Key Takeaways

- Realized merger synergies, digital platform upgrades, and product diversification are driving higher operating leverage, margin expansion, and improved earnings resiliency.

- Focus on ESG, regional partnerships, and community banking is strengthening deposit growth and customer acquisition, supporting funding stability and long-term growth.

- The merger brings significant integration and cost risks amid rising expenses, margin pressure, geographic concentration, and heightened competition, threatening sustained profitability if expected synergies are not realized.

Catalysts

About MyState- Through its subsidiaries, provides banking, trustee, equipment finance, and managed fund products and services in Australia.

- The successful merger with Auswide has already delivered substantial realized synergies and is targeting $20–25 million in annual pretax cost synergies, which is expected to significantly increase operating leverage and support double-digit EPS growth as integration continues-positively impacting earnings and margins.

- MyState's ongoing investment in its digital banking platform (now fully adopted by its retail customer base) and the rollout of new technology stacks and loan origination systems are expected to enhance user experience, operational efficiency, and process automation; this positions the company well to capture increased digital banking demand, supporting both revenue growth and margin expansion.

- Strong home loan and deposit book growth (62% and 71% increases, respectively) reflects MyState's ability to benefit from growing population inflows and urbanization in its regional core markets, which will expand the total addressable market and underpin sustained revenue growth over the medium to long term.

- The high-growth, higher-margin equipment finance business (Selfco) offers diversification beyond traditional home lending, enabling MyState to benefit from increased SME demand for asset finance and to improve blended net interest margins and overall earnings resilience.

- The increased focus on ESG, regional presence, and partnership models (such as Elders) positions MyState to attract deposits from customers who value community-oriented, sustainable banking-likely reducing customer acquisition costs and bolstering deposit growth, positively impacting funding stability and net interest income.

MyState Future Earnings and Revenue Growth

Assumptions

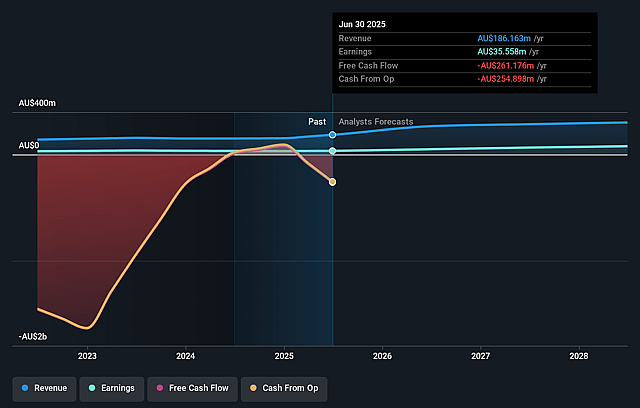

How have these above catalysts been quantified?- Analysts are assuming MyState's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.1% today to 26.2% in 3 years time.

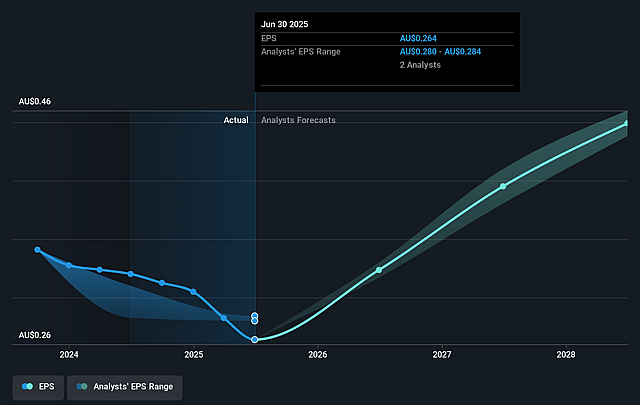

- Analysts expect earnings to reach A$79.3 million (and earnings per share of A$0.45) by about September 2028, up from A$35.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 20.3x today. This future PE is greater than the current PE for the AU Banks industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

MyState Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MyState's merger with Auswide introduces execution and integration risks, including delays or higher-than-expected integration costs ($29 million forecast over two years) and uncertainty over the timing and realization of cost synergies, which could put pressure on future earnings if anticipated savings are not fully achieved or are delayed.

- Despite initial cost synergies, underlying cost growth for the "business as usual" group is flagging at around 5% per annum, which, if not fully offset by synergies or revenue growth, may limit improvement in net margins and dampen overall profitability in the long term.

- Heightened competition on both lending (especially home loans) and deposit gathering is compressing net interest margin (NIM), with guidance that rate cuts of 25bps reduce NIM by 2bps, and MyState's blended NIM is exposed to further RBA rate reductions and industry-wide price competition, directly impacting future net interest income and core earnings.

- MyState remains heavily dependent on the Australian regional housing market and is expanding in equipment finance, but both sectors are at risk from adverse local economic trends, demographic stagnation in key geographies (like Tasmania), and geographic concentration, leading to potential revenue and loan book volatility if regional growth slows.

- Ongoing increases in technology, compliance, and regulatory costs-not fully mitigated by recent industry developments or government reviews-may disproportionately burden MyState as a smaller regional player, constraining its operating leverage and eroding net margins and returns if scale advantages from the merger do not materialize as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$5.04 for MyState based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$302.3 million, earnings will come to A$79.3 million, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$4.27, the analyst price target of A$5.04 is 15.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MyState?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.