Key Takeaways

- Ecosystem-driven platforms, direct-to-consumer strategies, and supply chain diversification are positioning Breville for durable revenue growth, margin expansion, and market share gains.

- Accelerated product innovation and premium market positioning enable Breville to benefit from shifts in consumer trends and outperform legacy competitors in the smart kitchen segment.

- Margin pressure looms from supply chain shifts, evolving consumer preferences, heavy competition, and higher investment requirements, threatening Breville's profitability and long-term revenue growth.

Catalysts

About Breville Group- Designs, develops, markets, and distributes small electrical kitchen appliances in the consumer products industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- While analyst consensus anticipates Beanz to generate a valuable semi-recurring revenue stream and improve hardware attachment rates, the platform's acceleration-without incremental marketing spend and via ecosystem partnerships (e.g., Williams-Sonoma, AeroPress)-positions it to evolve into a global, dominant network effect platform, capturing a material share of the premium home coffee experience and unlocking a rapid, high-margin revenue growth curve well beyond what is currently modeled into forecasts.

- Analyst consensus views new direct entries into China and the Middle East as moderate medium-term growth levers, but these moves could prove transformational as direct digital-first execution in China-with its enormous and digitally native premium appliance TAM-sets up Breville for a multi-year step-change in both revenue scale and margin improvement due to superior brand positioning, DTC channel economics, and first mover advantage in a secularly premiumizing market.

- Breville's pace of product innovation is underappreciated-expanding from core espresso into a broader suite of digitally enabled, health-focused kitchen appliances (leveraging strong R&D and capitalized development investment), the company is poised to outcompete legacy brands and capture disproportionate share of the premium/smart kitchen segment, thus supporting sustained pricing power and incremental gross margin expansion.

- The shift towards at-home cooking continues to benefit Breville, but the combination of rising health consciousness and affluent consumer willingness to trade up could accelerate a long-term mix shift in Breville's favor, especially as direct-to-consumer strategies and accessory rollouts unlock higher repeat purchasing rates and drive a structurally higher revenue base.

- Breville's ongoing manufacturing and supply chain diversification-running ahead of near and long-term tariff risks-will result in above-industry resilience, lower operating risk and potential cost advantages, translating into persistently higher net margins and freeing additional capital for market share-expanding initiatives or bolt-on acquisitions over time.

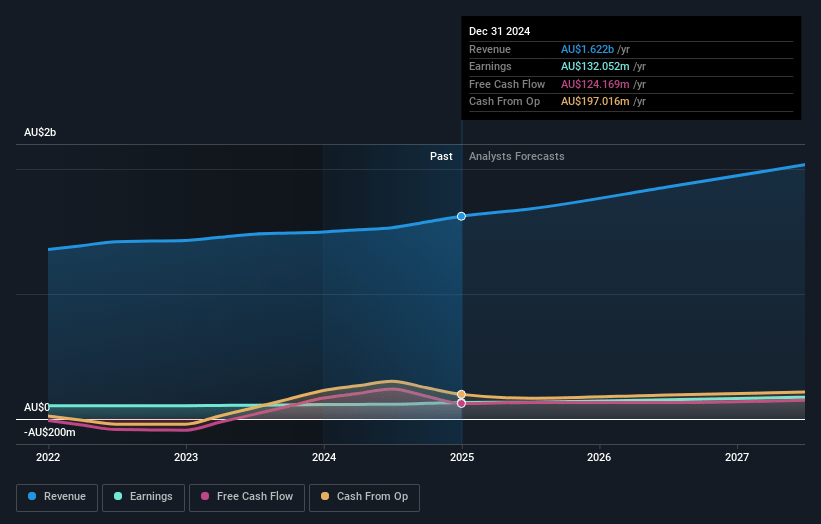

Breville Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Breville Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Breville Group's revenue will grow by 13.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 8.1% today to 7.4% in 3 years time.

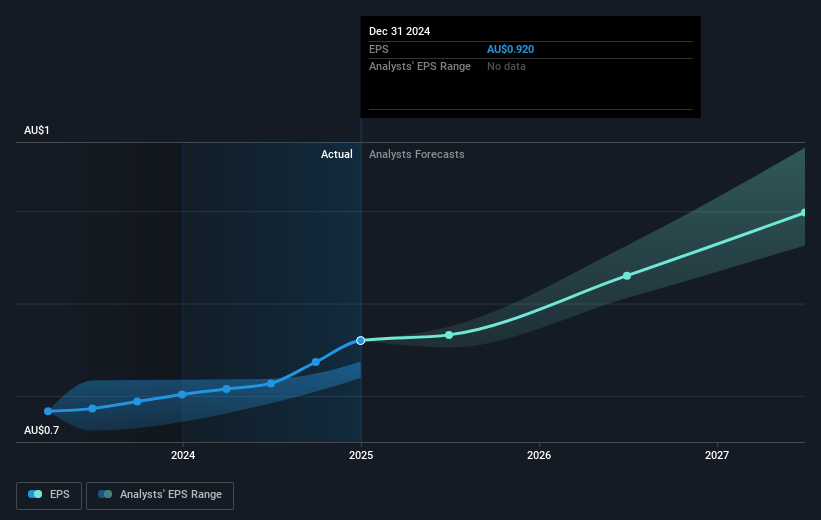

- The bullish analysts expect earnings to reach A$177.5 million (and earnings per share of A$1.22) by about July 2028, up from A$132.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, up from 33.2x today. This future PE is greater than the current PE for the AU Consumer Durables industry at 18.7x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Breville Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising geopolitical tensions and evolving global trade barriers, particularly between the US and China, are driving Breville to accelerate supply chain diversification out of China, which involves significant upfront capital expenditure and could still lead to higher ongoing manufacturing and distribution costs, negatively impacting net margins and gross profit if more tariffs or disruptions emerge.

- Persistent consumer focus on sustainability and minimalism present a secular risk to Breville's portfolio of premium, non-essential kitchen appliances, which could lead to structurally lower volume growth and eventually stagnate or shrink top-line revenue as market preferences shift over the long term.

- The company's continued high investment in R&D, marketing, and new manufacturing tooling to defend product differentiation-especially with ongoing SKUs relocation and new market entries-risks compressing net margins if revenue or hardware sales growth underperforms, thus reducing earnings leverage.

- Intensifying competitive pressure, especially from larger smart-home tech entrants and low-cost Asian manufacturers, threatens to either erode Breville's premium market share or trigger industry-wide price competition, which may depress revenue growth and compress net margins over time.

- Ongoing consolidation in key online and offline retail channels, coupled with heavy reliance on promotional periods to drive sales, could further squeeze Breville's pricing power and gross margins, especially if major retail partners demand greater concessions or if promotional activity intensifies during weakening consumer demand cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Breville Group is A$40.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Breville Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$40.2, and the most bearish reporting a price target of just A$21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$2.4 billion, earnings will come to A$177.5 million, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$30.42, the bullish analyst price target of A$40.2 is 24.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.