Key Takeaways

- Expansion into new markets and focus on recurring revenues position the company to benefit from global sustainability trends and regulatory changes.

- Operational improvements, proprietary technologies, and one-off cost reductions are expected to drive higher margins and more predictable profitability.

- Operational and financial challenges, asset impairments, and uncertain growth execution raise concerns about future earnings, solvency, and the company's ability to justify higher valuations.

Catalysts

About Close the Loop- Engages in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons, and other related activities in Australia, Europe, South Africa, and the United States.

- The global expansion of Close the Loop's ITAD operations into Europe and Asia Pacific, driven by existing OEM relationships (e.g., HP and Xerox) and regulatory tailwinds such as Europe's upcoming "right to repair" rules, is expected to accelerate revenue growth and broaden the addressable market, supporting recurring and predictable earnings.

- Increasing demand for sustainable packaging and the expansion of Close the Loop's packaging division-specifically into regions such as South Africa, leveraging cross-selling opportunities-positions the company to benefit from industry-wide shifts toward sustainable materials, which should drive higher packaging revenues and improved gross margins.

- Recent investments in proprietary recycling technologies, and the ramp-up of the Mexicali refurbishment facility-now positioned for greater labor efficiency and scalable volumes-are likely to result in improved EBITDA margins and operational leverage as asset utilization increases.

- The company's focus on supply chain integration and streamlining global operations, including a centralized data and management layer for OEM clients, is enhancing barriers to entry and client stickiness, which should support long-term contract wins, increased market share, and revenue per customer.

- Most of the large loss in FY25 was driven by one-off impairments and restructuring costs; with these largely behind them, management expects normalized profitability going forward, and continued reduction in net debt and interest expense should further support earnings and free cash flow conversion.

Close the Loop Future Earnings and Revenue Growth

Assumptions

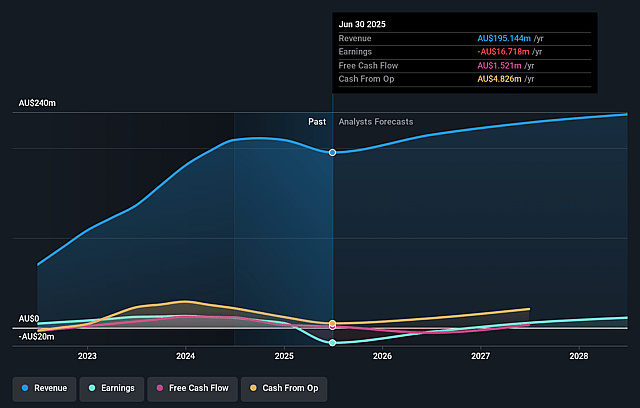

How have these above catalysts been quantified?- Analysts are assuming Close the Loop's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.6% today to 4.7% in 3 years time.

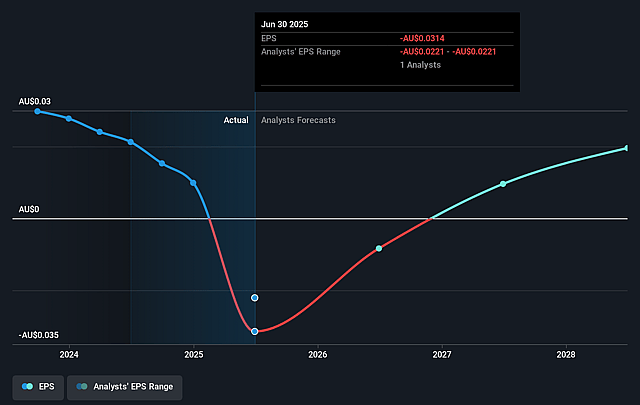

- Analysts expect earnings to reach A$11.2 million (and earnings per share of A$0.02) by about September 2028, up from A$-16.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, up from -1.0x today. This future PE is lower than the current PE for the AU Commercial Services industry at 33.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.53%, as per the Simply Wall St company report.

Close the Loop Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant decline in revenue (26% down year-on-year, with key ITAD division underperforming) and unfavorable profitability (net profit before tax at negative $20 million) indicate operational challenges and execution risk, which could result in persistent pressure on future earnings and margins if turnarounds do not materialize as planned.

- Intangible assets were substantially impaired, especially in the U.S. plastic recycling business, and a discontinued Melbourne business forced full amortizations-suggesting acquired businesses have not delivered as expected; repeated asset write-downs in the future would further erode net asset value and depress earnings.

- The company breached its banking covenants and relied on debt waivers/reset agreements, highlighting dependency on supportive creditors; should operational rebound or cash flow improvements not occur, or if market rates shift unfavorably, the company could face refinancing risks, stricter terms, or liquidity pressures, negatively impacting net margins and solvency.

- Management's strategy leans heavily on growth from global expansion (especially ITAD and Packaging), but admits to ongoing ramp-up issues (e.g., inefficiencies, learning curves in new facilities, need for technical staff, lag in channel development); failure to execute these expansions or secure OEM volumes could lead to continued revenue stagnation or margin compression.

- No formal earnings or revenue guidance provided for FY '26, citing uncertainty and early tenure of key executives; lack of visibility combined with one-off costs, restructuring needs, and uncertain product mix raises risk that normalized future profitability and cash flows may not reach levels sufficient to justify material share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.1 for Close the Loop based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$237.5 million, earnings will come to A$11.2 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 11.5%.

- Given the current share price of A$0.03, the analyst price target of A$0.1 is 67.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.