships introduces concentration risk; any churn or adverse shift in these relationships could produce significant volatility in earnings and impact near-term and medium-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for HUB24 is A$115.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HUB24's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$115.0, and the most bearish reporting a price target of just A$31.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$656.4 million, earnings will come to A$180.0 million, and it would be trading on a PE ratio of 63.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$104.78, the bullish analyst price target of A$115.0 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.