Key Takeaways

- Intensified global competition and shifting technology trends may erode market share, compress margins, and restrict growth in Andritz's core equipment and services.

- Regulatory and sustainability requirements could raise costs and challenge profitability, while cyclical end-markets and reduced equipment demand threaten revenue stability.

- Diversifying toward high-margin services, capitalizing on sustainability trends, and disciplined restructuring strengthen earnings resilience and position the company to capture future growth opportunities.

Catalysts

About Andritz- Provides industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

- The rapid globalization of supply chains is likely to intensify pricing competition from lower-cost regions, which could force Andritz to lower its product prices and compress gross margins over the coming years.

- An acceleration of automation and digitalization in industry could enable technology-native competitors to quickly erode Andritz's market share, reducing both service and equipment revenues and limiting future growth in digital solutions.

- Increased regulatory and consumer demands for sustainable and circular production will require heavy investment in research and development and environmental upgrades; this could increase operating expenses and put significant structural pressure on net margins if these costs cannot be fully passed on to customers.

- Andritz's reliance on highly cyclical end-markets such as pulp & paper, metals, and hydropower leaves future order intake and earnings especially vulnerable to economic downturns, weakening global demand, and unpredictable project cycles, which may make cash generation and recurring revenue targets difficult to sustain.

- Shrinking capital intensity in customer industries-where advances in process technology reduce the need for large-scale machinery-threatens to permanently lower equipment order volumes and stunt revenue growth potential for Andritz in its core business lines.

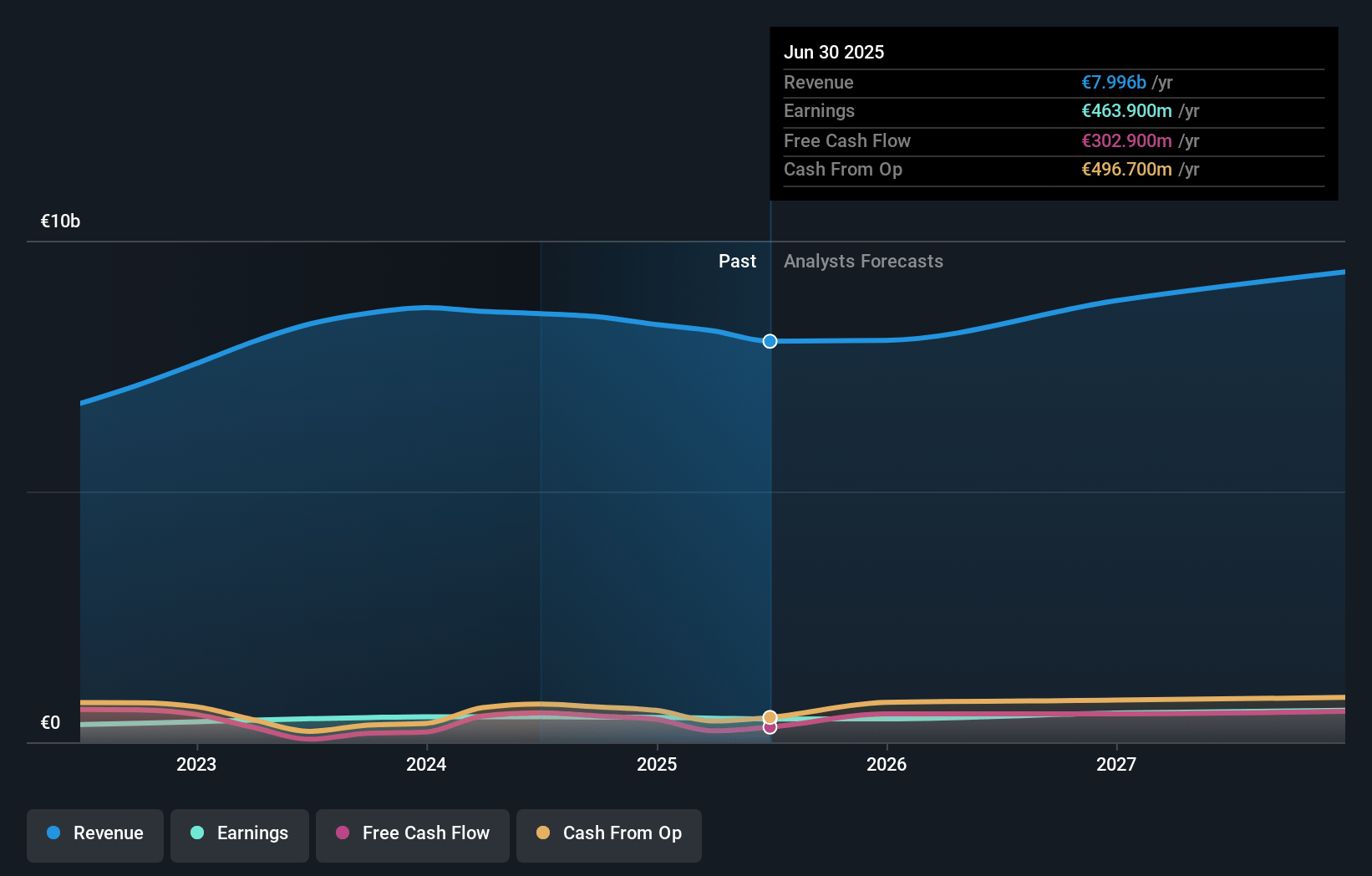

Andritz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Andritz compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Andritz's revenue will grow by 4.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.9% today to 6.5% in 3 years time.

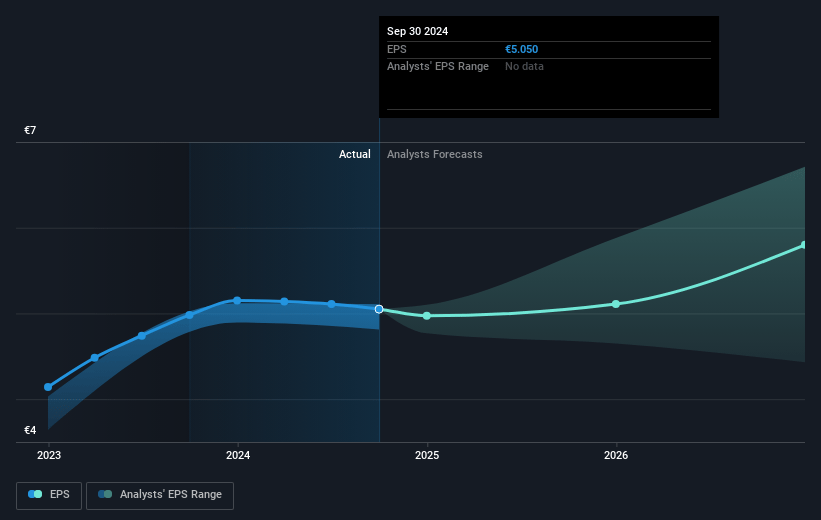

- The bearish analysts expect earnings to reach €614.7 million (and earnings per share of €5.6) by about July 2028, up from €481.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 13.6x today. This future PE is lower than the current PE for the GB Machinery industry at 14.4x.

- Analysts expect the number of shares outstanding to decline by 1.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Andritz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust long-term order backlog across Pulp & Paper and Hydropower, totaling €10.2 billion, provides high revenue visibility and shields the company from short-term cyclical downturns, supporting ongoing future sales.

- A strategic shift toward higher-margin recurring service revenues now at a record 44 percent of sales increases earnings stability and improves net margin resilience as the business model diversifies away from volatile capital equipment.

- Growing global investment in sustainability, renewables, decarbonization, and infrastructure drives demand for Andritz's core technologies, as evidenced by strong order intake in hydropower and environmental segments, which supports revenue and margin expansion in the medium and long term.

- Continuous operational improvements, restructuring, and capacity adjustments in underperforming segments have preserved and even slightly increased EBITA margins despite top-line headwinds, indicating an ability to maintain profitability even through industry cycles.

- The company's disciplined approach to M&A, recent successful acquisitions in Clean Air and tissue paper machinery, and ongoing investments in green technologies and service infrastructure all position Andritz to capture new growth opportunities, enhancing both revenue and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Andritz is €48.42, which represents two standard deviations below the consensus price target of €71.12. This valuation is based on what can be assumed as the expectations of Andritz's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €80.0, and the most bearish reporting a price target of just €43.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €9.4 billion, earnings will come to €614.7 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of €67.0, the bearish analyst price target of €48.42 is 38.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.