Key Takeaways

- Strategic technology integrations and platform launches are projected to increase cost savings and operational efficiencies, boosting net margins and earnings.

- Strong FUMAS growth and market expansion, including new investment schemes, indicate promising revenue growth and an improved financial outlook.

- High expenses from transformation and outsourcing may negatively impact EQT Holdings' net margins and earnings predictability, affecting overall profitability and dividend growth.

Catalysts

About EQT Holdings- Provides philanthropic, trustee executor, and investment services in Australia.

- Successful integration of AET and completion of major technology transformations are expected to unlock approximately $5 million per annum in employee cost savings and $6.3 million in revenue synergies, positively impacting future net margins and earnings.

- The launch of the new multi-client platform (NavOne) and technology upgrades, such as Workday implementations and a new data warehouse, will drive operational efficiencies and support margin improvements, potentially enhancing earnings.

- The strong growth in Funds Under Management, Administration, and Supervision (FUMAS) by 26%, along with new superannuation appointments, suggests continued revenue growth momentum, impacting future top-line financials positively.

- Expansion into market leadership positions in small APRA funds and Active Philanthropy markets, plus upcoming 40-plus new investment schemes, are expected to drive future revenue increases.

- The anticipated decrease in operating expenses by $6 million in the second half following technology and integration investments will enhance net profit margins, contributing to earnings growth.

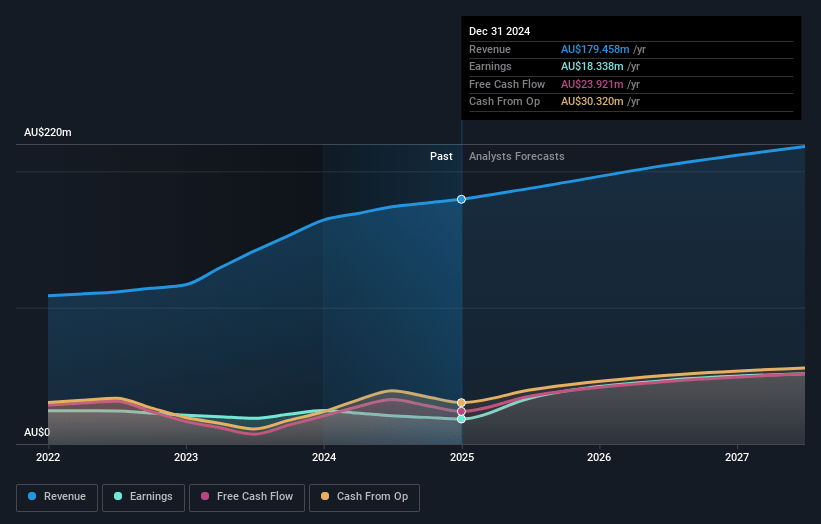

EQT Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EQT Holdings's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 22.7% in 3 years time.

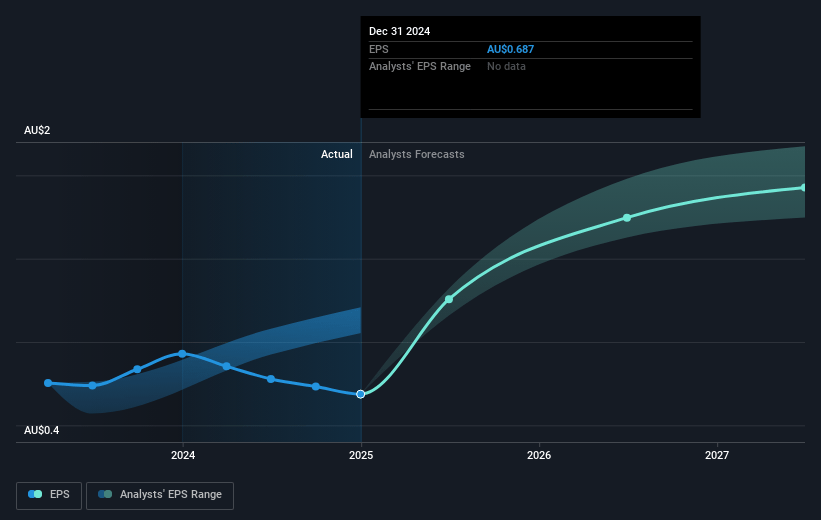

- Analysts expect earnings to reach A$48.4 million (and earnings per share of A$1.81) by about July 2028, up from A$18.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.0x on those 2028 earnings, down from 47.9x today. This future PE is greater than the current PE for the AU Capital Markets industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

EQT Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's expenses remained high due to transformation activities and technology development, which negatively impacted earnings, with statutory NPAT down 2.9%. This could affect the company’s net margins.

- There are complexities in the financial results due to the exit of certain businesses, which introduced a degree of financial instability and could affect revenue predictability.

- Non-operating expenses increased because of the peak spend in technology and the costs associated with transitioning trustee services and clients into new platforms. This affects net profit margins.

- The release of certain staff and subsequent outsourcing led to increased expenses, such as a $1.8 million rise due to outsourced services, which could continue to impact operating expenses and profit margins.

- The decline in earnings per share by around $0.05 to $0.06 per share indicates a decrease in profitability, which affects overall earnings and could impact dividend growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$40.0 for EQT Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$213.0 million, earnings will come to A$48.4 million, and it would be trading on a PE ratio of 28.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$32.84, the analyst price target of A$40.0 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.