Last Update 13 Dec 25

Fair value Increased 2.87%ANDR: Order Backlog Strength Will Support Earnings Upside Ahead

Analysts have modestly increased their fair value estimate for Andritz, lifting the price target from EUR 80.0 to EUR 82.3. This adjustment is supported by expectations for stronger revenue growth and a slightly higher future P/E multiple, despite a marginally higher discount rate and stable profit margins.

Analyst Commentary

Recent research updates point to a constructive outlook on Andritz, with bullish analysts highlighting improving revenue visibility, resilient margins, and disciplined capital allocation as key supports for the higher valuation range.

Bullish Takeaways

- The latest JPMorgan move to lift its price target to EUR 79 reinforces a tightening band of upward revisions, suggesting growing conviction that Andritz can deliver above prior expectations.

- Bullish analysts increasingly point to a healthier order backlog and robust project pipeline as drivers of sustained top line growth, which underpins the case for a modestly higher earnings multiple.

- Execution on cost efficiency programs and stable profitability metrics are seen as de-risking factors, supporting higher fair value estimates despite a slightly higher discount rate environment.

- Positive sentiment around the company, including incremental target upgrades, reflects confidence that management can navigate macro uncertainties while continuing to convert its strong market position into durable cash flow growth.

What's in the News

- Andritz AG confirmed its earnings guidance for full year 2025, expecting revenue to reach between EUR 8.0 billion and EUR 8.3 billion. This signals confidence in its medium term growth trajectory (Key Developments).

Valuation Changes

- Fair value estimate has risen modestly from €80.0 to €82.3, reflecting a slightly higher implied upside for the shares.

- The discount rate has increased slightly from 6.95% to approximately 7.38%, indicating a marginally higher required return and risk perception.

- Revenue growth has been raised from about 7.9% to roughly 9.2%, signaling stronger expectations for top line expansion over the forecast horizon.

- The net profit margin has edged down slightly from around 7.57% to about 7.50%, implying largely stable but marginally softer profitability assumptions.

- The future P/E multiple has increased from roughly 12.1x to about 12.9x, pointing to a somewhat higher valuation being applied to projected earnings.

Key Takeaways

- Structural global demand for renewables and resource efficiency is driving long-term growth opportunities across multiple Andritz end-markets, positioning the company for outperformance.

- Expanding high-margin service and digital offerings, combined with agile capital allocation, supports greater earnings quality, resilience, and cash flow stability amid market shifts.

- Weakness in key segments, sluggish service growth, higher integration costs, and lagging digital/green transition threaten topline growth, margin stability, and long-term competitiveness.

Catalysts

About Andritz- Engages in the provision of industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

- While analyst consensus expects the recent surge in order intake and robust project pipelines to act as a cushion for future growth, this may significantly understate the magnitude and duration of the upcycle, particularly in Hydropower, where management indicates a structural, multi-year global demand surge tied directly to the renewables transition; this could drive above-consensus long-term revenue and order backlog growth well into the decade.

- Analysts broadly agree that the expansion of the service business will stabilize margins, but this likely undervalues the combined impact of services and digitalization, as the integration of Metris digital offerings and recent margin-accretive acquisitions can create an inflection point for recurring, high-margin revenues, materially lifting group net margins and earnings quality over several years.

- The company's track record of high-return bolt-on M&A is being leveraged precisely at a time when tightening environmental regulations and the global shift to resource efficiency are accelerating capital investment cycles in water, clean air, and recycling industries; this positions Andritz to outpace peers in capturing share of wallet and driving both top-line acceleration and EBITDA margin expansion.

- Andritz's ongoing diversification across Metals, Hydro, and Separation-coupled with an asset-light, flexible operating model-gives it not only cyclical resilience, but also the capacity to shift capital and resources rapidly into the most lucrative and fastest growing end-markets, supporting more stable and potentially higher free cash flow and return on invested capital even during periods of market turbulence.

- Rapid urbanization and rising consumer demand in emerging markets are set to catalyze a wave of investment in tissue, packaging, and hygiene product supply chains, benefiting not only Andritz's core equipment revenues in these markets, but also further reinforcing the growth trajectory of aftermarket services, which in turn structurally raises long-term earnings visibility and cash flow conversion.

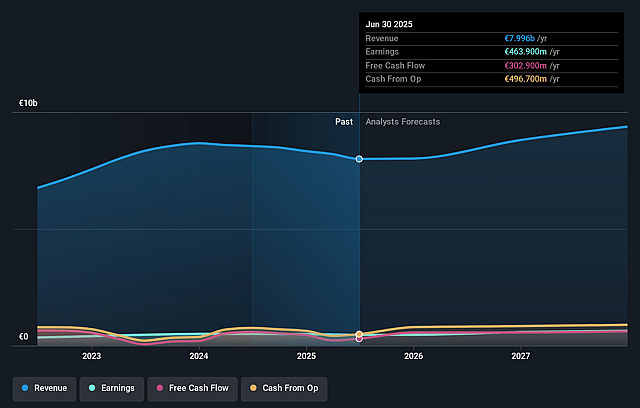

Andritz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Andritz compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Andritz's revenue will grow by 7.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.8% today to 7.6% in 3 years time.

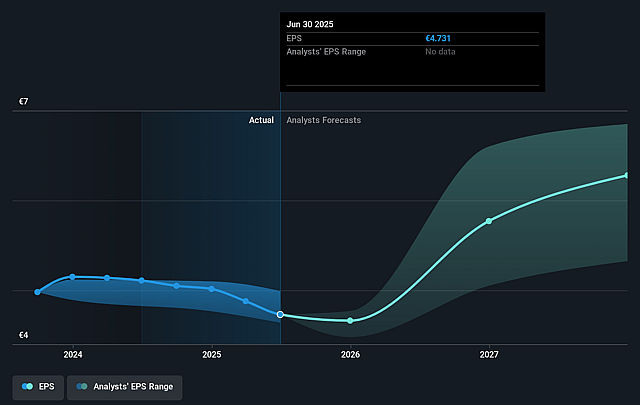

- The bullish analysts expect earnings to reach €760.1 million (and earnings per share of €7.25) by about September 2028, up from €463.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 12.8x today. This future PE is lower than the current PE for the GB Machinery industry at 27.0x.

- Analysts expect the number of shares outstanding to decline by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

Andritz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in revenue in Pulp & Paper and Metals due to previous year's weak order intake, combined with incomplete recovery in order pipelines, expose Andritz to prolonged underperformance in topline growth and lower near-term earnings.

- Service segment growth in Metals is lagging, with challenges in customer adoption and lower modernization spending in automotive, which may limit progress in expanding stable, higher-margin revenue streams critical to net margin sustainability.

- Increased capital allocation to frequent M&A, combined with temporary revenue softness and a drop in free cash flow, raises the risk that rising integration and SG&A costs could erode margin improvements and impact long-term net profit.

- Structurally muted investment activity in Environment & Energy, compounded by customer caution, regulatory uncertainty, and delayed large project decisions, may result in recurring variable demand and sustained volatility in revenues.

- Accelerated digitalization and automation trends, coupled with Andritz's slower pace in expanding digital and "green" product offerings relative to ambitious ESG targets and peers, could weaken the company's pricing power and expose its portfolio to product obsolescence, ultimately affecting long-term revenue growth and margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Andritz is €80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Andritz's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €80.0, and the most bearish reporting a price target of just €43.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €10.0 billion, earnings will come to €760.1 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of €60.8, the bullish analyst price target of €80.0 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Andritz?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.