Key Takeaways

- Expansion in high-margin, recurring service revenue and digital solutions is set to structurally improve earnings quality and lift margins.

- Strategic focus on green technologies, regulatory-driven demand, and large project wins underpin outsized, sustainable growth and industry leadership.

- Heavy reliance on cyclical industries, global protectionism, project delays, rising competition, and high regulatory costs pose significant risks to growth, profitability, and cash flow.

Catalysts

About Andritz- Provides industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

- While analyst consensus points to strong order intake in Hydropower and Pulp & Paper as a cushion for growth, the scale and quality of the new pipeline-especially three consecutive complete pulp mills in China and large projects in the US and Japan-signals not just stability but outsized, durable growth in revenues that could materially exceed expectations as these contracts convert to sales over 2025-2027.

- Analysts broadly view the surge in service revenue as a margin stabilizer, but the expansion to a record 44% of revenue-combined with accelerating adoption of predictive analytics and digital service models-has the potential to structurally transform earnings by shifting an even greater share of revenue mix toward high-margin, recurring income streams and significantly lifting net margins over the medium term.

- Andritz's early-mover investments and acquisitions in green technologies (Clean Air, biofuels, decarbonization, and metals recycling) position the company as an essential supplier to global decarbonization and energy transition efforts, pointing to outsized demand growth and premium pricing opportunities that are likely to drive earnings and margin expansion ahead of industry averages.

- The growing global appetite for automation and digitalization in manufacturing is generating increasing demand for integrated, full-line process solutions-an area in which Andritz is rapidly expanding its capabilities, suggesting above-market growth in backlog and service revenues over the coming years.

- With increased regulatory pressure and a worldwide shift to circular economy and recycling, Andritz is exceptionally well-placed to capture modernization projects and new equipment demand-particularly in sectors facing stricter environmental mandates-supporting both higher order intake and long-term visibility on revenue and profit growth.

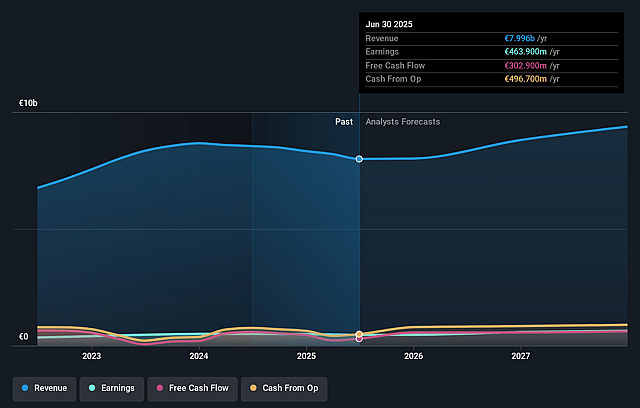

Andritz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Andritz compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Andritz's revenue will grow by 6.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.9% today to 7.5% in 3 years time.

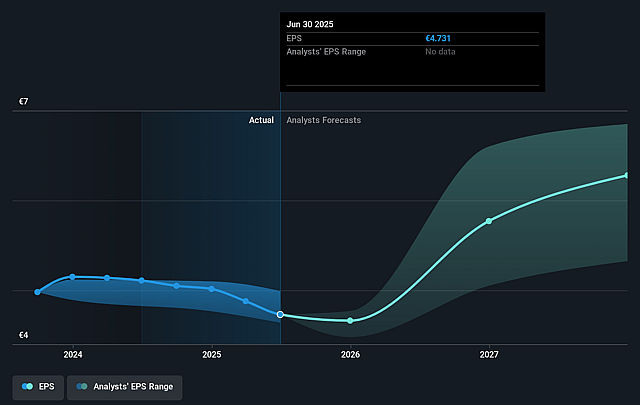

- The bullish analysts expect earnings to reach €743.1 million (and earnings per share of €7.25) by about July 2028, up from €481.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, down from 13.6x today. This future PE is lower than the current PE for the GB Machinery industry at 14.4x.

- Analysts expect the number of shares outstanding to decline by 1.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Andritz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Andritz remains heavily exposed to cyclical process industries such as pulp & paper and metals, which experienced revenue declines of 7% and 6% respectively; prolonged downturns or structural declines in these sectors could magnify revenue volatility and negatively impact profitability.

- Elevated global trade protectionism and deglobalization trends, combined with management's own admission that tariffs and shifting supply chains are slowing customer decision-making, threaten Andritz's ability to secure future international sales and may ultimately suppress both order intake and revenue growth.

- The company continues to rely heavily on project-based revenue, and delays or cost overruns in large projects-especially given recent references to slower investment decisions and uncertainty in final investment in key segments like Environment & Energy-could disproportionately hit net margins and earnings.

- Andritz faces intensifying competition from Asian and local manufacturers, with even management noting stronger activity and growth in China versus muted demand in Europe and North America; this could exert ongoing pressure on pricing, erode market share, and reduce profit margins, particularly as local players scale up.

- Stricter ESG regulations and substantial capital expenditure on R&D and compliance-including recent acquisitions and investment in decarbonization-risk diverting cash from organic growth and expansion, meaning that if these investments fail to yield expected returns, both operational efficiency and future free cash flow could suffer.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Andritz is €80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Andritz's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €80.0, and the most bearish reporting a price target of just €43.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €9.9 billion, earnings will come to €743.1 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 7.1%.

- Given the current share price of €67.0, the bullish analyst price target of €80.0 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.