Catalysts

About AT & S Austria Technologie & Systemtechnik

AT&S is a leading manufacturer of advanced printed circuit boards and high end IC substrates for cutting edge computing and connectivity applications.

What are the underlying business or industry changes driving this perspective?

- Ramp up of the new high volume IC substrate fabs in Kulim and Leoben Hinterberg for AI and high performance processors is set to translate current qualification success into materially higher utilization, driving top line growth and better fixed cost absorption to support EBITDA and EBIT.

- Increasing demand for AI data centers and high performance computing, where AT&S is already qualified with core customers such as AMD, positions the company to capture premium substrate volumes and mix improvement that can support revenue expansion and margin resilience.

- Deep engagement in next generation packaging technologies, including silicon interposers and glass substrates co developed with leading chipmakers, supports AT&S’ technology positioning and pricing power, and may contribute to higher gross margins and long term earnings potential.

- Ongoing global diversification of electronics supply chains away from higher risk regions makes Austria a preferred location for advanced R&D and production, supporting more stable customer roadmaps, higher value programs and improved visibility for revenue and return on capital.

- A comprehensive, already implemented cost reduction and efficiency program targeting around EUR 250 million of sustainable savings from procurement and operations is expanding operating leverage so that incremental volumes have the potential to translate into higher EBITDA margin and faster earnings growth.

Assumptions

This narrative explores a more optimistic perspective on AT & S Austria Technologie & Systemtechnik compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

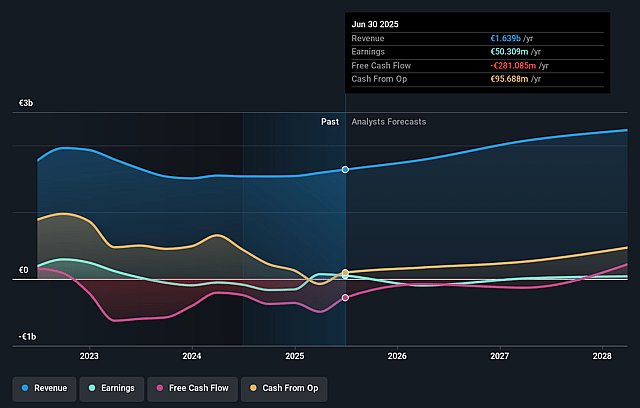

- The bullish analysts are assuming AT & S Austria Technologie & Systemtechnik's revenue will grow by 18.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 4.4% today to 4.0% in 3 years time.

- The bullish analysts expect earnings to reach €108.6 million (and earnings per share of €2.8) by about December 2028, up from €71.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €28.9 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 16.5x today. This future PE is greater than the current PE for the GB Electronic industry at 15.7x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.25%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistent foreign exchange headwinds, particularly from a weaker U.S. dollar against the euro while a large part of IC substrate revenues is billed in dollars and significant production costs are incurred in other currencies, could continue to erode reported top line growth, compress EBITDA and keep the company in a net loss position despite underlying volume growth, weighing on earnings.

- The substantial ramp up of the new Kulim and Leoben Hinterberg IC substrate fabs, with more than EUR 1.5 billion invested and long production cycle times, may move more slowly than expected due to customer qualification timelines that AT&S cannot control, leaving large fixed cost bases underutilized and putting pressure on EBITDA margin and return on capital employed.

- Rapid innovation in advanced packaging, including technologies like chip on wafer on PCB that may reduce or bypass the need for traditional IC substrates, could structurally dilute AT&S’ addressable market and pricing power over time, undermining the long term revenue expansion and keeping net margins below the bullish trajectory.

- Ongoing geopolitical and macroeconomic risks, such as potential U.S. tariffs on products assembled in higher risk regions, recession risk in key end markets and logistics or energy cost disruptions, could dampen demand in automotive and industrial segments and offset AI driven growth, limiting revenue growth and constraining EBITDA margin improvement.

- The ambitious EUR 250 million sustainable cost saving and efficiency program, which relies on thousands of individual measures across procurement and operations, may face execution fatigue or diminishing returns just as price pressure from customers and competitors increases, restricting the expected uplift in operating leverage and slowing future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for AT & S Austria Technologie & Systemtechnik is €40.0, which represents up to two standard deviations above the consensus price target of €26.92. This valuation is based on what can be assumed as the expectations of AT & S Austria Technologie & Systemtechnik's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €40.0, and the most bearish reporting a price target of just €15.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €2.7 billion, earnings will come to €108.6 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 11.2%.

- Given the current share price of €30.35, the analyst price target of €40.0 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AT & S Austria Technologie & Systemtechnik?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.