Narratives are currently in beta

Key Takeaways

- The Oly brand and growth in EV demand are key revenue drivers, tapping into new markets and green funding products.

- Initiatives like Simply Stronger Program and digital solutions aim to boost efficiency, customer satisfaction, and net margins.

- Economic challenges, competitive pricing, and policy changes could impact McMillan Shakespeare's revenue growth and profit margins across novated leasing and GRS segments.

Catalysts

About McMillan Shakespeare- Provides salary packaging, novated leasing, disability plan management, support co-ordination, asset management, and related financial products and services in Australia and New Zealand.

- The launch and full rollout of the Oly brand, a novated leasing solution for small

- and medium-sized businesses, taps into an unaddressed market worth approximately $160 million, potentially increasing revenue significantly as it gains traction.

- Significant growth in the demand for electric vehicles, which made up 43% of new novated orders, and the introduction of new green funding products for EVs could positively impact revenue as the trend towards zero and low-emission vehicles continues.

- The Simply Stronger Program, focusing on customer experience, technology-enabled productivity, and competency-led solutions, aims to improve operational efficiency and customer satisfaction, potentially increasing net margins over time.

- Implementation of digital solutions such as the Employer Connect portal and Acrobat Sign is expected to enhance customer experience and efficiency, which may contribute to improved earnings by reducing operational costs.

- Onboard Finance's growth to finance 20% of monthly novated lease volumes is projected to increase annuity-based income and enhance net margins by capturing a greater share of transaction value.

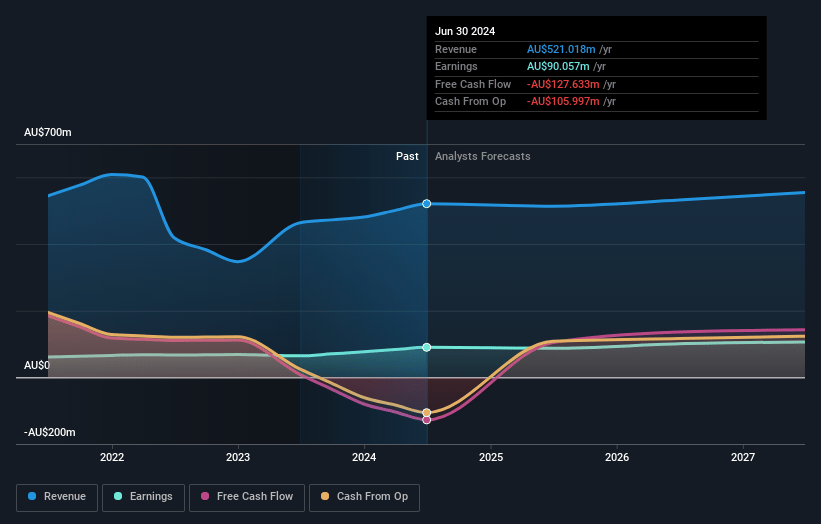

McMillan Shakespeare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming McMillan Shakespeare's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.3% today to 19.2% in 3 years time.

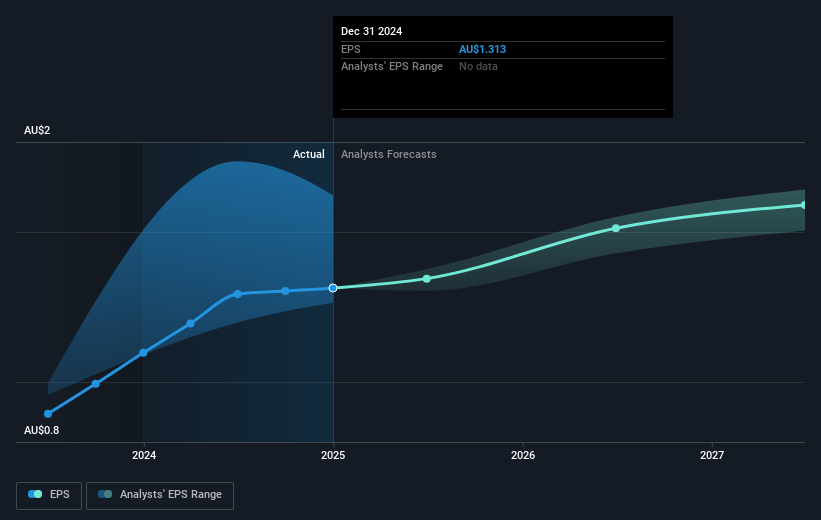

- Analysts expect earnings to reach A$106.3 million (and earnings per share of A$1.52) by about February 2028, up from A$90.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from 10.7x today. This future PE is lower than the current PE for the AU Professional Services industry at 19.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.21%, as per the Simply Wall St company report.

McMillan Shakespeare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expiry of the FBT benefit for plug-in hybrids in April 2025 might reduce demand for these vehicles, potentially impacting the revenue growth from novated leases which have been significant (43% from EV orders).

- Competitive vehicle pricing, particularly from brands like Tesla, could lessen the net amount financed and reduce margins in the novated leasing business.

- The loss of the South Australian government contract is expected to impact future earnings, which could challenge revenue and profit growth in the GRS segment.

- The company's deployment of its Oly brand into the small

- and medium-sized business market may require significant investment in technology and marketing, potentially impacting net margins before significant revenue can be generated.

- Economic challenges from inflation and increased cost of living may constrain consumer spending, possibly affecting sales and earnings in segments dependent on discretionary consumer spending, like novated leasing and auto purchasing.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$18.172 for McMillan Shakespeare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$20.78, and the most bearish reporting a price target of just A$14.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$554.6 million, earnings will come to A$106.3 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of A$13.81, the analyst price target of A$18.17 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives