Narratives are currently in beta

Key Takeaways

- Increased investment in customer advocacy and technology could strain net margins short term, delaying benefit realization.

- Asset quality decline and increased credit impairments in Business Lending indicate potential risks to earnings stability.

- Consistent strategy execution and digital investment bolster NAB's financial momentum, promising stable earnings and growth in consumer and business banking.

Catalysts

About National Australia Bank- Provides financial services to individuals and businesses in Australia, New Zealand, and internationally.

- The strategic initiative to increase investment spend to $1.8 billion in FY '25, with a focus on improving customer advocacy and technology modernization, could put pressure on net margins as costs rise in the short term before benefits materialize.

- The persistent growth in Business and Private Banking has led to a deceleration in business credit growth outlook to 5% in 2025, below competitors' growth rates, potentially impacting revenue momentum in the segment.

- The ongoing challenges in competition for both home lending and business markets, especially through broker channels, may lead to tighter net interest margins if market pricing becomes progressively competitive.

- Asset quality deterioration, especially with increased credit impairment charges and non-performing loans in Business Lending, indicates potential future risks for earnings stability as provisions may have to be increased.

- NAB's ambitious initiative to remodel its banking systems through modular modernization rather than comprehensive overhaul may result in slower scalability and operational efficiency gains, affecting long-term earnings growth.

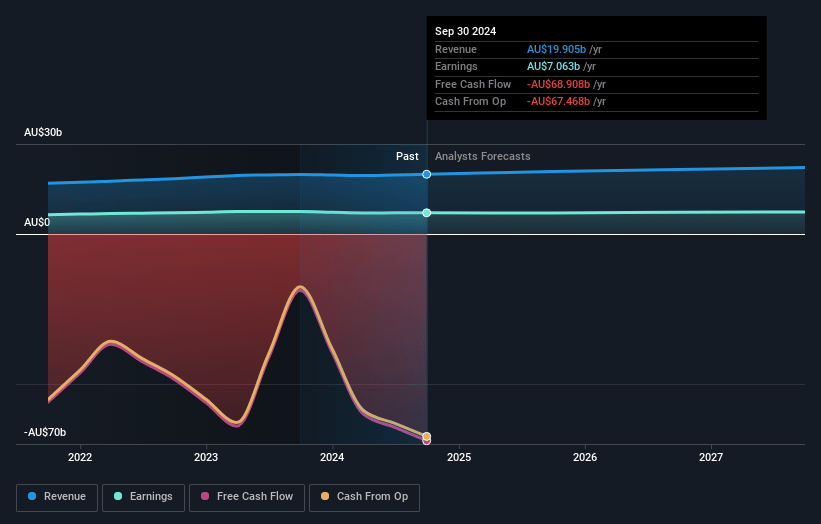

National Australia Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Australia Bank's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.1% today to 34.0% in 3 years time.

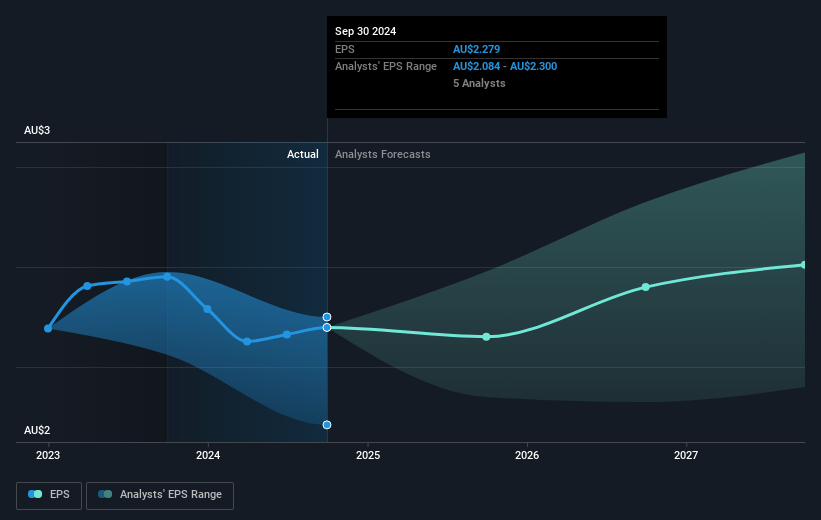

- Analysts expect earnings to reach A$7.5 billion (and earnings per share of A$2.42) by about November 2027, up from A$7.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as A$6.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2027 earnings, down from 17.2x today. This future PE is greater than the current PE for the AU Banks industry at 13.0x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

National Australia Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NAB has delivered sound financial results with consistent strategy execution, which has improved balance sheet momentum and shareholder returns. This could help maintain stable earnings.

- The easing of inflationary pressures and anticipation of a gradual interest rate cut could support growth in household incomes, providing potential upside to revenue through improved consumer banking activity.

- NAB's ongoing investment in digital and data tools, as well as the growth in SME and proprietary lending, positions it to enhance operational efficiency and effectively manage costs, potentially supporting net margins.

- NAB's growth in business and private banking, with a disciplined focus on high-return segments and deposits, suggests a robust revenue pipeline and improved return on equity in the long run.

- The successful completion of strategic priorities including technology modernization and enhancing customer advocacy could lead to sustainable revenue growth and higher earnings through increased customer satisfaction and retention.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$33.13 for National Australia Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$38.4, and the most bearish reporting a price target of just A$26.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be A$22.0 billion, earnings will come to A$7.5 billion, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$39.33, the analyst's price target of A$33.13 is 18.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives