Last Update01 May 25

Key Takeaways

- Strategic expansions and new product launches position IPD Group to unlock fresh revenue and increase market share across regions and customer segments.

- Investments in data centers, EV infrastructure, and strategic acquisitions position IPD Group for growth and enhanced earnings through improved efficiency and expanded portfolios.

- Heavy reliance on acquisitions and a concentrated focus on commercial construction could reveal operational vulnerabilities and result in revenue volatility if challenges persist.

Catalysts

About IPD Group- Distributes electrical infrastructure in Australia.

- IPD Group is focusing on expanding its market reach organically by growing into new regions, industries, and customer segments, while also launching new products such as high-efficiency electric motors and a new switchboard offer. This is expected to unlock fresh revenue opportunities and increase their market share, ultimately boosting revenue.

- The company is seeing growth in the data center sector, which now comprises 15% of their revenue. Continued investment in AI and data center expansion is expected to drive demand for their products and solutions, potentially increasing revenue and earnings.

- Rising investments in electric vehicle (EV) charging infrastructure and public transport electrification position IPD Group well for growth in this sector. Legislative changes mandating EV charger installations in buildings are anticipated to significantly increase demand for IPD's solutions, leading to increased revenue streams.

- IPD Group's strategy includes accelerating growth through strategic acquisitions that increase earnings and market share. This not only aids in expanding their product portfolio but also improves operational efficiency, contributing to improved net margins and earnings.

- The company is prioritizing operational efficiencies through digitization and warehouse automation, to better manage their cost model and improve margins. These efforts are expected to lead to more streamlined operations, potentially increasing net margins and overall profitability.

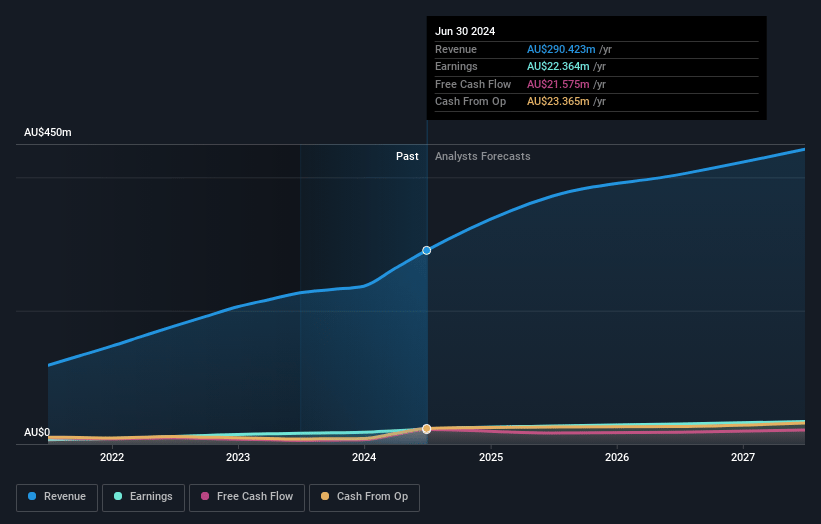

IPD Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IPD Group's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 7.7% in 3 years time.

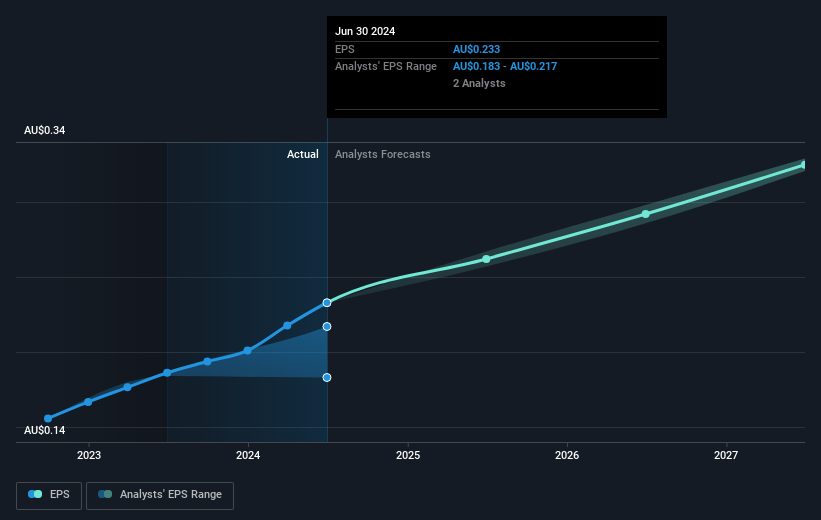

- Analysts expect earnings to reach A$36.3 million (and earnings per share of A$0.34) by about May 2028, up from A$26.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from 15.9x today. This future PE is lower than the current PE for the AU Trade Distributors industry at 18.8x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

IPD Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of CMI Operations, with its lower operating gross profit margins, has diluted the overall gross profit margins of IPD Group, potentially pressuring net margins in the future if not managed properly.

- IPD Group relies on significant revenue from new acquisitions to support its growth. This dependence on acquisitions may mask underlying operational issues, and if acquisition synergies do not materialize as expected, it could negatively impact earnings.

- The heavy focus on the commercial construction sector, which has faced challenging market conditions, could result in revenue volatility if the sector experiences further downturns.

- The company has a high order backlog which, though generally positive, involves risks around timing and delivery. Delays or failures to convert backlog orders into revenue as planned could impact cash flows and earnings.

- There is a strong reliance on ABB products for distribution. Any changes in ABB's strategy, product quality, or pricing could adversely affect IPD's ability to maintain or grow its revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$5.083 for IPD Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.5, and the most bearish reporting a price target of just A$4.42.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$470.2 million, earnings will come to A$36.3 million, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$4.0, the analyst price target of A$5.08 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.