Last Update11 Sep 25Fair value Increased 4.40%

The upward revision in NRW Holdings’ fair value is primarily driven by improved consensus revenue growth forecasts, resulting in the analyst price target increasing from A$4.16 to A$4.34.

What's in the News

- NRW Holdings expects revenue to exceed $3.4 billion in 2026.

- Announced an ordinary dividend of AUD 0.095 per share for the six months ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for NRW Holdings

- The Consensus Analyst Price Target has risen slightly from A$4.16 to A$4.34.

- The Consensus Revenue Growth forecasts for NRW Holdings has significantly risen from 7.9% per annum to 9.2% per annum.

- The Discount Rate for NRW Holdings remained effectively unchanged, moving only marginally from 8.21% to 8.11%.

Key Takeaways

- Strong project pipeline, infrastructure investment, and diversification boost revenue visibility and margin stability across mining and civil operations.

- Enhanced ESG focus and strategic acquisitions position NRW Holdings for sustainable earnings growth and successful contract retention.

- High exposure to weather, client insolvency, tight margins, sector reliance, and elevated financial risk threaten long-term profitability and resilience.

Catalysts

About NRW Holdings- Through its subsidiaries, provides diversified contract services to the resources and infrastructure sectors in Australia.

- The significant expansion in the project pipeline and order book, underpinned by ongoing global demand for critical minerals such as lithium and copper for electrification and energy transition, positions NRW Holdings to capture robust future revenue growth as mining investment in Australia accelerates.

- Growing public infrastructure spending in Western Australia and Queensland, driven by acute infrastructure needs and government stimulus, is fuelling a record near-term tender pipeline and strong revenue visibility, supporting top-line growth and margin resilience in the Civil division.

- Investments in safety, environmental performance, and Indigenous engagement strengthen NRW Holdings' profile as a preferred contractor for miners and government agencies facing heightened ESG standards, enhancing prospects for contract wins and supporting long-term revenue growth.

- Recent diversification into adjacent infrastructure markets and the expansion of recurring services offerings (e.g., maintenance, products, and parts) are expected to reduce earnings volatility and improve EBITDA/net margin stability over time.

- Strategic M&A (e.g., HSE, South Walker Creek acquisition) and major contract extensions are expected to drive step-changes in run-rate revenues and operational leverage, contributing to sustainable earnings growth as weather impacts normalise.

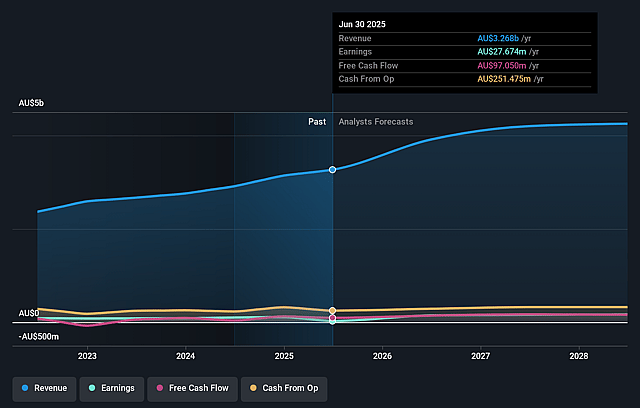

NRW Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NRW Holdings's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 4.0% in 3 years time.

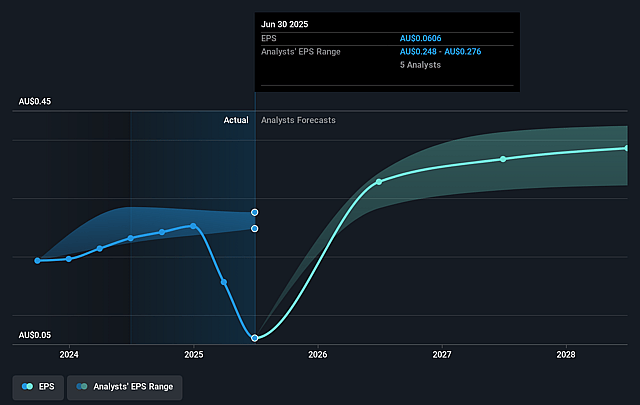

- Analysts expect earnings to reach A$164.4 million (and earnings per share of A$0.4) by about September 2028, up from A$27.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$196.5 million in earnings, and the most bearish expecting A$145.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, down from 66.4x today. This future PE is lower than the current PE for the AU Construction industry at 18.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

NRW Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's earnings are highly exposed to weather-related disruptions, as demonstrated by the significantly reduced Mining margins due to above-average rainfall in Queensland, highlighting long-term climate risks that could continue to negatively impact revenue and earnings volatility.

- NRW Holdings faced material exposure to client insolvency and government intervention, as seen in the OneSteel administration and resulting receivable impairment, which underscores ongoing risks of revenue concentration and credit losses from large contracts, directly impacting profitability and working capital.

- Margin pressures remain elevated due to competitive project bidding and a greater earnings contribution from lower-margin Civil and MET businesses, indicating that even with higher revenue, net margins and return on invested capital may be structurally constrained in the long term.

- Ongoing reliance on the resources sector for growth, particularly coal and iron ore projects, leaves NRW vulnerable to secular declines in traditional mining investment stemming from global decarbonization and energy transition efforts, potentially eroding future contract opportunities and long-term revenue growth.

- Increased requirements for capital management (e.g., bank debt drawdowns, elevated equipment financing, and acquisition costs) heighten financial risk and may constrain future cash flows or dividends, particularly if market conditions become less favorable or if strategic projects fail to deliver anticipated returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$4.156 for NRW Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$4.52, and the most bearish reporting a price target of just A$3.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$4.1 billion, earnings will come to A$164.4 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of A$4.02, the analyst price target of A$4.16 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.