Key Takeaways

- Strong order intake, record backlog, and favorable market trends position Andritz for revenue and margin growth, especially in hydropower and through expansion in services.

- Portfolio diversification via acquisitions and a higher share of recurring service revenue will boost resilience and support sustainable long-term profitability.

- Overdependence on cyclical markets, operational inefficiencies, and challenging market and currency conditions heighten risks to revenue stability, margin recovery, and long-term earnings sustainability.

Catalysts

About Andritz- Engages in the provision of industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

- The surge in order intake (+26% in Q2, +23% YTD) across Hydropower, Metals, and a recovering Pulp & Paper segment, combined with a record-high order backlog (€10.4bn), positions Andritz for a significant revenue rebound as backlogged projects are executed and as macro trends (decarbonization, infrastructure renewal) continue to spur end-market demand.

- Hydropower, benefiting from the global transition toward renewable energy and electrification, is at the start of a structural upcycle with multi-year growth visibility, increasing order volumes and service revenues-implying sustained top-line and eventual margin growth from higher project activity and recurring services.

- Aftermarket and service share of revenue reached a new high (44%), with recent M&A deals specifically targeting complementary service and digital assets; this shift is expected to drive recurring revenue, improve net margins, and increase resilience to cyclical downturns.

- Recent capacity reductions and restructuring in Pulp & Paper and Metals are nearly complete, which should lower the cost base and set the stage for margin recovery in these divisions as revenue normalizes, potentially unlocking operating leverage and boosting earnings.

- Ongoing strategic acquisitions in niche technologies (e.g., automation, sustainability, and regional fill-ins in paper, metals, and energy) accelerate portfolio diversification and digital capabilities, positioning Andritz to capture growth from automation and decarbonization trends and supporting both revenue growth and margin expansion long term.

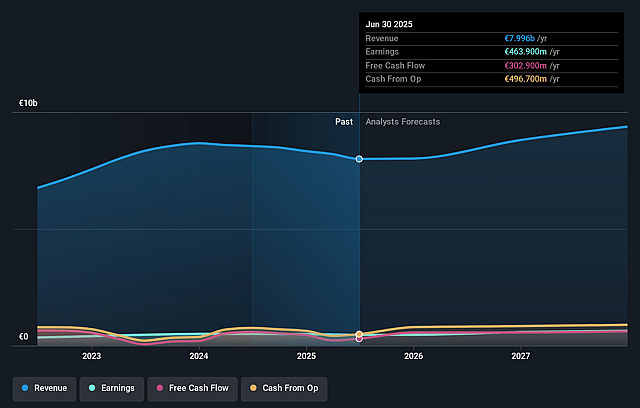

Andritz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Andritz's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.8% today to 7.1% in 3 years time.

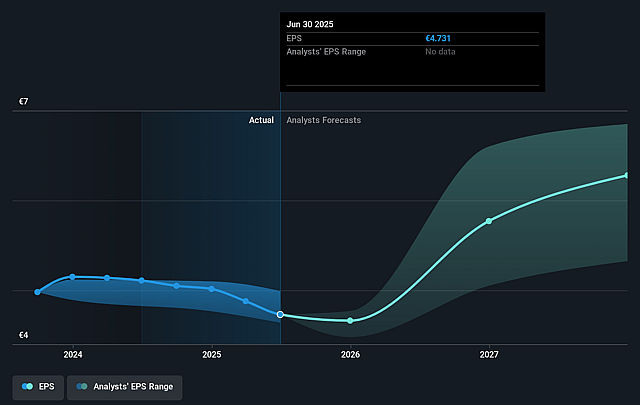

- Analysts expect earnings to reach €684.0 million (and earnings per share of €6.2) by about September 2028, up from €463.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €574.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 12.5x today. This future PE is lower than the current PE for the GB Machinery industry at 25.6x.

- Analysts expect the number of shares outstanding to decline by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

Andritz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued revenue decline in the Pulp & Paper and Metals business areas, driven by last year's low order intake, highlights overreliance on cyclical end-markets-raising the risk of earnings volatility and sustained pressure on overall revenue if demand fails to rebound as expected.

- Weakness and uncertainty in the Environment & Energy segment, with customers delaying investment decisions and muted activity in Pumps and Separation, signal exposure to market hesitancy and slow adoption of new sustainable solutions, potentially impacting long-term growth and earnings quality.

- The need for ongoing capacity reductions and restructuring in Pulp & Paper and Metals indicates possible operational inefficiencies and delayed margin recovery; restructuring charges have already reduced reported margins and net income, and execution risk remains if demand does not improve swiftly.

- Margin and revenue headwinds from unfavorable FX trends, especially the strengthening euro, are expected to persist, directly reducing reported top-line and potentially compressing net margins if the currency environment does not stabilize.

- Increasing capital allocation to M&A, combined with decreasing net liquidity and a rising proportion of smaller, lower-margin orders, exposes Andritz to balance sheet strain and integration risk, with the possibility that new acquisitions may not deliver anticipated margin uplift or long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €70.5 for Andritz based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €80.0, and the most bearish reporting a price target of just €43.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €9.7 billion, earnings will come to €684.0 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of €59.45, the analyst price target of €70.5 is 15.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Andritz?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.